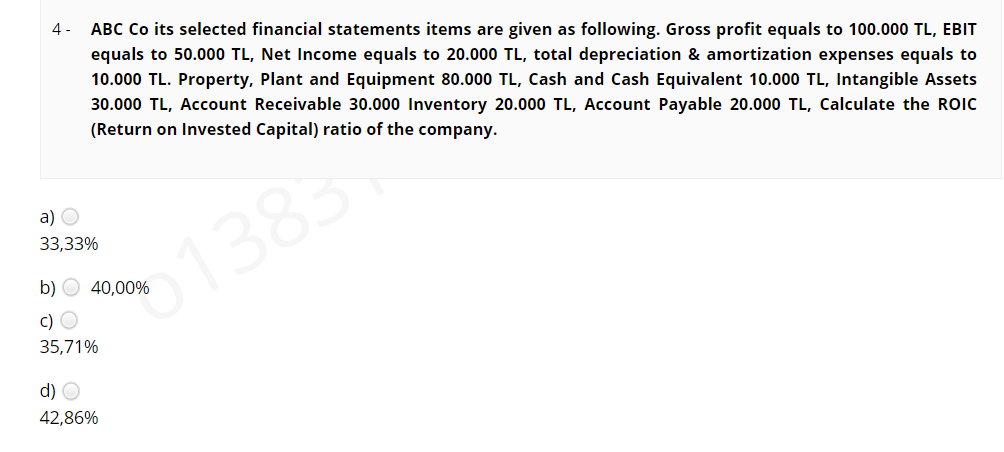

4 - ABC Co its selected financial statements items are given as following. Gross profit equals to 100.000 TL, EBIT equals to 50.000 TL, Net Income equals to 20.000 TL, total depreciation & amortization expenses equals to 10.000 TL. Property, Plant and Equipment 80.000 TL, Cash and Cash Equivalent 10.000 TL, Intangible Assets 30.000 TL, Account Receivable 30.000 Inventory 20.000 TL, Account Payable 20.000 TL, Calculate the ROIC (Return on Invested Capital) ratio of the company. a) O 33,33% 1383 b) 40,00% c) O 35,71% d) O

4 - ABC Co its selected financial statements items are given as following. Gross profit equals to 100.000 TL, EBIT equals to 50.000 TL, Net Income equals to 20.000 TL, total depreciation & amortization expenses equals to 10.000 TL. Property, Plant and Equipment 80.000 TL, Cash and Cash Equivalent 10.000 TL, Intangible Assets 30.000 TL, Account Receivable 30.000 Inventory 20.000 TL, Account Payable 20.000 TL, Calculate the ROIC (Return on Invested Capital) ratio of the company. a) O 33,33% 1383 b) 40,00% c) O 35,71% d) O

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 62BE: Brief ExerciseRatio Analysis Valiant Corporation has $1,800,000 in total liabilities, $800,000 of...

Related questions

Question

Transcribed Image Text:ABC Co its selected financial statements items are given as following. Gross profit equals to 100.000 TL, EBIT

equals to 50.000 TL, Net Income equals to 20.000 TL, total depreciation & amortization expenses equals to

10.000 TL. Property, Plant and Equipment 80.000 TL, Cash and Cash Equivalent 10.000 TL, Intangible Assets

30.000 TL, Account Receivable 30.000 Inventory 20.000 TL, Account Payable 20.000 TL, Calculate the ROIC

4-

(Return on Invested Capital) ratio of the company.

a) O

33,33%

138

b) O 40,00%

c) O

35,71%

d) O

42,86%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning