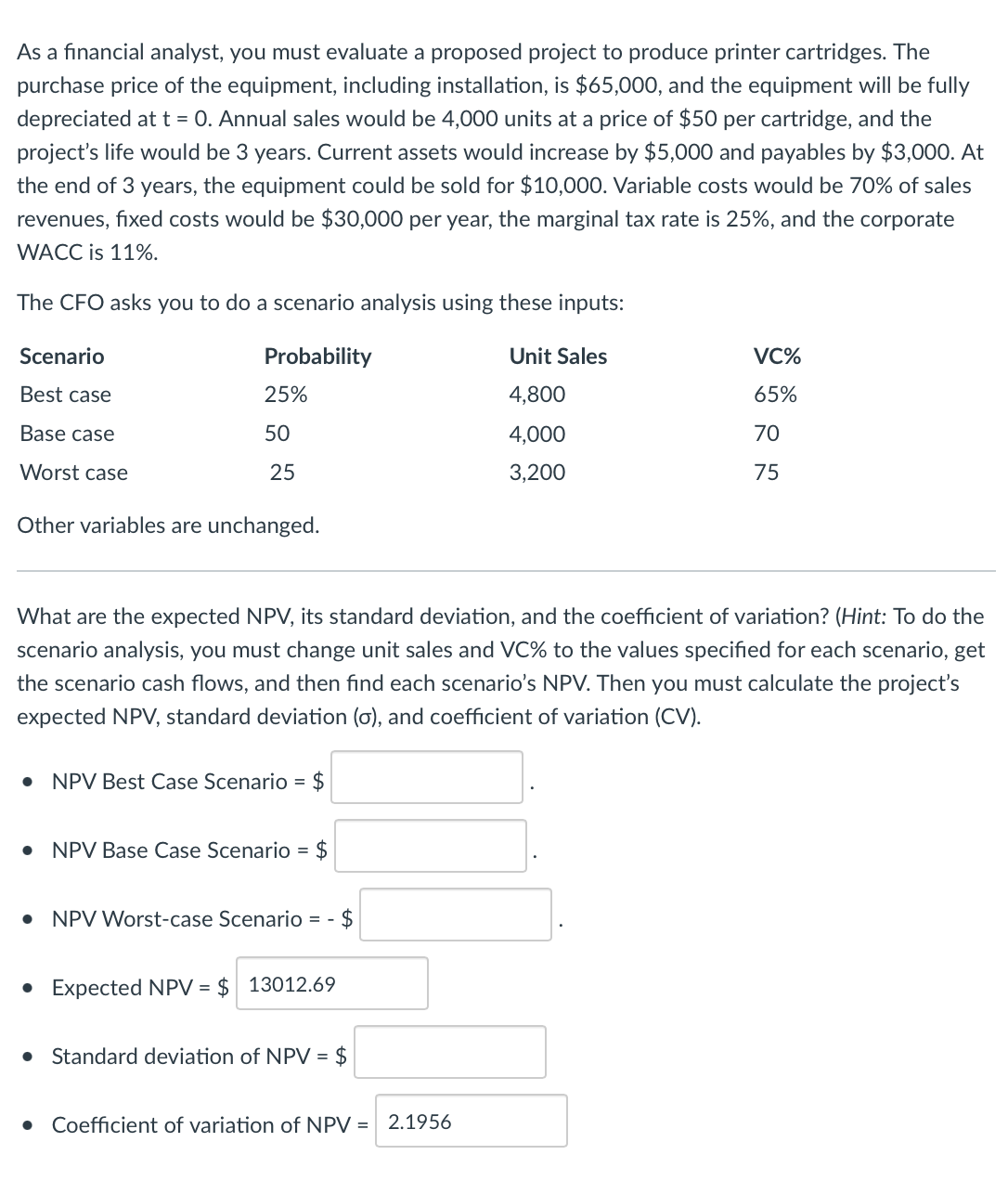

As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The purchase price of the equipment, including installation, is $65,000, and the equipment will be fully depreciated att = 0. Annual sales would be 4,000 units at a price of $50 per cartridge, and the project's life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At the end of 3 years, the equipment could be sold for $10,000. Variable costs would be 70% of sales revenues, fixed costs would be $30,000 per year, the marginal tax rate is 25%, and the corporate WACC is 11%. The CFO asks you to do a scenario analysis using these inputs: Scenario Probability Unit Sales VC% Best case 25% 4,800 65% Base case 50 4,000 70 Worst case 25 3,200 75 Other variables are unchanged. What are the expected NPV, its standard deviation, and the coefficient of variation? (Hint: To do the scenario analysis, you must change unit sales and VC% to the values specified for each scenario, get the scenario cash flows, and then find each scenario's NPV. Then you must calculate the project's expected NPV, standard deviation (o), and coefficient of variation (CV). • NPV Best Case Scenario = $ NPV Base Case Scenario = $ • NPV Worst-case Scenario = -

As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The purchase price of the equipment, including installation, is $65,000, and the equipment will be fully depreciated att = 0. Annual sales would be 4,000 units at a price of $50 per cartridge, and the project's life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At the end of 3 years, the equipment could be sold for $10,000. Variable costs would be 70% of sales revenues, fixed costs would be $30,000 per year, the marginal tax rate is 25%, and the corporate WACC is 11%. The CFO asks you to do a scenario analysis using these inputs: Scenario Probability Unit Sales VC% Best case 25% 4,800 65% Base case 50 4,000 70 Worst case 25 3,200 75 Other variables are unchanged. What are the expected NPV, its standard deviation, and the coefficient of variation? (Hint: To do the scenario analysis, you must change unit sales and VC% to the values specified for each scenario, get the scenario cash flows, and then find each scenario's NPV. Then you must calculate the project's expected NPV, standard deviation (o), and coefficient of variation (CV). • NPV Best Case Scenario = $ NPV Base Case Scenario = $ • NPV Worst-case Scenario = -

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:As a financial analyst, you must evaluate a proposed project to produce printer cartridges. The

purchase price of the equipment, including installation, is $65,000, and the equipment will be fully

depreciated at t = 0. Annual sales would be 4,000 units at a price of $50 per cartridge, and the

project's life would be 3 years. Current assets would increase by $5,000 and payables by $3,000. At

the end of 3 years, the equipment could be sold for $10,000. Variable costs would be 70% of sales

revenues, fixed costs would be $30,000 per year, the marginal tax rate is 25%, and the corporate

WACC is 11%.

The CFO asks you to do a scenario analysis using these inputs:

Scenario

Probability

Unit Sales

VC%

Best case

25%

4,800

65%

Base case

50

4,000

70

Worst case

25

3,200

75

Other variables are unchanged.

What are the expected NPV, its standard deviation, and the coefficient of variation? (Hint: To do the

scenario analysis, you must change unit sales and VC% to the values specified for each scenario, get

the scenario cash flows, and then find each scenario's NPV. Then you must calculate the project's

expected NPV, standard deviation (o), and coefficient of variation (CV).

NPV Best Case Scenario =

$

• NPV Base Case Scenario = $

NPV Worst-case Scenario = -

$

• Expected NPV = $ 13012.69

Standard deviation of NPV = $

• Coefficient of variation of NPV = 2.1956

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College