As part of its accounting process, estimated incon ed each month for 28% of the current month's net income. The income taxes are paid in the first month of each qu nt accrued for the prior quarter. The following information is available for the fourth quarter of the year just ended. utations are completed on January 20 of the following year, Nishi determines that the quarter's Income Taxes Pay ce should be $29,446 on December 31 of the year just ended (its unadjusted balance is $24,346). ober net income ember net income ember net income $ 31,000 20, 150 35, 800 ermine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in t Payable account. pare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the la nt of the fourth-quarter taxes. nplete this question by entering your answers In the tabs below.

As part of its accounting process, estimated incon ed each month for 28% of the current month's net income. The income taxes are paid in the first month of each qu nt accrued for the prior quarter. The following information is available for the fourth quarter of the year just ended. utations are completed on January 20 of the following year, Nishi determines that the quarter's Income Taxes Pay ce should be $29,446 on December 31 of the year just ended (its unadjusted balance is $24,346). ober net income ember net income ember net income $ 31,000 20, 150 35, 800 ermine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in t Payable account. pare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the la nt of the fourth-quarter taxes. nplete this question by entering your answers In the tabs below.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1SEB

Related questions

Question

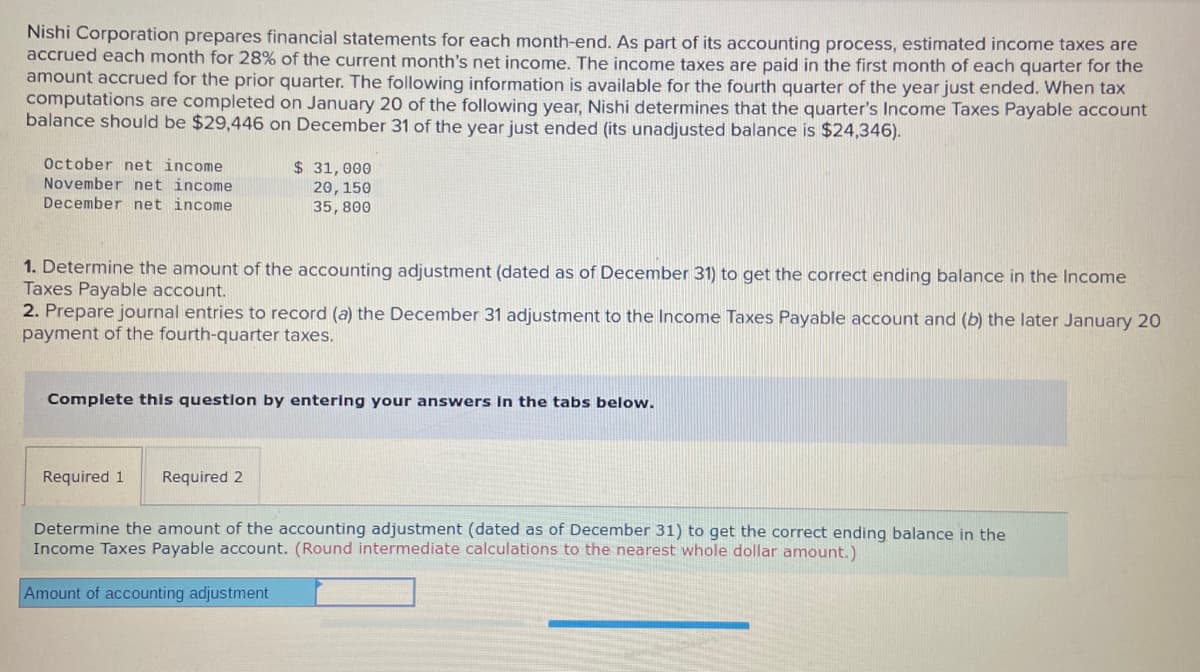

Transcribed Image Text:Nishi Corporation prepares financial statements for each month-end. As part of its accounting process, estimated income taxes are

accrued each month for 28% of the current month's net income. The income taxes are paid in the first month of each quarter for the

amount accrued for the prior quarter. The following information is available for the fourth quarter of the year just ended. When tax

computations are completed on January 20 of the following year, Nishi determines that the quarter's Income Taxes Payable account

balance should be $29,446 on December 31 of the year just ended (its unadjusted balance is $24,346).

October net income

November net income

$ 31,000

20,150

35, 800

December net income

1. Determine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in the Income

Taxes Payable account.

2. Prepare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the later January 20

payment of the fourth-quarter taxes.

Complete this question by entering your answers In the tabs below.

Required 1

Required 2

Determine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in the

Income Taxes Payable account. (Round intermediate calculations to the nearest whole dollar amount.)

Amount of accounting adjustment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning