ary fund 7. The national government receives a foreign grant conditioned on the construction of a public infrastructure. According to the GAM for NGAS, when does the national government recognize revenue from the grant (i.e., credit to the 'Income from Grants and Donations in Cash' account)?

ary fund 7. The national government receives a foreign grant conditioned on the construction of a public infrastructure. According to the GAM for NGAS, when does the national government recognize revenue from the grant (i.e., credit to the 'Income from Grants and Donations in Cash' account)?

Chapter24: Multistate Corporate Taxation

Section: Chapter Questions

Problem 28P

Related questions

Question

PLEASE HELP ME TO ANSWER #7

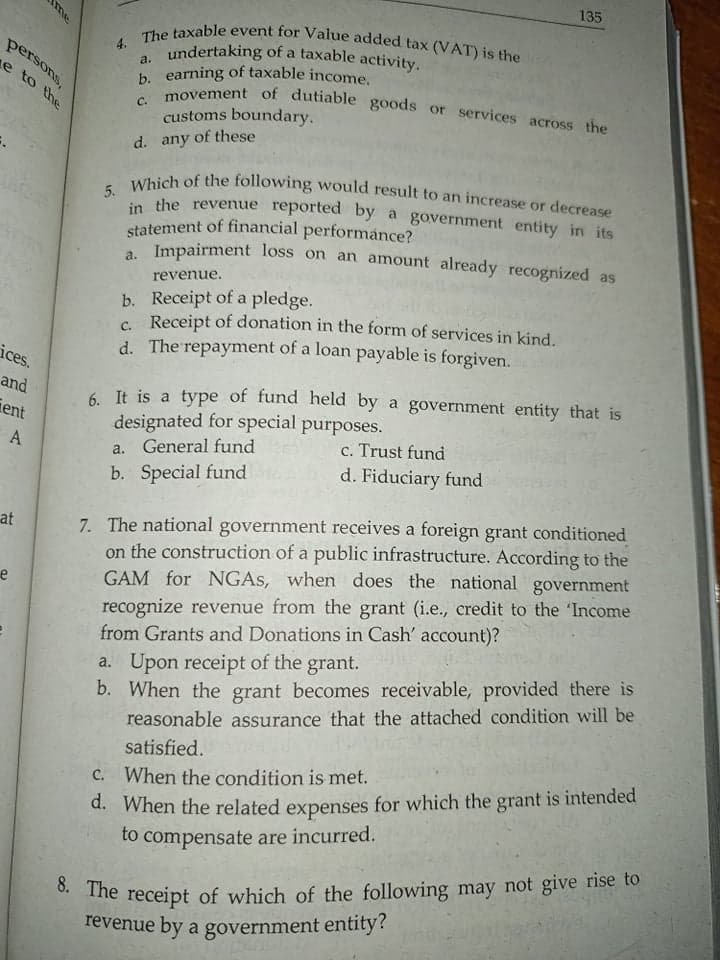

Transcribed Image Text:8. The receipt of which of the following may not give rise to

in the revenue reported by a government entity in its

movement of dutiable goods or services across the

135

statement of financial performance?

undertaking of a taxable activity.

b. earning of taxable income.

5. Which of the following would result to an increase or decrease

4. The taxable event for Value added tax (VAT) is the

persons,

a.

e to the

C.

customs boundary.

d. any of these

Impairment loss on an amount already recognized as

a.

revenue.

b. Receipt of a pledge.

c Receipt of donation in the form of services in kind.

d. The repayment of a loan payable is forgiven.

ices.

and

6 It is a type of fund held by a government entity that is

designated for special purposes.

ient

A

c. Trust fund

a. General fund

b. Special fund

d. Fiduciary fund

7. The national government receives a foreign grant conditioned

on the construction of a public infrastructure. According to the

GAM for NGAS, when does the national government

recognize revenue from the grant (i.e., credit to the 'Income

from Grants and Donations in Cash' account)?

at

e

a. Upon receipt of the grant.

b. When the grant becomes receivable, provided there is

reasonable assurance that the attached condition will be

satisfied.

d. When the related expenses for which the grant is intended

to compensate are incurred.

C. When the condition is met.

revenue by a government entity?

me

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning