APPLY THE CONCEPTS: Determining benefits of negotiated transfer price Assume that Selling Division and Buying Division are both owned by Overall Corporation. Selling Division sells a product that is used by Buying Division and outside customers. Selling Division has 18,000 units of excess capacity. Selling Division currently sells the product for $60 per unit and Buying Division currently buys 18,000 units of the product from an outside source for $60 per unit. Variable costs of the product are $12, of which $3 is the cost of selling the product to an outside customer. Using Selling price less avoidable costs as the minimum price, fill in the following formula for the desired transfer price: $fill in the blank 51adeff30f88fa7_1 < transfer price < $fill in the blank 51adeff30f88fa7_2. Using Variable costs as the minimum price, fill in the following formula for the desired transfer price: $fill in the blank 51adeff30f88fa7_3 < transfer price < $fill in the blank 51adeff30f88fa7_4. Assume there are no avoidable costs with an internal sale (variable costs equal $12) and that Buying Division buys 18,000 units from Selling Division. Complete the table for each transfer price: Transfer Price Transfer Price $55 $19 Increase in net income of Selling Division $fill in the blank 51adeff30f88fa7_5 $fill in the blank 51adeff30f88fa7_6 Increase in net income of Buying Division $fill in the blank 51adeff30f88fa7_7 $fill in the blank 51adeff30f88fa7_8 Increase in net income of Overall Corporation $fill in the blank 51adeff30f88fa7_9 $fill in the blank 51adeff30f88fa7_10

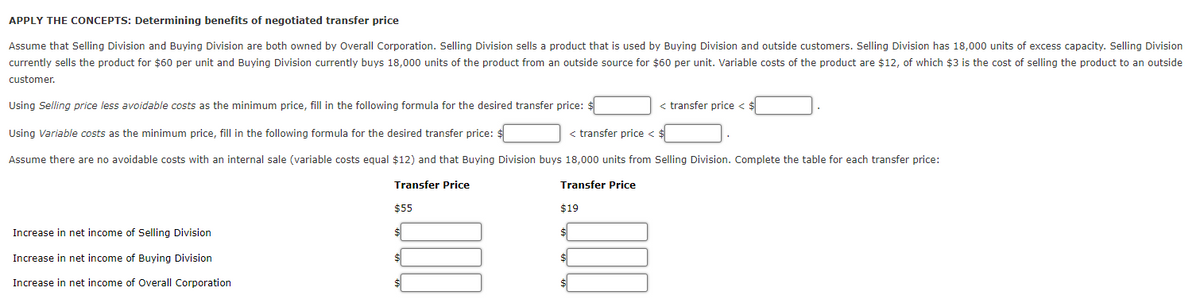

APPLY THE CONCEPTS: Determining benefits of negotiated transfer price

Assume that Selling Division and Buying Division are both owned by Overall Corporation. Selling Division sells a product that is used by Buying Division and outside customers. Selling Division has 18,000 units of excess capacity. Selling Division currently sells the product for $60 per unit and Buying Division currently buys 18,000 units of the product from an outside source for $60 per unit. Variable costs of the product are $12, of which $3 is the cost of selling the product to an outside customer.

Using Selling price less avoidable costs as the minimum price, fill in the following formula for the desired transfer price: $fill in the blank 51adeff30f88fa7_1 < transfer price < $fill in the blank 51adeff30f88fa7_2.

Using Variable costs as the minimum price, fill in the following formula for the desired transfer price: $fill in the blank 51adeff30f88fa7_3 < transfer price < $fill in the blank 51adeff30f88fa7_4.

Assume there are no avoidable costs with an internal sale (variable costs equal $12) and that Buying Division buys 18,000 units from Selling Division. Complete the table for each transfer price:

| Transfer Price | Transfer Price | |

| $55 | $19 | |

| Increase in net income of Selling Division | $fill in the blank 51adeff30f88fa7_5 | $fill in the blank 51adeff30f88fa7_6 |

| Increase in net income of Buying Division | $fill in the blank 51adeff30f88fa7_7 | $fill in the blank 51adeff30f88fa7_8 |

| Increase in net income of Overall Corporation | $fill in the blank 51adeff30f88fa7_9 | $fill in the blank 51adeff30f88fa7_10 |

Trending now

This is a popular solution!

Step by step

Solved in 2 steps