Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2022, and a balance sheet at December 31, 2022, for Breanna Incorporated. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Required: a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2022, and a balance sheet at December 31, 2022, for Breanna Incorporated. Based on the financial statements that you have prepared for part a, answer the questions in parts b-e. b. What is the company's average income tax rate? c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the average long-term debt account balance throughout the year. d. What is the par value per share of common stock? e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 17E

Related questions

Question

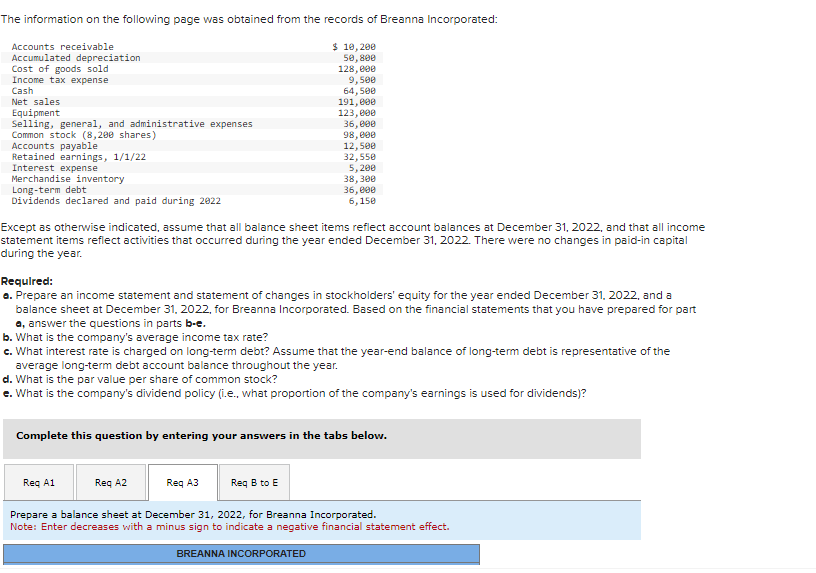

Transcribed Image Text:The information on the following page was obtained from the records of Breanna Incorporated:

$ 10, 200

50,800

128,000

9,500

64,500

Accounts receivable

Accumulated depreciation

Cost of goods sold

Income tax expense

Cash

Net sales

Equipment

Selling, general, and administrative expenses

Common stock (8,200 shares)

Accounts payable

Retained earnings, 1/1/22

Interest expense

Merchandise inventory

Long-term debt

Dividends declared and paid during 2022

Except as otherwise indicated, assume that all balance sheet items reflect account balances at December 31, 2022, and that all income

statement items reflect activities that occurred during the year ended December 31, 2022. There were no changes in paid-in capital

during the year.

Required:

a. Prepare an income statement and statement of changes in stockholders' equity for the year ended December 31, 2022, and a

balance sheet at December 31, 2022, for Breanna Incorporated. Based on the financial statements that you have prepared for part

a, answer the questions in parts b-e.

Req A1

191,000

123,000

36,000

b. What is the company's average income tax rate?

c. What interest rate is charged on long-term debt? Assume that the year-end balance of long-term debt is representative of the

average long-term debt account balance throughout the year.

d. What is the par value per share of common stock?

e. What is the company's dividend policy (i.e., what proportion of the company's earnings is used for dividends)?

Req A2

98,000

12,500

Complete this question by entering your answers in the tabs below.

Req A3

32,550

5,200

38,300

36,000

6,150

Req B to E

BREANNA INCORPORATED

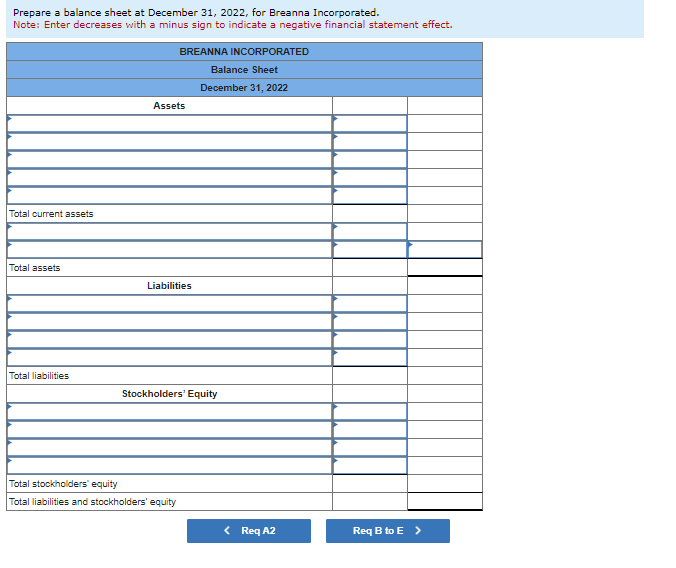

Prepare a balance sheet at December 31, 2022, for Breanna Incorporated.

Note: Enter decreases with a minus sign to indicate a negative financial statement effect.

Transcribed Image Text:Prepare a balance sheet at December 31, 2022, for Breanna Incorporated.

Note: Enter decreases with a minus sign to indicate a negative financial statement effect.

Total current assets

Total assets

Total liabilities

BREANNA INCORPORATED

Balance Sheet

December 31, 2022

Assets

Liabilities

Stockholders' Equity

Total stockholders' equity

Total liabilities and stockholders' equity

< Req A2

Req B to E >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning