Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 16PC

REQUIRED

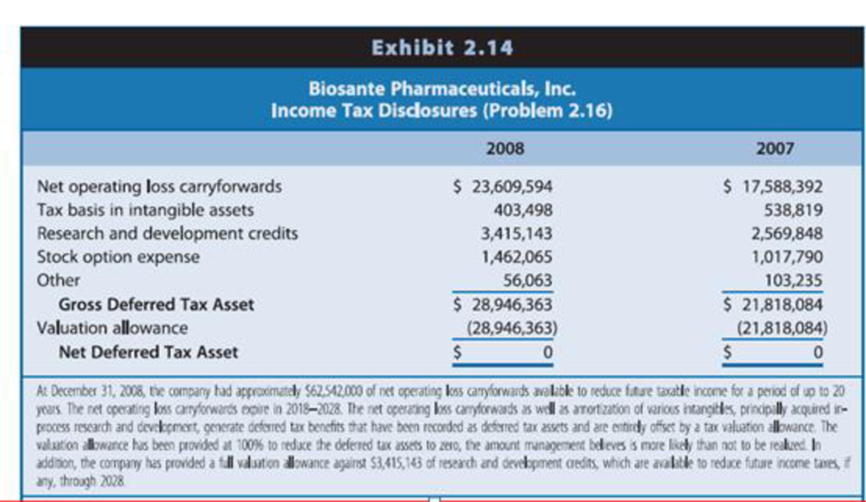

- a. At the end of 2008, the largest deferred tax asset is for net operating loss carryforwards. (Net operating loss carryforwards [also referred to as tax loss carryforwards] are amounts reported as taxable losses on tax filings. Because the tax authorities generally do not “pay” corporations for incurring losses, companies are allowed to “carry forward” taxable losses to future years to offset taxable income. These future tax benefits give rise to deferred tax assets.) As of the end of 2008, what is the dollar amount of the company’s net operating loss carryforwards? What is the dollar amount of the deferred tax asset for the net operating loss carryforwards? Describe how these two amounts are related.

- b. Biosante has gross deferred tax assets of $28,946,363. However, the net deferred tax assets balance is zero. Explain.

- c. The valuation allowance for the deferred tax asset increased from $21,818,084 to $28,946,363 between 2007 and 2008. How did this change affect the company's net income?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Cinnamon, Inc. recorded a total deferred tax asset in 2007 of $12,301, off set by a $12,301valuation allowance. Cinnamon most likely :A . fully utilized the deferred tax asset in 2007.B . has an equal amount of deferred tax assets and deferred tax liabilities.C . expects not to earn any taxable income before the deferred tax asset expires.

Crystal Critters, Inc., a U.S. GAAP reporter, has the deferred tax assets and liabilities presented below:

Item

Classification on the Balance Sheet of Related Account

Deferred Tax Associated with Item

Excess of warranty expense over warranty deductions

Current

$74,000 Asset

Accelerated depreciation for tax purposes

Noncurrent

$84,000 Liability

Installment sales receivable

Current

$44,000 Liability

Contingent liability

Current

$34,000 Asset

Assuming it meets the conditions to net assets and liabilities, how will the company report deferred taxes on the balance sheet?

Group of answer choices

current asset: deferred tax asset $108,000; noncurrent liability: deferred tax liability $128,000

noncurrent liability: deferred tax liability $20,000

current liability: deferred tax liability $64,000; noncurrent liability: deferred tax liability $84,000

current liability: deferred tax liability $44,000; noncurrent asset: deferred tax asset $84,000

Tetra Corp, an IFRS reporter, has the deferred tax assets and liabilities presented below:

Item

Classification on the Balance Sheet of Related Account

Deferred Tax Associated with Item

Excess of warranty expense over warranty deductions

Current

$69,000 Asset

Accelerated depreciation for tax purposes

Noncurrent

$79,000 Liability

Installment sales receivable

Current

$39,000 Liability

Contingent liability

Current

$29,000 Asset

What will the company report for deferred taxes on the balance sheet?

Group of answer choices

noncurrent assets: deferred tax asset $20,000

noncurrent liabilities: deferred tax liability $20,000

current assets: deferred tax asset $59,000; noncurrent liabilities: deferred tax liability $79,000

Companies do not report deferred taxes on the balance sheet under IFRS.

Chapter 2 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 2 - Prob. 1QECh. 2 - Asset Valuation and Income Recognition. Asset...Ch. 2 - Trade-Offs among Acceptable Accounting...Ch. 2 - Income Flows versus Cash Flows. The text states,...Ch. 2 - Prob. 5QECh. 2 - Prob. 6QECh. 2 - Prob. 7QECh. 2 - Prob. 8QECh. 2 - Computation of Income Tax Expense. A firms income...Ch. 2 - Computation of Income Tax Expense. A firms income...

Ch. 2 - Costs to Be Included in Historical Cost Valuation....Ch. 2 - Effect of Valuation Method for Nonmonetary Asset...Ch. 2 - Prob. 13PCCh. 2 - Prob. 14PCCh. 2 - Prob. 15PCCh. 2 - Deferred Tax Assets. Components of the deferred...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Interpreting Income Tax Disclosures. Prepaid Legal...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Analyzing Transactions. Using the analytical...Ch. 2 - Prob. 21PCCh. 2 - Starbucks The financial statements of Starbucks...Ch. 2 - Prob. 1BICCh. 2 - Prob. 1CICCh. 2 - Prob. 1DICCh. 2 - Prob. 1EICCh. 2 - Prob. 1FICCh. 2 - Starbucks The financial statements of Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Barth James Inc. has the following deferred tax assets and liabilities: 12,000 noncurrent deferred tax asset, and 10,500 noncurrent deferred tax liability. Show how Barth James would report these deferred tax assets and liabilities on its balance sheet.arrow_forwardDefinitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions. 1. The deferred tax consequences of future deductible amounts and operating loss carryforwards 2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively 3. Temporary difference that results in taxable amounts in future years when the related asset or liability is recovered or settled, respectively 4. The future effects on income taxes, as measured by the applicable enacted tax rate and provisions of the enacted tax low, resulting from temporary differences and operating loss carryforwards at the end of the current year 5. The change during the year in a corporations deferred tax liabilities and assets 6. The deferred tax consequences of future taxable amounts 7. The portion of o deferred tax asset for which it is more likely than not that a tax benefit will not be realized 8. Temporary difference that results in deductible amounts in future years when the related asset or liability is recovered or settled, respectively 9. The sum of income tax payable and deferred tax expense (or benefit) 10. The amount of income taxes paid or payable (or refundable) for the current year 11. An excess of tax deductible expenses over taxable revenues in a year that may be carried forward to reduce taxable income in a future year 12. The excess of taxable revenues over tax deductible expenses and exemptions for the year 13. Income tax expense divided by income before income taxesarrow_forwardDue to differences between depreciation reported in the income statement and depreciation deducted for tax purposes, Lucas Corp. has $2 million in temporary differences that will increase taxable income next year. Assuming that Lucas has no other temporary differences, deferred income taxes should be reported in this year's ending balance sheet as a______?arrow_forward

- Blossom Corporation has a deferred tax asset at December 31, 2022 of $ 250000 due to the recognition of potential tax benefits of an operating loss carryforward. The enacted tax rates are as follows: 30% for 2019–2021; 25% for 2022; and 20% for 2023 and thereafter. Assuming that management expects that only 50% of the related benefits will actually be realized, a valuation account should be established in the amount of:arrow_forwardLindemax Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.) The tax rates listed were all enacted by the beginning of 2018. Instructions a) Prepare the journal entries for the years 2018-2021 to record income tax expense (benefit) and income tax payable (refundable) and the tax effects of the loss carryback and carryforward, assuming that the end of 2020 it is probable that the benefits of the loss carryforward will be realized in the future.arrow_forwardA net operating loss occurs when tax-deductible expenses exceed taxable revenues. Tax laws permit the net operating loss to be used to reduce taxable income in future profitable years. How are loss carryforwards recognized for financial reporting purposes?arrow_forward

- A company has only one deductible temporary difference due to the use of the current expected credit loss method (CECL) of recognizing credit losses (ie, bad debts) for financial reporting purposes. The company is trying to determine how the resulting deferred tax asset will be reported on the balance sheet. Which section of the authoritative literature describes whether deferred tax assets and liabilities are classified as current or noncurrent? Enter your response in the answer fields below. Unless specifically requested, your response should not cite implementation guidance. Guidance on correctly structuring your response appears above and below the answer fields. Type the topic here. Correctly formatted FASB ASC topics are 3 digits. FASB ASCarrow_forwardAssume that The Bell Company operates in an industry for which NOL carryback is allowed. The Bell Company had the following operating results: Year Income (loss) Tax rate Income tax 2018 40,000 25 % 10,000 2019 40,000 25 % 10,000 2020 50,000 30 % 15,000 2021 (130,000 ) 30 % 0 What is the Deferred tax Asset in 2021?arrow_forwardWhich of the following usually results in an increase in a deferred tax asset? A) Accelerated depreciation for tax reporting and straight-line depreciation for financial reporting. B) Prepaid insurance. C) Subscriptions delivered for which customers had paid in advance. D) None of these answer choices are correct.arrow_forward

- A net operating loss occurs when tax-deductible expenses exceed taxable revenues. Tax laws permit the net operating loss to be used to reduce taxable income in other, profitable years by either a carryback of the loss to prior years or a carryforward of the loss to later years. How are loss carrybacks and loss carryforwards recognized for financial reporting purposes?arrow_forwardLynch Company had a net deferred tax asset of $69,224 at the beginning of the year, representing a net taxable deductible difference of $203,600 (taxed at 34 percent). During the year, Lynch reported pretax book income of $814,400. Included in the computation were favorable temporary differences of $23,600 and unfavorable temporary differences of $51,800. At the beginning of the year, Congress reduced the corporate tax rate to 21 percent. Lynch's deferred income tax expense or benefit for the current year would be: Multiple Choice Net deferred tax benefit of $5,922. Net deferred tax expense of $5,922. Net deferred tax benefit of $32,390. Net deferred tax expense of $20,546.arrow_forwardAn entity computed its pre-tax income in its GAAP compliant books at P2,450,000 while its income per income tax return properly computed at P2,850,000. There has been a temporary difference causing the discrepancy between the two amounts. The tax rate is 30%. How much is the Deferred Tax Liability of the company to be presented in its statement of financial position? P120,000P855,000P735,000P0 Norie Company leased an asset on a finance lease. The present value of the lease payments total P686,000 and the fair value of the asset is P750,000. The asset has a useful life of 5 years and the lease term is 4 years. The bargain purchase option for the asset at the end of its useful life is nominal and is substantially lower than the value of the asset at that date. Depreciation for the asset is computed using straight line method. How much is the annual depreciation for the asset? P187,500 P150,000 P171,500 P137,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License