As of January 2, 2021, The Triple J Company had the following items in its capital structure: o 12,000 shares of preferred stock issued, with a par value of $7, a market value of $12, an annual dividend of $2, and 3,000 shares in the treasury, and 24,000 shares of common stock issued, with a stated value of $5, a market value of $9, and 4,000 shares in the treasury.

As of January 2, 2021, The Triple J Company had the following items in its capital structure: o 12,000 shares of preferred stock issued, with a par value of $7, a market value of $12, an annual dividend of $2, and 3,000 shares in the treasury, and 24,000 shares of common stock issued, with a stated value of $5, a market value of $9, and 4,000 shares in the treasury.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 27E: Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2...

Related questions

Question

100%

Need help with doing the statement entries on accounting paper.

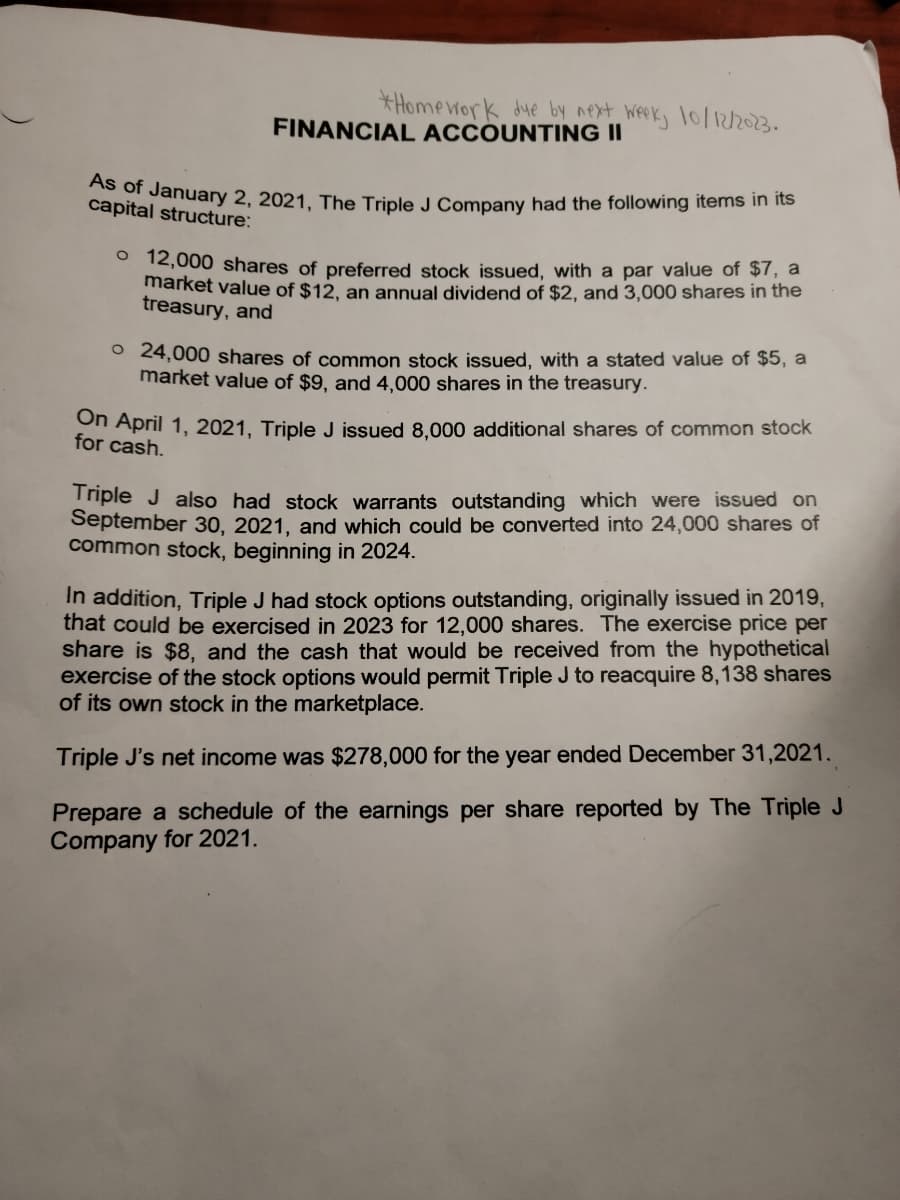

Transcribed Image Text:*Homework due by next week, 10/12/2023.

FINANCIAL ACCOUNTING II

As of January 2, 2021, The Triple J Company had the following items in its

capital structure:

o 12,000 shares of preferred stock issued, with a par value of $7, a

market value of $12, an annual dividend of $2, and 3,000 shares in the

treasury, and

24,000 shares of common stock issued, with a stated value of $5, a

market value of $9, and 4,000 shares in the treasury.

On April 1, 2021, Triple J issued 8,000 additional shares of common stock

for cash.

Triple J also had stock warrants outstanding which were issued on

September 30, 2021, and which could be converted into 24,000 shares of

common stock, beginning in 2024.

In addition, Triple J had stock options outstanding, originally issued in 2019,

that could be exercised in 2023 for 12,000 shares. The exercise price per

share is $8, and the cash that would be received from the hypothetical

exercise of the stock options would permit Triple J to reacquire 8,138 shares

of its own stock in the marketplace.

Triple J's net income was $278,000 for the year ended December 31,2021.

Prepare a schedule of the earnings per share reported by The Triple J

Company for 2021.

![7

6

8

9

0

4

5

3

Approv

9

of

1

2

5

6

7

8

S

3

9

4

7

0

2

3

1

4

Jeffrey Wang

Triple J Company

Computation of Earnings Per share [EPS]

For the Year Ended December 31, 2021

F

= $10,000

2

INITIALS

DATE

Busic

Prepared By Approved By

hilatel](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb7b9bc12-9bec-475d-bc99-e13d2a9b76e2%2Fa64f3773-ee53-4201-befc-15a1315ae5b3%2Fkqy712s_processed.jpeg&w=3840&q=75)

Transcribed Image Text:7

6

8

9

0

4

5

3

Approv

9

of

1

2

5

6

7

8

S

3

9

4

7

0

2

3

1

4

Jeffrey Wang

Triple J Company

Computation of Earnings Per share [EPS]

For the Year Ended December 31, 2021

F

= $10,000

2

INITIALS

DATE

Busic

Prepared By Approved By

hilatel

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning