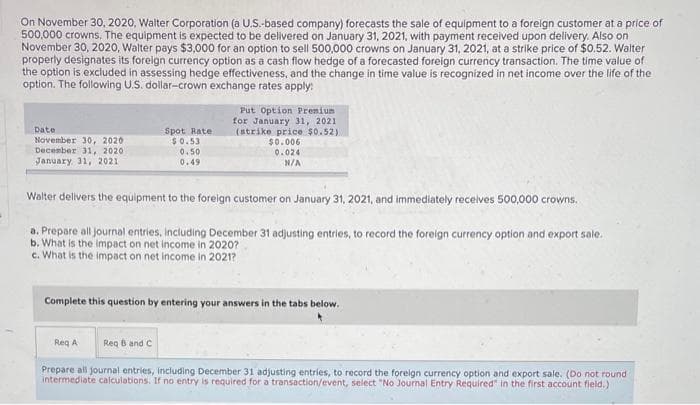

On November 30, 2020, Walter Corporation (a U.S.-based company) forecasts the sale of equipment to a foreign customer at a price of 500,000 crowns. The equipment is expected to be delivered on January 31, 2021, with payment received upon delivery. Also on November 30, 2020, Walter pays $3,000 for an option to sell 500,000 crowns on January 31, 2021, at a strike price of $0.52. Walter properly designates its foreign currency option as a cash flow hedge of a forecasted foreign currency transaction. The time value of the option is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income over the life of the option. The following U.S. dollar-crown exchange rates apply: Date November 30, 2020 December 31, 2020 January 31, 2021 Spot Rate $0.53 0.50 0.49 Put Option Premium for January 31, 2021 (strike price $0.52) $0.006 0.024 N/A Walter delivers the equipment to the foreign customer on January 31, 2021, and immediately receives 500,000 crowns. a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency option and export sale. b. What is the impact on net income in 2020? c. What is the impact on net income in 2021?

On November 30, 2020, Walter Corporation (a U.S.-based company) forecasts the sale of equipment to a foreign customer at a price of 500,000 crowns. The equipment is expected to be delivered on January 31, 2021, with payment received upon delivery. Also on November 30, 2020, Walter pays $3,000 for an option to sell 500,000 crowns on January 31, 2021, at a strike price of $0.52. Walter properly designates its foreign currency option as a cash flow hedge of a forecasted foreign currency transaction. The time value of the option is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income over the life of the option. The following U.S. dollar-crown exchange rates apply: Date November 30, 2020 December 31, 2020 January 31, 2021 Spot Rate $0.53 0.50 0.49 Put Option Premium for January 31, 2021 (strike price $0.52) $0.006 0.024 N/A Walter delivers the equipment to the foreign customer on January 31, 2021, and immediately receives 500,000 crowns. a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency option and export sale. b. What is the impact on net income in 2020? c. What is the impact on net income in 2021?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter27: Multinational Financial Management

Section: Chapter Questions

Problem 11P: Boisjoly Watch Imports has agreed to purchase 15,000 Swiss watches for 1 million francs at today’s...

Related questions

Question

Please do not give image format

Transcribed Image Text:1

bok

-

int

n

rences

Req A

Req B and C

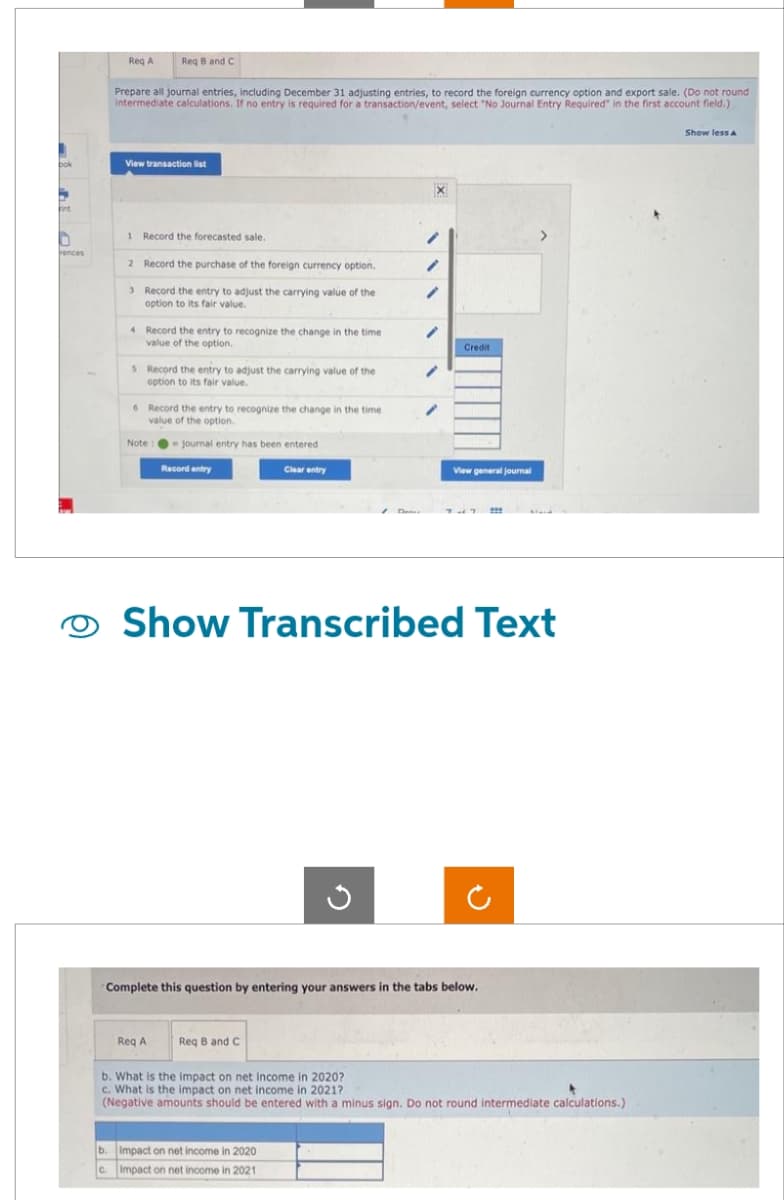

Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency option and export sale. (Do not round

intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

1 Record the forecasted sale.

2 Record the purchase of the foreign currency option.

3 Record the entry to adjust the carrying value the

option to its fair value.

4 Record the entry to recognize the change in the time

value of the option.

5 Record the entry to adjust the carrying value of the

option to its fair value.

6 Record the entry to recognize the change in the time

value of the option.

Note: journal entry has been entered

Record entry

Req A

Clear entry

Req B and C

X

G

b. Impact on net income in 2020

c. Impact on net income in 2021

Credit

Show Transcribed Text

Complete this question by entering your answers in the tabs below.

View general journal

222

>

b. What is the impact on net income in 2020?

c. What is the impact on net income in 2021?

(Negative amounts should be entered with a minus sign. Do not round intermediate calculations.)

Show less A

Transcribed Image Text:On November 30, 2020, Walter Corporation (a U.S.-based company) forecasts the sale of equipment to a foreign customer at a price of

500,000 crowns. The equipment is expected to be delivered on January 31, 2021, with payment received upon delivery. Also on

November 30, 2020, Walter pays $3,000 for an option to sell 500,000 crowns on January 31, 2021, at a strike price of $0.52. Walter

properly designates its foreign currency option as a cash flow hedge of a forecasted foreign currency transaction. The time value of

the option is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income over the life of the

option. The following U.S. dollar-crown exchange rates apply:

Date

November 30, 2020

December 31, 2020

January 31, 2021

Spot Rate

$ 0.53

Req A

0.50

0.49

Walter delivers the equipment to the foreign customer on January 31, 2021, and immediately receives 500,000 crowns.

a. Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency option and export sale.

b. What is the impact on net income in 2020?

c. What is the impact on net income in 2021?

Req B and C

Put Option Premium

for January 31, 2021

(strike price $0.52).

$0.006

0.024

N/A

Complete this question by entering your answers in the tabs below.

Prepare all journal entries, including December 31 adjusting entries, to record the foreign currency option and export sale. (Do not round

intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT