ar Colfs tree cash fows are expected to grow by 8.% per year, what is the market value of s equity loday? Colfs tree cash fows are expected to grow by 8% per year, the market value milion Round to one decimal place) ihe interest rate on its debt is 10% how much can Colt borow now and s have non-negative net income this coming year? the interest rate on s debt is 10%, Colt can bomowS on Round to one decimal place.) eis there atax incendive today for Colt to choose a debtovalue ratio that exceeds 70%? Explain (Select the best choice below)

ar Colfs tree cash fows are expected to grow by 8.% per year, what is the market value of s equity loday? Colfs tree cash fows are expected to grow by 8% per year, the market value milion Round to one decimal place) ihe interest rate on its debt is 10% how much can Colt borow now and s have non-negative net income this coming year? the interest rate on s debt is 10%, Colt can bomowS on Round to one decimal place.) eis there atax incendive today for Colt to choose a debtovalue ratio that exceeds 70%? Explain (Select the best choice below)

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 24P

Related questions

Question

M4

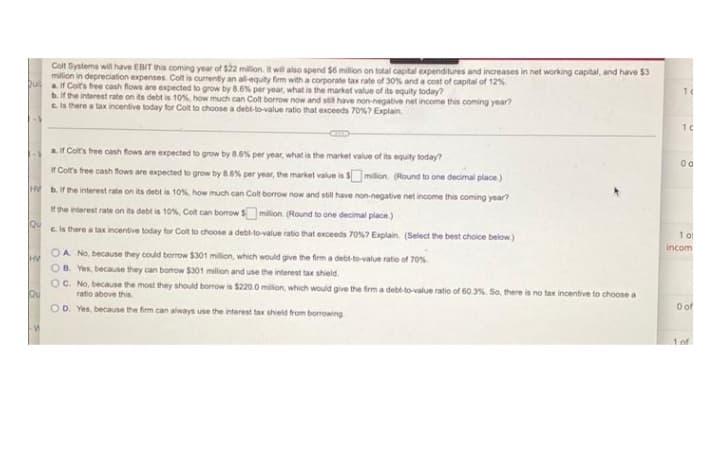

Transcribed Image Text:Colt Systems will have EBIT this coming year of $22 million. It wil also spend $6 million on total capital expenditures and increases in net working capital, and have $3

million in depreciation expenses. Colt is currently an all-equity firm with a corporate tax rate of 30% and a cost of capital of 12%

puaif Colf's tree cash fows are expected to grow by 8.6% per year, what is the market value of its equity today?

b. If the interest rate on its debt is 10%, how much can Colt borrow now and sti have non-negative net income this coming year?

e is there a tax incentive today for Colt to choose a deb-to-value ratio that exceeds 70%? Explain.

10

a If Colt's tree cash fows are expected to grow by 8.6% per year, what is the market value of ita equity today?

It Colfs free cash fows are expected to grow by 8.6% per year, the market value is smilion. (Round to one decimal place.)

HV b.If the interest rate on its debt is 10%. how much can Colt borrow now and still have non-negative net income this coming year?

the interest rate on its debt is 10%, Cot can borow Smilion. (Round to one decimal place.)

e is there a tax incentive today for Colt to choose a debt-to-value ratio that exceeds 70%? Explain. (Select the best choice below)

1o

incom

OA No, because they could borrow $301 million, which would give the firm a debt-to-value ratio of 70%

HV

OB Yes, because they can bomow $301 million and use the interest tax shield.

OC. No, because the most they should borrow is $220.0 millon, which would give the firm a debe-to-value ratio of 603%. So, there is no tax incentive to choose a

Qu

ratio above this

OD. Yes, because the firm can always use the interest tax shield from borrowing

of

1of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning