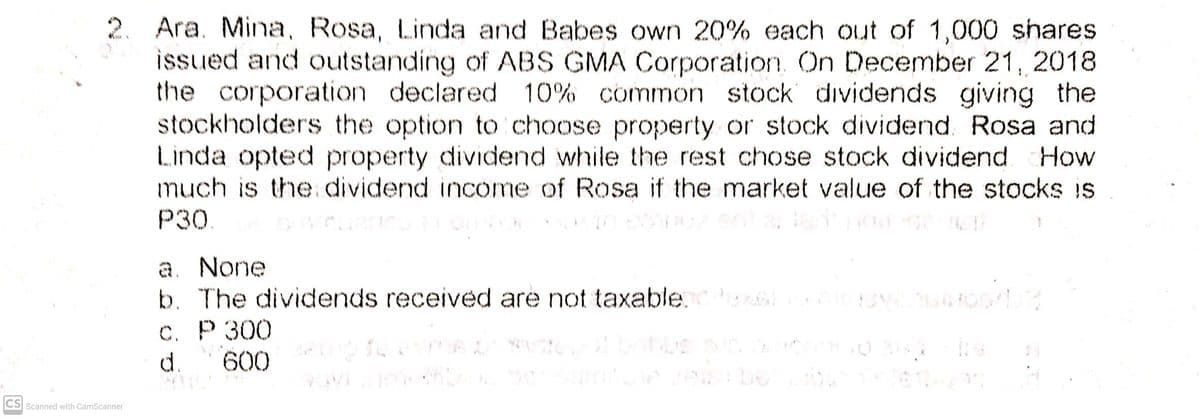

Ara. Mina, Rosa, Linda and Babes own 20% each out of 1,000 shares issued and outstanding of ABS GMA Corporation. On December 21, 2018 the corporation declared 10% common stock dividends giving the stockholders the option to choose property or stock dividend. Rosa and Linda opted property dividend while the rest chose stock dividend much is the.dividend income of Rosa if the market value of the stocks IS Р30 How

Ara. Mina, Rosa, Linda and Babes own 20% each out of 1,000 shares issued and outstanding of ABS GMA Corporation. On December 21, 2018 the corporation declared 10% common stock dividends giving the stockholders the option to choose property or stock dividend. Rosa and Linda opted property dividend while the rest chose stock dividend much is the.dividend income of Rosa if the market value of the stocks IS Р30 How

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 81IIP

Related questions

Question

Transcribed Image Text:2. Ara. Mina, Rosa, Linda and Babes own 20% each out of 1,000 shares

issued and outstanding of ABS GMA Corporation. On December 21, 2018

the corporation declared 10% common stock dividends giving the

stockholders the option to choose property or stock dividend Rosa and

Linda opted property dividend while the rest chose stock dividend How

much is the dividend income of Rosa if the market value of the stocks is

Р30

a. None

b. The dividends received are not taxable.

С. Р 300

d.

600

CS Scanned with CamScanner

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT