Concept explainers

Classifying costs

The following is a list of costs that were incurred in the production and sale of all-terrain vehicles (ATVs).

a.Attorney fees for drafting a new lease for headquarters offices.

b.Cash paid to outside firm for janitorial services for factory.

c. Commissions paid to sales representatives, based on the number of ATVs sold.

d.Cost of advertising in a national magazine.

e.Cost of boxes used in packaging ATVs.

f. Electricity used to run the robotic machinery.

g.Engine oil used in engines prior to shipment. h. Factory cafeteria cashier's wages.

i. Filler for spray gun used to paint the ATVs.

j. Gasoline engines used for ATVs.

k.Hourly wages of operators of robotic machinery used in production.

I. License fees for use of patent for transmission assembly, based on the number of ATVs produced.

m. Maintenance costs for new robotic factory equipment, based on hours of usage.

n. Paint used to coat the ATVs.

o.Payroll taxes on hourly assembly line employees.

p.Plastic for outside housing of ATVs.

q.Premiums on insurance policy for factory buildings.

r. Properly taxes on the factory building and equipment.

s.Salary of factory supervisor.

t. Salary of quality control supervisor who inspects each ATV before it is shipped.

u.Salary of vice president of marketing.

v. Steering wheels for ATVs.

w. Straight-line

x.Steel used in producing the ATVs.

y.Telephone charges for company controller's office.

z.Tires for ATVs.

Instructions

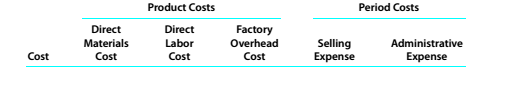

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Hicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forwardIdentify activity bases From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons commission of 5% of the sales price for each car sold, and (3) administrative costs for ordering cars. Number of cars sold Dollar amount of cars ordered Number of cars ordered Number of cars on hand Number of cars received Dollar amount of cars sold Dollar amount of cars received Dollar amount of cars on handarrow_forwardFor apparel manufacturer Abercrombie Fitch, Inc. (ANF), classify each of the following costs as either a product cost or a period cost: a. Advertising expenses b. Chief financial officers salary c. Depreciation on office equipment d. Depreciation on sewing machines e. Fabric used during production f. Factory janitorial supplies g. Factory supervisors salaries h. Property taxes on factory building and equipment i. Oil used to lubricate sewing machines j. Repairs and maintenance costs for sewing machines k. Research and development costs l. Sales commissions m. Salaries of distribution center personnel n. Salaries of production quality control supervisors o. Travel costs of media relations employees p. Utility costs for office building q. Wages of sewing machine operatorsarrow_forward

- Ethan Manufacturing Incorporated produces floor mats for automobiles. The owner, Joseph Ethan, has asked you to assist in estimating maintenance costs. Together, you and Joseph determine that the single best cost driver for maintenance costs is machine hours. These data are from the previous fiscal year for maintenance costs and machine hours: Month Maintenance Costs Machine Hours 1 $ 2,780 1,870 2 2,940 1,950 3 3,090 2,030 4 3,200 2,050 5 3,280 2,080 6 3,250 2,060 7 3,190 2,040 8 3,030 2,020 9 2,800 1,880 10 2,400 1,280 11 2,410 1,480 12 2,630 1,770 Required: 1. What is the cost equation for maintenance costs using the high-low method? 2. Calculate the mean absolute percentage error (MAPE) for the cost equation you developed in requirement 1.arrow_forwardIdentifying product costs and period costs Classify each cost of a paper manufacturer as either product cost or period cost: a. Salaries of scientists studying ways to speed forest growth. b. Cost of computer software to track WIP Inventory. c. Cost of electricity at the paper mill. d. Salaries of the company’s top executives. e. Cost of chemicals to treat the paper. f. Cost of TV ads. g. Depreciation on the manufacturing plant. h. Cost to purchase wood pulp. i. Life insurance on the CEO.arrow_forwardAssigning Costs to Activities, Resource Drivers The Receiving Department has three activities: unloading, counting goods, and inspecting. Unloading uses a forklift that is leased for $21,000 per year. The forklift is used only for unloading. The fuel for the forklift is $3,700 per year. Other operating costs (maintenance) for the forklift total $1,500 per year. Inspection uses some special testing equipment that has depreciation of $1,750 per year and an operating cost of $1,750. Receiving has three employees who have an average salary of $50,000 per year. The work distribution matrix for the receiving personnel is as follows: Activity Percentage of Time on Each Activity Unloading 40% Counting 25% Inspecting 35% No other resources are used for these activities. Required: 1. Calculate the cost of each activity. Unloading $fill in the blank 1 Counting $fill in the blank 2 Inspecting $fill in the blank 3 2. Explain the two methods used to assign costs to activities.…arrow_forward

- Classify the following costs of this new product as direct materials, direct labor, manufacturing overhead, selling, or administrative 1. President's salary. 2. Packages used to hold the skin wipes. 3. Cleaning materials used to clean the skin wipe packages. 4. Wages of workers who package the product. 5. Cost of advertising the product. 6. The salary of the supervisor of the workers who package the product. 7. Cost accountant's salary (the accountant works in the factory). 8. Cost of a market research survey. 9. Sales commissions paid as a percent of sales. 10. Depreciation of administrative office building. Problem B Classify the costs listed in the previous problem as either product costs or period costs.arrow_forwardClassifying Costs The following is a list of costs incurred by several manufacturing companies. Classify each of the following costs as product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overhead cost. Indicate whether each period cost is a selling expense or an administrative expense. Costs Classification a. Bonus for vice president of marketing b. Costs of operating a research laboratory c. Cost of unprocessed milk for a dairy d. Depreciation of factory equipment e. Entertainment expenses for sales representatives f. Factory supplies g. First-aid nurse for factory workers h. Health insurance premiums paid for factory workers i. Hourly wages of warehouse laborers j. Lumber used by furniture manufacturer k. Maintenance costs for factory equipment l. Microprocessors for a microcomputer manufacturer m. Packing supplies for products sold, which are…arrow_forwardClassifying costsThe following is a list of costs incurred by several businesses:a. Salary of quality control supervisor b. Packing supplies for products sold. These supplies are a verysmall portion of the total cost of the product.c. Factory operating suppliesd. Depreciation of factory equipmente. Hourly wages of warehouse laborers f. Wages of company controller's secretaryg. Maintenance and repair costs for factory equipmenth. Paper used by commercial printeri. Entertainment expenses for sales representativesj. Protective glasses for factory machine operators k. Sales commissionsl. Cost of hogs for meat processorm. Cost of telephone operators for a toll-free hotline to helpcustomers operate productsn. Hard drives for a microcomputer manufacturer o. Lumber used by furniture manufacturerp. Wages of a machine operator on the production lineq. First-aid supplies for factory workersr. Tires for an automobile manufacturers. Paper used by Computer Department in processing variousmanagerial…arrow_forward

- Classify each of the following activities for a bed-frame manufacturer as either unit-level, batch-level, product-level, or facility-level: 1. Ordering of glue and nails 2. Design of bed frames 3. Depreciation of manufacturing building 4. Sanding the wood 5. Management salaries 6. Property taxes 7. Staining of furniture 8. Cutting the wood 9. Setting up equipment to make children’s bed frames 10.…arrow_forwardSM, Inc. makes ski-boards in Davao. Identify the correct matching of terms. * A. Fiberglass is factory overhead B. Plant real estate taxes are a period cost C. Depreciation on delivery trucks is a product cost D. Payroll taxes for workers in the Packaging Dept. are direct laborarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College