Aracel Engineering completed the following transactions in the month of June. J. Aracel, the owner, invested $240,000 cash, office equipment with a value of $10,000, and $77,000 of drafting equipment to launch the company. The company purchased land worth $53,000 for an office by paying $7,400 cash and signing a note payable for $45,600. The company purchased a portable building with $56,000 cash and moved it onto the land acquired in b. The company paid $2,900 cash for the premium on an 18-month insurance policy. The company provided services to a client and collected $8,700 cash. The company purchased $26,000 of additional drafting equipment by paying $10,500 cash and signing a note payable for $15,500. The company completed $17,500 of services for a client. This amount is to be received in 30 days. The company purchased $1,600 of additional office equipment on credit. The company completed $25,000 of services for a customer on credit. The company purchased $1,338 of TV advertising on credit. The company collected $6,000 cash in partial payment from the client described in transaction g. The company paid $1,500 cash for employee wages. The company paid $1,600 cash to settle the account payable created in transaction h. The company paid $1,040 cash for repairs. J. Aracel withdrew $10,990 cash from the company for personal use. The company paid $1,500 cash for employee wages. The company paid $4,100 cash for advertisements on the Web during June. Required: Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); J. Aracel, Capital (301); J. Aracel, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). Post the journal entries from part 1 to the ledger accounts. Prepare a trial balance as of the end of June.

Aracel Engineering completed the following transactions in the month of June. J. Aracel, the owner, invested $240,000 cash, office equipment with a value of $10,000, and $77,000 of drafting equipment to launch the company. The company purchased land worth $53,000 for an office by paying $7,400 cash and signing a note payable for $45,600. The company purchased a portable building with $56,000 cash and moved it onto the land acquired in b. The company paid $2,900 cash for the premium on an 18-month insurance policy. The company provided services to a client and collected $8,700 cash. The company purchased $26,000 of additional drafting equipment by paying $10,500 cash and signing a note payable for $15,500. The company completed $17,500 of services for a client. This amount is to be received in 30 days. The company purchased $1,600 of additional office equipment on credit. The company completed $25,000 of services for a customer on credit. The company purchased $1,338 of TV advertising on credit. The company collected $6,000 cash in partial payment from the client described in transaction g. The company paid $1,500 cash for employee wages. The company paid $1,600 cash to settle the account payable created in transaction h. The company paid $1,040 cash for repairs. J. Aracel withdrew $10,990 cash from the company for personal use. The company paid $1,500 cash for employee wages. The company paid $4,100 cash for advertisements on the Web during June. Required: Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); J. Aracel, Capital (301); J. Aracel, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). Post the journal entries from part 1 to the ledger accounts. Prepare a trial balance as of the end of June.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.7E: Determining amounts to be paid on invoices Determine the amount to be paid in full settlement of...

Related questions

Topic Video

Question

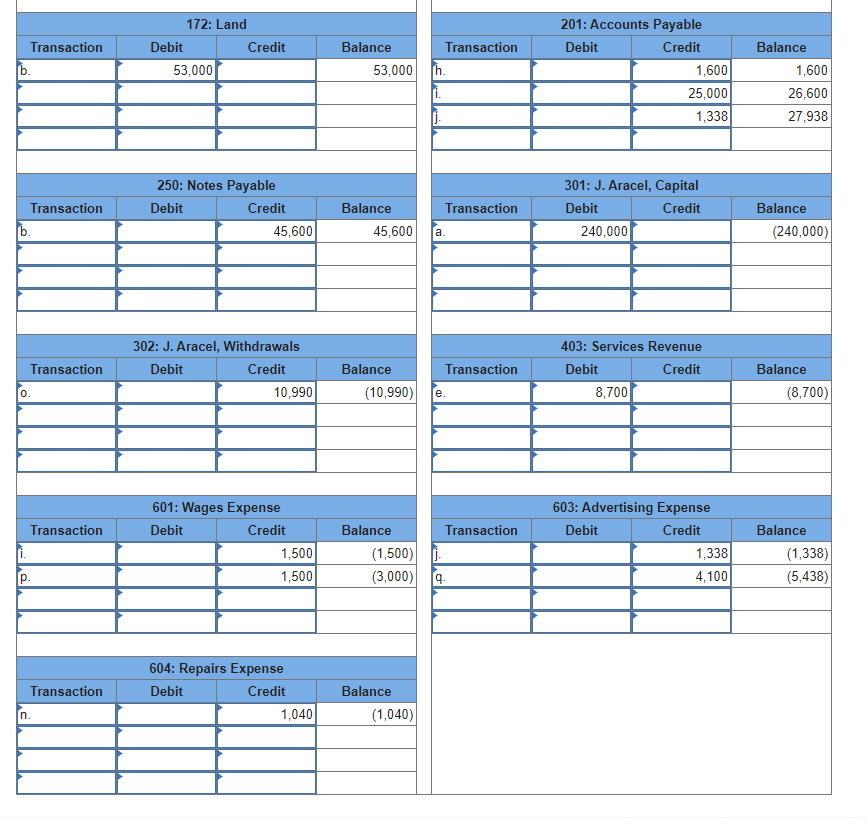

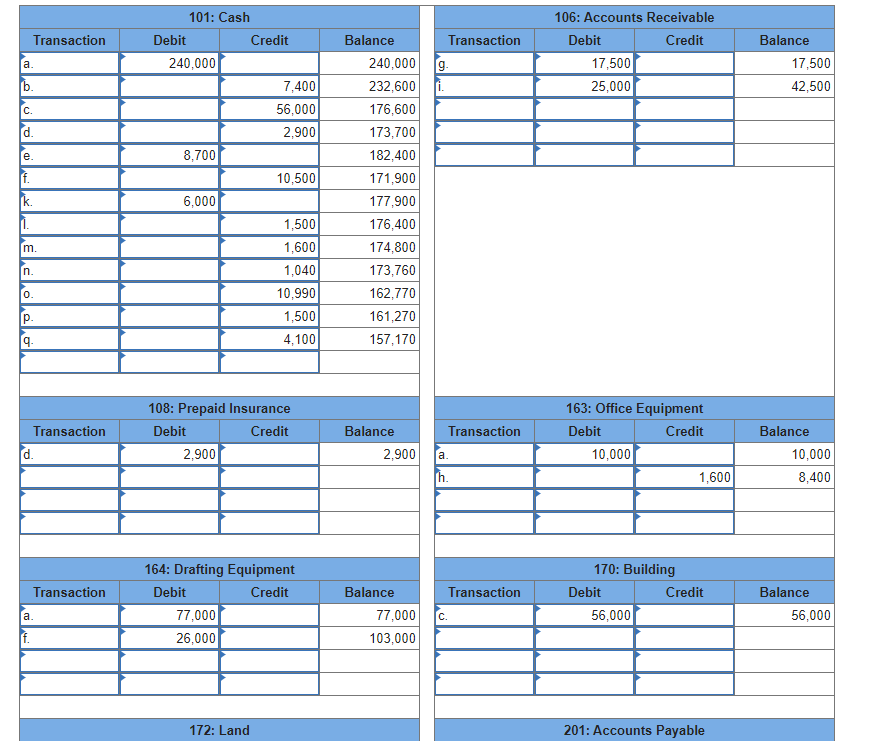

Can someone please help me check my work on this?

Aracel Engineering completed the following transactions in the month of June.

- J. Aracel, the owner, invested $240,000 cash, office equipment with a value of $10,000, and $77,000 of drafting equipment to launch the company.

- The company purchased land worth $53,000 for an office by paying $7,400 cash and signing a note payable for $45,600.

- The company purchased a portable building with $56,000 cash and moved it onto the land acquired in b.

- The company paid $2,900 cash for the premium on an 18-month insurance policy.

- The company provided services to a client and collected $8,700 cash.

- The company purchased $26,000 of additional drafting equipment by paying $10,500 cash and signing a note payable for $15,500.

- The company completed $17,500 of services for a client. This amount is to be received in 30 days.

- The company purchased $1,600 of additional office equipment on credit.

- The company completed $25,000 of services for a customer on credit.

- The company purchased $1,338 of TV advertising on credit.

- The company collected $6,000 cash in partial payment from the client described in transaction g.

- The company paid $1,500 cash for employee wages.

- The company paid $1,600 cash to settle the account payable created in transaction h.

- The company paid $1,040 cash for repairs.

- J. Aracel withdrew $10,990 cash from the company for personal use.

- The company paid $1,500 cash for employee wages.

- The company paid $4,100 cash for advertisements on the Web during June.

Required:

- Prepare general

journal entries to record these transactions using the following titles: Cash (101);Accounts Receivable (106); Prepaid Insurance (108); Office Equipment (163); Drafting Equipment (164); Building (170); Land (172); Accounts Payable (201); Notes Payable (250); J. Aracel, Capital (301); J. Aracel, Withdrawals (302); Services Revenue (403); Wages Expense (601); Advertising Expense (603); and Repairs Expense (604). Post the journal entries from part 1 to the ledger accounts.- Prepare a

trial balance as of the end of June.

Transcribed Image Text:Transaction

[b.

0.

Transaction

b.

Transaction

Transaction

Transaction

n.

Debit

172: Land

53,000

Credit

250: Notes Payable

Debit

Credit

45,600

302: J. Aracel, Withdrawals

Debit

Credit

10,990

601: Wages Expense

Debit

Credit

1,500

1,500

604: Repairs Expense

Debit

Credit

1,040

Balance

53,000

Balance

45,600

Balance

(10,990)

Balance

Balance

(1,040)

Transaction

h.

(1,500) j

(3,000)

Transaction

a.

Transaction

e.

Transaction

201: Accounts Payable

Debit

Credit

301: J. Aracel, Capital

Debit

Credit

240,000

1,600

25,000

1,338

403: Services Revenue

Debit

Credit

8,700

603: Advertising Expense

Debit

Credit

1,338

4,100

Balance

1,600

26,600

27,938

Balance

(240,000)

Balance

(8,700)

Balance

(1,338)

(5,438)

Transcribed Image Text:a.

b.

C.

d.

Transaction

e.

f.

m.

n.

0.

P.

9.

Transaction

d.

f.

Transaction

a.

Debit

101: Cash

240,000

8,700

6,000

2,900

Credit

77,000

26,000

7,400

56,000

2,900

108: Prepaid Insurance

Debit

Credit

172: Land

10,500

1,500

1,600

1,040

10,990

1,500

4,100

164: Drafting Equipment

Debit

Credit

Balance

240,000 9.

232,600 i.

176,600

173,700

182,400

171,900

177,900

176,400

174,800

173,760

162,770

161,270

157,170

Balance

2,900

Balance

Transaction

77,000

103,000

Transaction

a.

Th.

Transaction

C.

106: Accounts Receivable

Debit

Credit

17,500

25,000

163: Office Equipment

Debit

Credit

10,000

170: Building

Debit

56,000

1,600

Credit

201: Accounts Payable

Balance

17,500

42,500

Balance

10,000

8,400

Balance

56,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning