ROCE 2- ROE 3- Earnings per share

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Required:

a. Calculate the following ratios for Sweets plc for 2021 and 2020, showing the formulas and workings:

1- ROCE

2- ROE

3- Earnings per share

4- Net profit margin

5- Asset turnover

6- Stock holding days

7- Debtors collection period

8- Current ratio

9- Gearing ratio

10- Interest cover

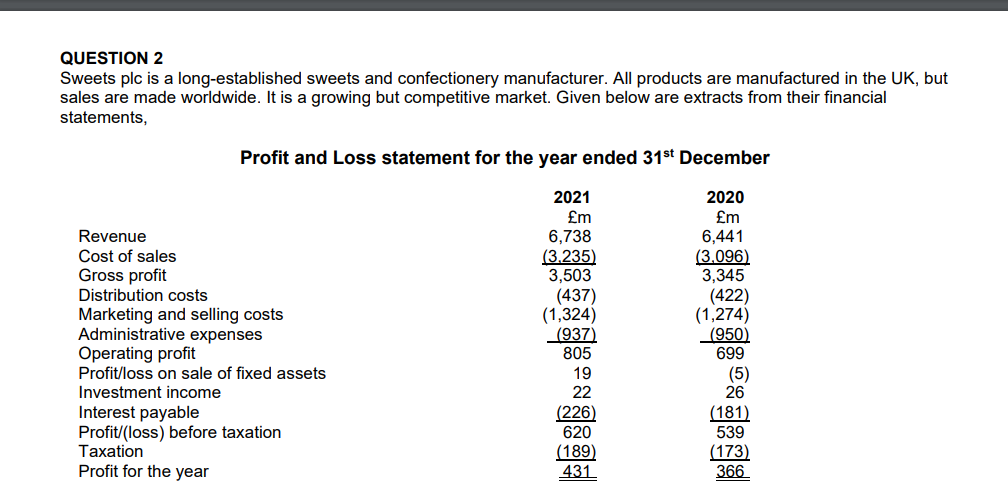

Transcribed Image Text:QUESTION 2

Sweets plc is a long-established sweets and confectionery manufacturer. All products are manufactured in the UK, but

sales are made worldwide. It is a growing but competitive market. Given below are extracts from their financial

statements,

Revenue

Cost of sales

Gross profit

Profit and Loss statement for the year ended 31st December

2020

£m

6,441

(3,096)

3,345

Distribution costs

Marketing and selling costs

Administrative expenses

Operating profit

Profit/loss on sale of fixed assets

Investment income

Interest payable

Profit/(loss) before taxation

Taxation

Profit for the year

2021

£m

6,738

(3.235)

3,503

(437)

(1,324)

(937)

805

19

22

(226)

620

(189)

431

(422)

(1,274)

(950)

699

(5)

26

(181)

539

(173)

366

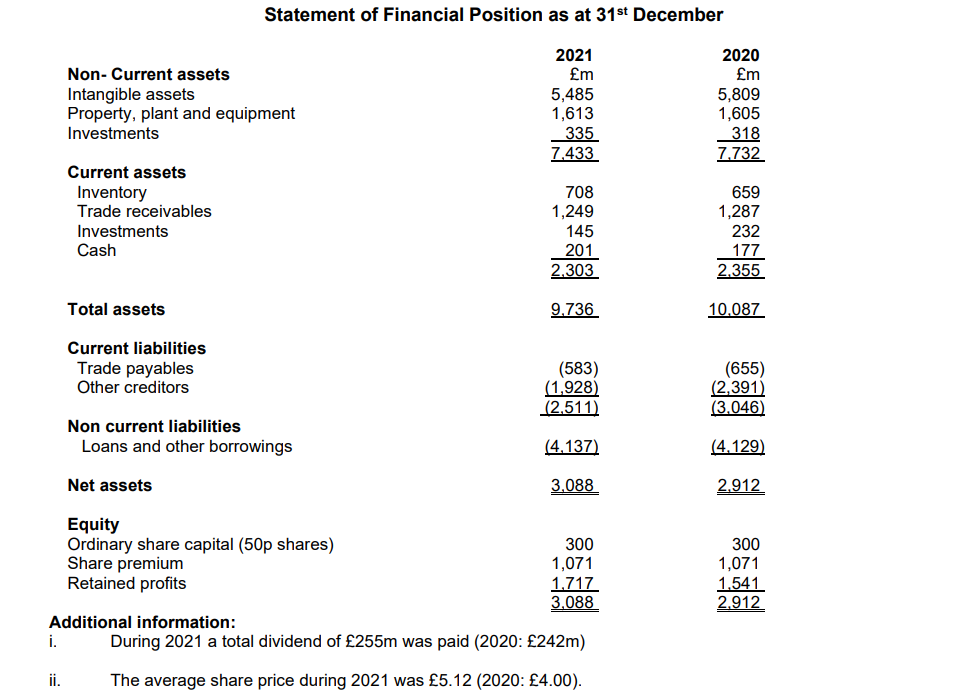

Transcribed Image Text:i.

ii.

Non- Current assets

Intangible assets

Property, plant and equipment

Investments

Current assets

Inventory

Trade receivables

Investments

Cash

Total assets

Current liabilities

Trade payables

Other creditors

Statement of Financial Position as at 31st December

2021

£m

Additional information:

Non current liabilities

Loans and other borrowings

Net assets

Equity

Ordinary share capital (50p shares)

Share premium

Retained profits

5,485

1,613

335

7,433

708

1,249

145

201

2,303

9.736

(583)

(1,928)

(2,511)

(4.137)

3,088

300

1,071

1.717

3,088

During 2021 a total dividend of £255m was paid (2020: £242m)

The average share price during 2021 was £5.12 (2020: £4.00).

2020

£m

5,809

1,605

318

7.732

659

1,287

232

177

2,355

10,087

(655)

(2,391)

(3,046)

(4.129)

2,912

300

1,071

1,541

2,912

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education