Applesoft, Inc. Income Statement For the year ended December 31

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 2AP

Related questions

Question

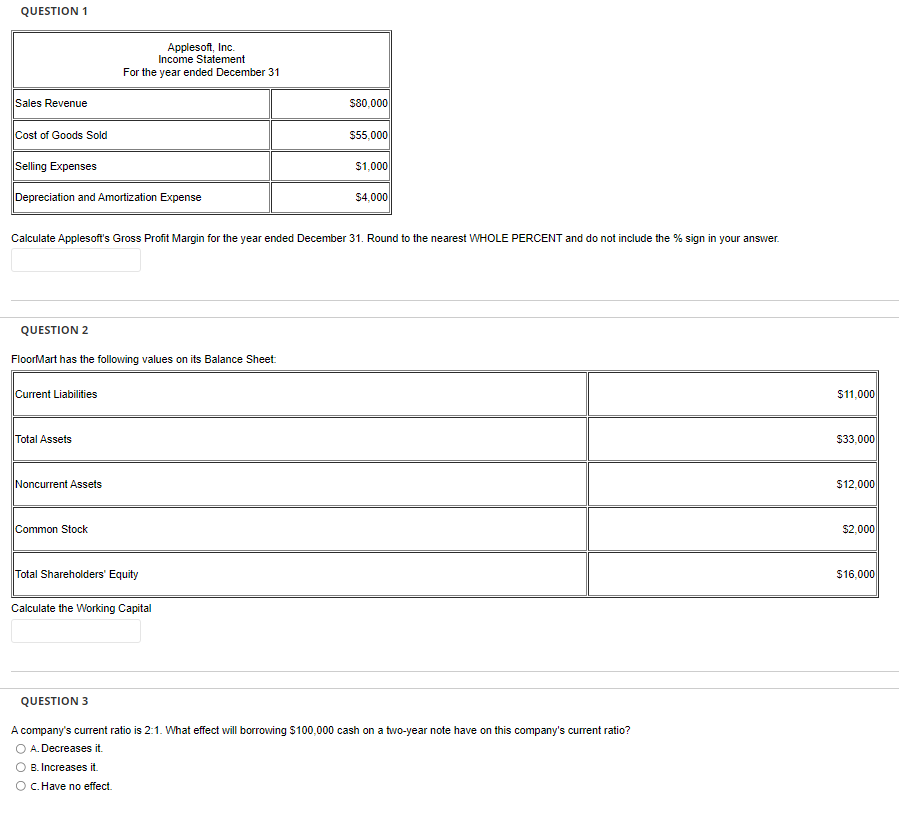

Transcribed Image Text:QUESTION 1

Sales Revenue

Cost of Goods Sold

Selling Expenses

Depreciation and Amortization Expense

QUESTION 2

FloorMart has the following values on its Balance Sheet

Current Liabilities

Applesoft, Inc.

Income Statement

For the year ended December 31

Total Assets

Noncurrent Assets

Calculate Applesoft's Gross Profit Margin for the year ended December 31. Round to the nearest WHOLE PERCENT and do not include the % sign in your answer.

Common Stock

Total Shareholders' Equity

$80,000

Calculate the Working Capital

$55,000

$1,000

$4,000

QUESTION 3

A company's current ratio is 2:1. What effect will borrowing $100,000 cash on a two-year note have on this company's current ratio?

O A. Decreases it.

B. Increases it.

O C. Have no effect.

$11,000

$33,000

$12,000

$2,000

$16,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub