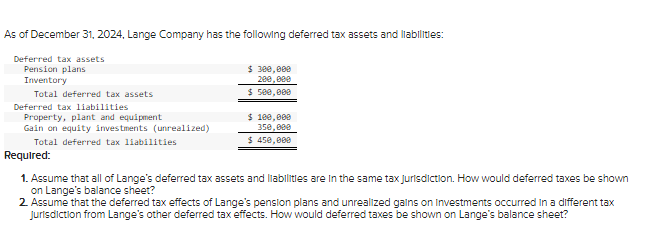

As of December 31, 2024, Lange Company has the following deferred tax assets and liabilities: Deferred tax assets Pension plans Inventory Total deferred tax assets Deferred tax liabilities Property, plant and equipment Gain on equity investments (unrealized) Total deferred tax liabilities $ 300,000 200,000 $ 500,000 $ 100,000 350,000 $ 450,000 Required: 1. Assume that all of Lange's deferred tax assets and liabilities are in the same tax jurisdiction. How would deferred taxes be shown on Lange's balance sheet? 2. Assume that the deferred tax effects of Lange's pension plans and unrealized gains on Investments occurred in a different tax Jurisdiction from Lange's other deferred tax effects. How would deferred taxes be shown on Lange's balance sheet?

As of December 31, 2024, Lange Company has the following deferred tax assets and liabilities: Deferred tax assets Pension plans Inventory Total deferred tax assets Deferred tax liabilities Property, plant and equipment Gain on equity investments (unrealized) Total deferred tax liabilities $ 300,000 200,000 $ 500,000 $ 100,000 350,000 $ 450,000 Required: 1. Assume that all of Lange's deferred tax assets and liabilities are in the same tax jurisdiction. How would deferred taxes be shown on Lange's balance sheet? 2. Assume that the deferred tax effects of Lange's pension plans and unrealized gains on Investments occurred in a different tax Jurisdiction from Lange's other deferred tax effects. How would deferred taxes be shown on Lange's balance sheet?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 16PC: Deferred Tax Assets. Components of the deferred tax asset of Biosante Pharmaceuticals, Inc., are...

Related questions

Question

Hw.58.

Transcribed Image Text:As of December 31, 2024, Lange Company has the following deferred tax assets and liabilities:

Deferred tax assets

Pension plans

Inventory

Total deferred tax assets

Deferred tax liabilities

Property, plant and equipment

Gain on equity investments (unrealized)

Total deferred tax liabilities

$ 300,000

280,000

$ 500,000

$ 100,000

350,000

$ 450,000

Required:

1. Assume that all of Lange's deferred tax assets and liabilities are in the same tax jurisdiction. How would deferred taxes be shown

on Lange's balance sheet?

2. Assume that the deferred tax effects of Lange's pension plans and unrealized gains on Investments occurred in a different tax

Jurisdiction from Lange's other deferred tax effects. How would deferred taxes be shown on Lange's balance sheet?

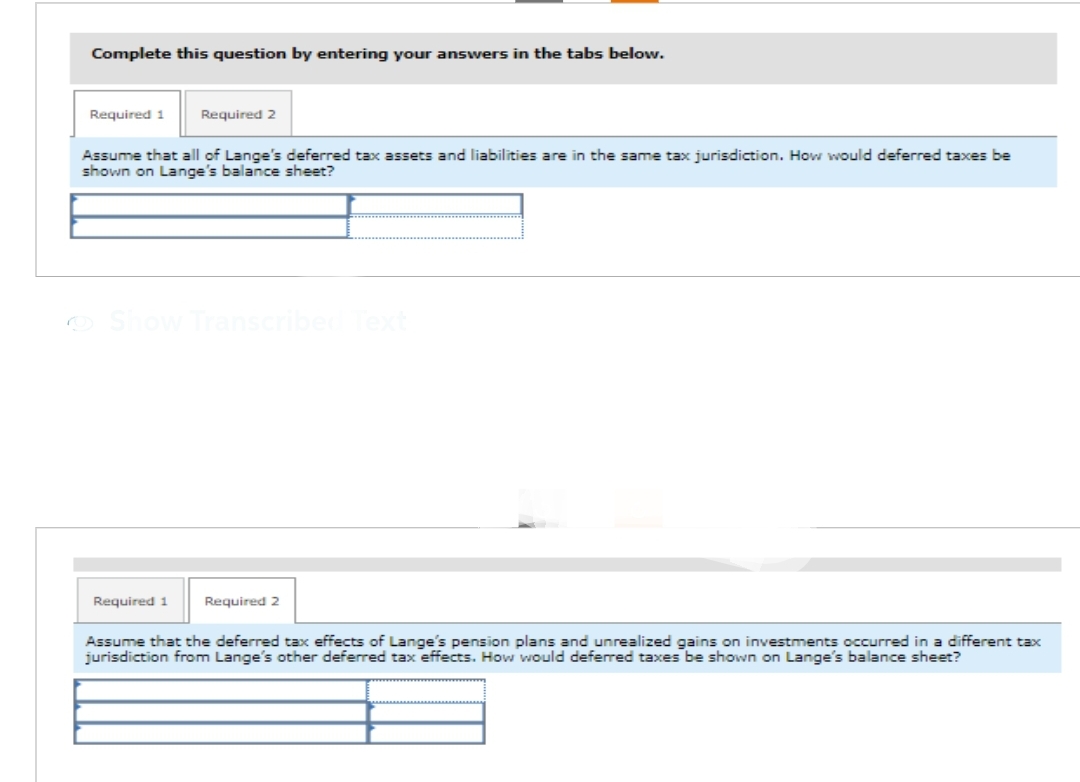

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Assume that all of Lange's deferred tax assets and liabilities are in the same tax jurisdiction. How would deferred taxes be

shown on Lange's balance sheet?

Show Transcribed Text

Required 1

Required 2

Assume that the deferred tax effects of Lange's pension plans and unrealized gains on investments occurred in a different tax

jurisdiction from Lange's other deferred tax effects. How would deferred taxes be shown on Lange's balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning