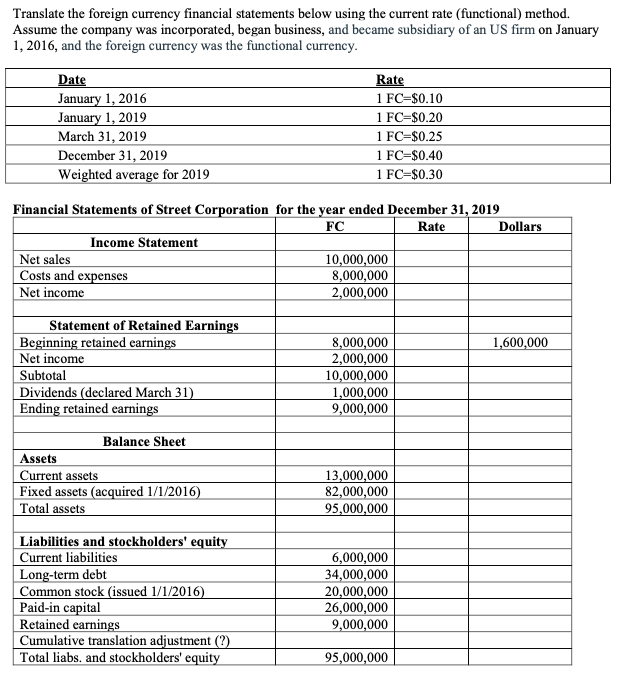

Translate the foreign currency financial statements below using the current rate (functional) method. Assume the company was incorporated, began business, and became subsidiary of an US firm on January 1, 2016, and the foreign currency was the functional currency. Date January 1, 2016 January 1, 2019 March 31, 2019 December 31, 2019 Weighted average for 2019 Rate 1 FC=$0.10 1 FC=$0.20 1 FC=$0.25 1 FC=$0.40 1 FC=S0.30 Financial Statements of Street Corporation_for the year ended December 31, 2019 FC Rate Dollars Income Statement Net sales Costs and expenses Net income 10,000,000 8,000,000 2,000,000 Statement of Retained Earnings Beginning retained earnings |Net income Subtotal Dividends (declared March 31) Ending retained carnings 8,000,000 2,000,000 10,000,000 1,000,000 9,000,000 1,600,000 Balance Sheet Assets Current assets Fixed assets (acquired 1/1/2016) Total assets 13,000,000 82,000,000 95,000,000 Liabilities and stockholders' equity |Current liabilities |Long-term debt |Common stock (issued 1/1/2016) Paid-in capital Retained earnings Cumulative translation adjustment (?) Total liabs. and stockholders' equity 6,000,000 34,000,000 20,000,000 26,000,000 9,000,000 95,000,000

Translate the foreign currency financial statements below using the current rate (functional) method. Assume the company was incorporated, began business, and became subsidiary of an US firm on January 1, 2016, and the foreign currency was the functional currency. Date January 1, 2016 January 1, 2019 March 31, 2019 December 31, 2019 Weighted average for 2019 Rate 1 FC=$0.10 1 FC=$0.20 1 FC=$0.25 1 FC=$0.40 1 FC=S0.30 Financial Statements of Street Corporation_for the year ended December 31, 2019 FC Rate Dollars Income Statement Net sales Costs and expenses Net income 10,000,000 8,000,000 2,000,000 Statement of Retained Earnings Beginning retained earnings |Net income Subtotal Dividends (declared March 31) Ending retained carnings 8,000,000 2,000,000 10,000,000 1,000,000 9,000,000 1,600,000 Balance Sheet Assets Current assets Fixed assets (acquired 1/1/2016) Total assets 13,000,000 82,000,000 95,000,000 Liabilities and stockholders' equity |Current liabilities |Long-term debt |Common stock (issued 1/1/2016) Paid-in capital Retained earnings Cumulative translation adjustment (?) Total liabs. and stockholders' equity 6,000,000 34,000,000 20,000,000 26,000,000 9,000,000 95,000,000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:Translate the foreign currency financial statements below using the current rate (functional) method.

Assume the company was incorporated, began business, and became subsidiary of an US firm on January

1, 2016, and the foreign currency was the functional currency.

Date

January 1, 2016

January 1, 2019

March 31, 2019

Rate

1 FC=$0.10

1 FC=$0.20

1 FC=$0.25

1 FC=$0.40

1 FC=$0.30

December 31, 2019

Weighted average for 2019

Financial Statements of Street Corporation for the year ended December 31, 2019

FC

Rate

Dollars

Income Statement

Net sales

Costs and expenses

Net income

10,000,000

8,000,000

2,000,000

Statement of Retained Earnings

Beginning retained earnings

8,000,000

2,000,000

10,000,000

1,000,000

9,000,000

1,600,000

Net income

Subtotal

Dividends (declared March 31)

Ending retained earnings

Balance Sheet

Assets

Current assets

Fixed assets (acquired 1/1/2016)

Total assets

13,000,000

82,000,000

95,000,000

Liabilities and stockholders' equity

Current liabilities

|Long-term debt

|Common stock (issued 1/1/2016)

Paid-in capital

Retained earnings

Cumulative translation adjustment (?)

Total liabs. and stockholders' equity

6,000,000

34,000,000

20,000,000

26,000,000

9,000,000

95,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning