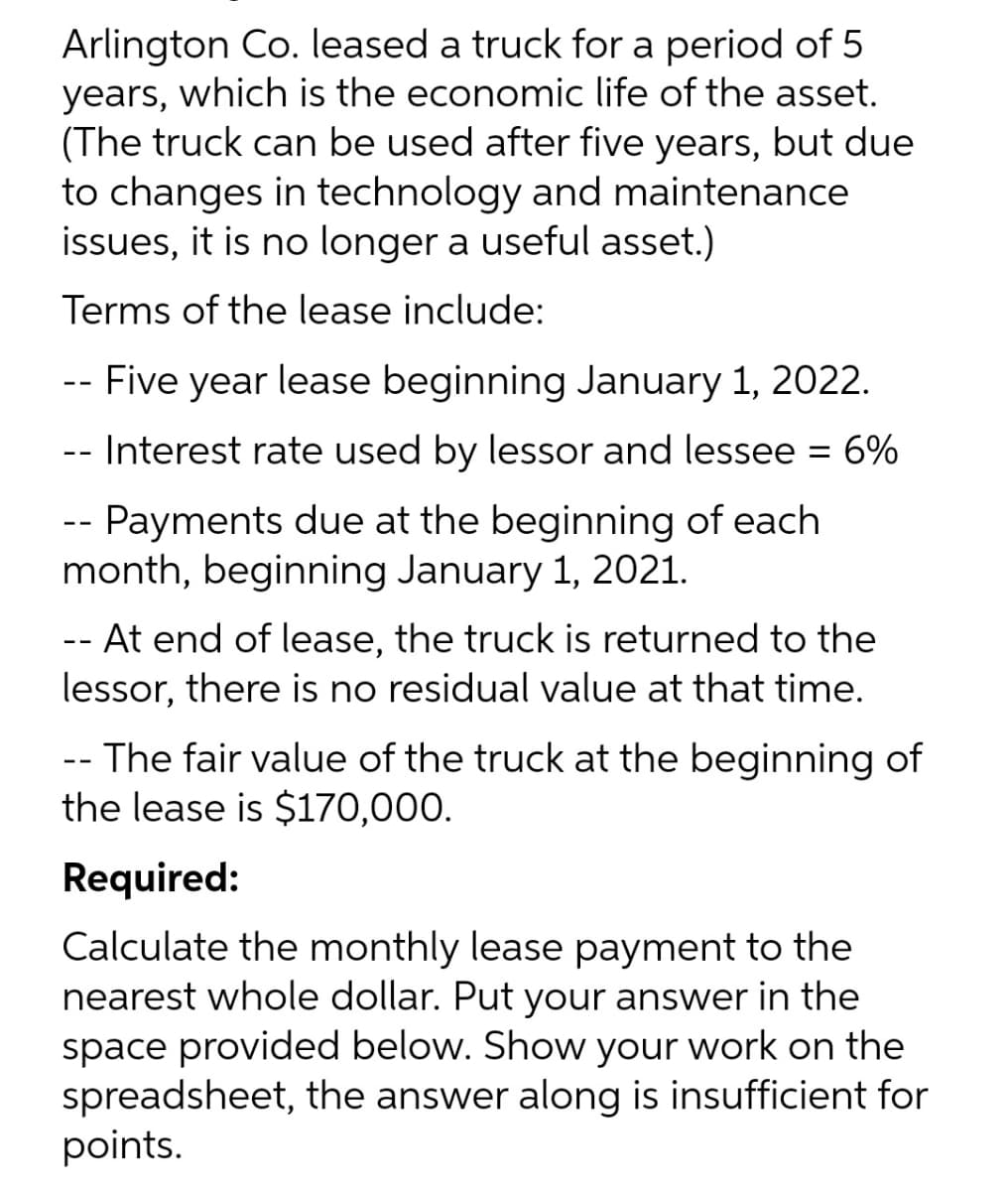

Arlington Co. leased a truck for a period of 5 years, which is the economic life of the asset. (The truck can be used after five years, but due to changes in technology and maintenance issues, it is no longer a useful asset.) Terms of the lease include: -- Five year lease beginning January 1, 2022. -- Interest rate used by lessor and lessee = 6% -- Payments due at the beginning of each month, beginning January 1, 2021. -- At end of lease, the truck is returned to the lessor, there is no residual value at that time. -- The fair value of the truck at the beginning of the lease is $170,000. Required: Calculate the monthly lease payment to the nearest whole dollar. Put your answer in the space provided below. Show your work on the spreadsheet, the answer along is insufficient for points.

Arlington Co. leased a truck for a period of 5 years, which is the economic life of the asset. (The truck can be used after five years, but due to changes in technology and maintenance issues, it is no longer a useful asset.) Terms of the lease include: -- Five year lease beginning January 1, 2022. -- Interest rate used by lessor and lessee = 6% -- Payments due at the beginning of each month, beginning January 1, 2021. -- At end of lease, the truck is returned to the lessor, there is no residual value at that time. -- The fair value of the truck at the beginning of the lease is $170,000. Required: Calculate the monthly lease payment to the nearest whole dollar. Put your answer in the space provided below. Show your work on the spreadsheet, the answer along is insufficient for points.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6P: Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a...

Related questions

Concept explainers

Question

100%

Give me answer within 45 min please its urgent I will give you upvotes .....

Transcribed Image Text:Arlington Co. leased a truck for a period of 5

years, which is the economic life of the asset.

(The truck can be used after five years, but due

to changes in technology and maintenance

issues, it is no longer a useful asset.)

Terms of the lease include:

--

- Five year lease beginning January 1, 2022.

-- Interest rate used by lessor and lessee = 6%

-- Payments due at the beginning of each

month, beginning January 1, 2021.

-- At end of lease, the truck is returned to the

lessor, there is no residual value at that time.

-- The fair value of the truck at the beginning of

the lease is $170,000.

Required:

Calculate the monthly lease payment to the

nearest whole dollar. Put your answer in the

space provided below. Show your work on the

spreadsheet, the answer along is insufficient for

points.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT