Arvada Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment expected to cost $240,000 with a 12-year life and no salvage value. It will be depreciated on a straight-line basis. The compan expects to sell 96,000 units of the equipment's product each year. The expected annual income related to this equipment follows. Sales $ 150,000 Costs Materials, 1abor, and overhead (except depreciation on new equipment) Depreciation on new equipment Selling and administrative expenses Total costs and expenses ৪0, 000 20,000 15,000 115,000 35,000 17,500 $ 17,500 Pretax income Income taxes (508) Net income 1. Compute the payback period. 2. Compute the accounting rate of return for this equipment.

Arvada Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment expected to cost $240,000 with a 12-year life and no salvage value. It will be depreciated on a straight-line basis. The compan expects to sell 96,000 units of the equipment's product each year. The expected annual income related to this equipment follows. Sales $ 150,000 Costs Materials, 1abor, and overhead (except depreciation on new equipment) Depreciation on new equipment Selling and administrative expenses Total costs and expenses ৪0, 000 20,000 15,000 115,000 35,000 17,500 $ 17,500 Pretax income Income taxes (508) Net income 1. Compute the payback period. 2. Compute the accounting rate of return for this equipment.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

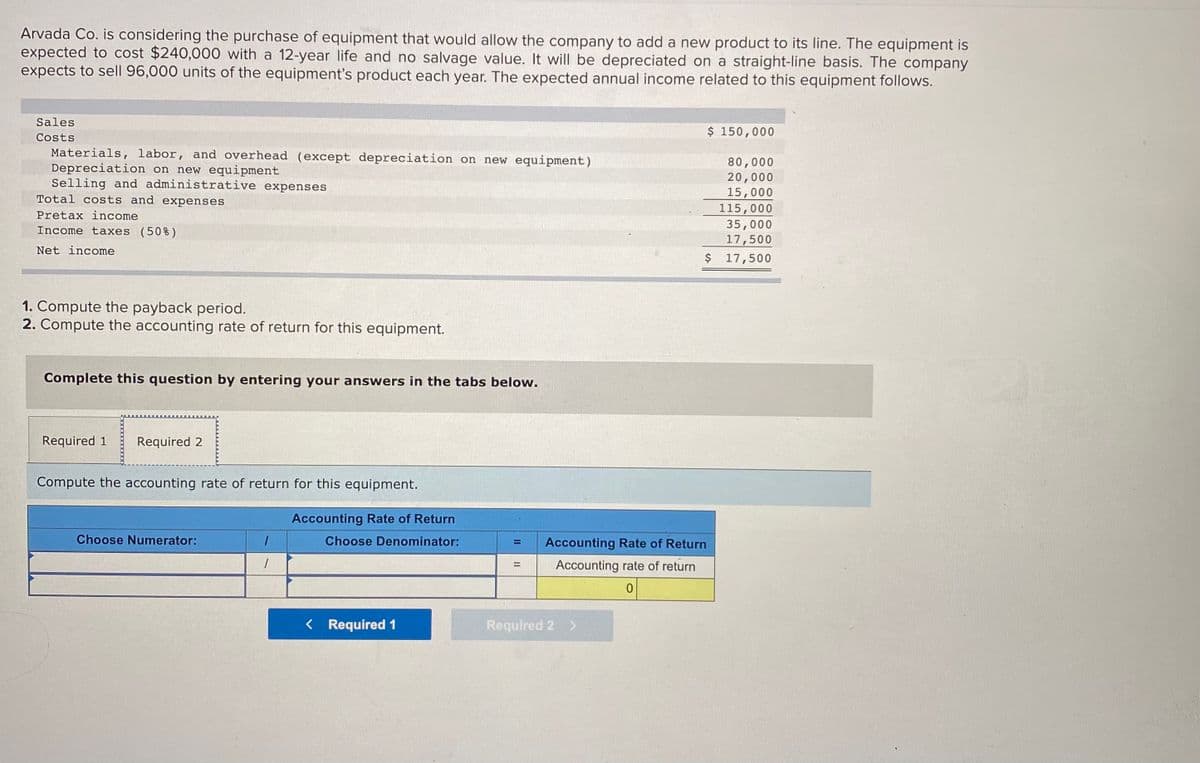

Transcribed Image Text:Arvada Co. is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment is

expected to cost $240,000 with a 12-year life and no salvage value. It will be depreciated on a straight-line basis. The company

expects to sell 96,000 units of the equipment's product each year. The expected annual income related to this equipment follows.

Sales

$ 150,000

Costs

Materials, labor, and overhead (except depreciation on new equipment)

Depreciation on new equipment

Selling and administrative expenses

Total costs and expenses

80,000

20,000

15,000

115,000

35,000

17,500

$ 17,500

Pretax income

Income taxes (50%)

Net income

1. Compute the payback period.

2. Compute the accounting rate of return for this equipment.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Compute the accounting rate of return for this equipment.

Accounting Rate of Return

Choose Numerator:

Choose Denominator:

Accounting Rate of Return

Accounting rate of return

%3D

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning