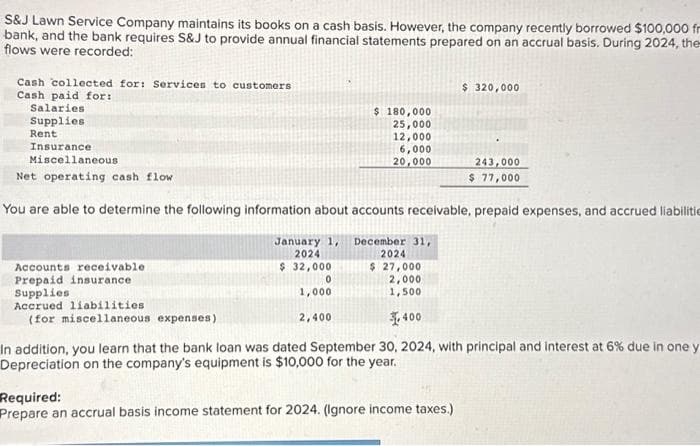

S&J Lawn Service Company maintains its books on a cash basis. However, the company recently borrowed $100,000 bank, and the bank requires S&J to provide annual financial statements prepared on an accrual basis. During 2024, t flows were recorded: Cash collected for: Services to customers Cash paid for: Salaries Supplies Rent Accounts receivable. Prepaid insurance) Supplies Accrued liabilities. (for miscellaneous expenses) $ 180,000 25,000 12,000 6,000 20,000 Insurance Miscellaneous. Net operating cash flow You are able to determine the following information about accounts receivable, prepaid expenses, and accrued liabi January 1, December 31, 2024 2024 $ 32,000 $ 27,000 2,000 1,500 400 In addition, you learn that the bank loan was dated September 30, 2024, with principal and interest at 6% due in one Depreciation on the company's equipment is $10,000 for the year. 0 1,000 2,400 $ 320,000 Required: Prepare an accrual basis income statement for 2024. (Ignore income taxes.) 243,000 $ 77,000

S&J Lawn Service Company maintains its books on a cash basis. However, the company recently borrowed $100,000 bank, and the bank requires S&J to provide annual financial statements prepared on an accrual basis. During 2024, t flows were recorded: Cash collected for: Services to customers Cash paid for: Salaries Supplies Rent Accounts receivable. Prepaid insurance) Supplies Accrued liabilities. (for miscellaneous expenses) $ 180,000 25,000 12,000 6,000 20,000 Insurance Miscellaneous. Net operating cash flow You are able to determine the following information about accounts receivable, prepaid expenses, and accrued liabi January 1, December 31, 2024 2024 $ 32,000 $ 27,000 2,000 1,500 400 In addition, you learn that the bank loan was dated September 30, 2024, with principal and interest at 6% due in one Depreciation on the company's equipment is $10,000 for the year. 0 1,000 2,400 $ 320,000 Required: Prepare an accrual basis income statement for 2024. (Ignore income taxes.) 243,000 $ 77,000

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P: Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and...

Related questions

Topic Video

Question

275.

Subject : - Accounting

Transcribed Image Text:S&J Lawn Service Company maintains its books on a cash basis. However, the company recently borrowed $100,000 fr

bank, and the bank requires S&J to provide annual financial statements prepared on an accrual basis. During 2024, the

flows were recorded:

Cash collected for: Services to customers.

Cash paid for:

Salaries

Supplies

Rent

Insurance

Miscellaneous.

Net operating cash flow

Accounts receivable

Prepaid insurance)

Supplies

Accrued liabilities

(for miscellaneous expenses)

$ 180,000

25,000

12,000

6,000

20,000

You are able to determine the following information about accounts receivable, prepaid expenses, and accrued liabilitie

January 1, December 31,

2024

2024

$32,000

0

1,000

2,400

$ 27,000

2,000

1,500

400

$ 320,000

243,000

$ 77,000

Required:

Prepare an accrual basis income statement for 2024. (Ignore income taxes.)

In addition, you learn that the bank loan was dated September 30, 2024, with principal and interest at 6% due in one y

Depreciation on the company's equipment is $10,000 for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning