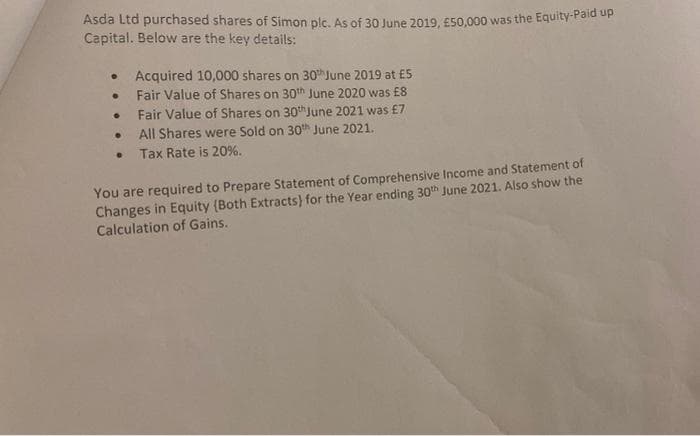

Asda Ltd purchased shares of Simon plc. As of 30 June 2019, E50,000 was the Equity-Pald op Capital. Below are the key details: Acquired 10,000 shares on 30h June 2019 at ES Fair Value of Shares on 30th June 2020 was £8 Fair Value of Shares on 30th June 2021 was £7 All Shares were Sold on 30h June 2021. Tax Rate is 20%. You are required to Prepare Statement of Comprehensive Income and Statement of Changes in Equity (Both Extracts) for the Year ending 30h June 2021. Also show the Calculation of Gains.

Q: Gomez Corporation uses the allowance method to account for uncollectibles. On January 31, it wrote…

A: Allowance method for bad debts is the method in which allowance is made for the account receivable…

Q: Question 1 A company produces a single product called the Fidget. The following information relating…

A: Sales value required to earn desired profit=Fixed Cost+Desired Profit before taxContribution margin…

Q: Exercise 11-31 (Algo) Impairment; goodwill (LO11-8] [The following information applies to the…

A: 2)Computation of the impairment loss: In the above question, Book value of Centerpoint's net assets…

Q: Rembrandt Company acquired a plant asset at the beginning of Year 1. The asset has an estimated…

A: Given, First year depreciation under double declining balance = $20,000 Double declining rate =…

Q: Montana Incorporated began the year with a retained earnings balance of $50,000. The company paid a…

A: Formula: Ending Retained Earnings = Beginning Retained Earnings - net loss - Dividends paid

Q: For what decisions is the manager of a cost center not responsible?

A: Responsibility of Cost Centre Manager The main responsibility of the cost center managers to…

Q: 1. Under individual employee coverage, the worker is covered by the FLSA if: a.the worker is a…

A: The Fair Labor Standards Act (FLSA) is an employment law organization that defines the employer's…

Q: Statement 1: All property, plant and equipment shall be initially measured at cost and presented in…

A: The property, plant and equipment includes the amount for plant, machinery, land, equipment of the…

Q: The realized gain (loss) on sale of debt investments with an objective of collecting contractual…

A: Realized Gain: When an investment is sold for a greater price than it was originally acquired, this…

Q: Cane Company manufactures two products called Alpha and Beta that sell for $150 and $105,…

A: Fixed overhead is a collection of costs that do not change as a result of exercise increases. The…

Q: Mosa joined Avion Electronics in April 1983. Her employment was terminated on November 30, 2016 and…

A: Calculate the amount of retiring allowance eligible for transfer as follows: Step 1: $2,000 × 13…

Q: Beech has budgeted fixed overhead of $402,500 based on budgeted production of 17,500 units. During…

A: Budgeted Fixed overhead rate is calculated in the beginning of the period (i.e., a year). Such…

Q: Properly designed performance measures will help move the company toward meeting the goals of its…

A: The true or false question on performance measures has been answered hereunder : What are…

Q: What is the amount of the economic value added (EVA)? * The following information is available for…

A: Solution Concept EVA means economic value added It means the value that is added over and above the…

Q: Q1. Reginald Logistics, a U.S. shipping company, has just begun distributing goods across the…

A: What do we understand by the term Stakeholders? Stakeholders are the people who are interested in…

Q: de Incorporated declared and paid dividends of P250,000 in 2021 and reported net income of…

A: Tan Beda acquired 10% voting shares in Taint Dude . 10% is very low amount for controlling…

Q: On December 31, 2019, an equipment with a carrying amount of P6,500,000 (cost of P10,000,000 less…

A: Concept of Impairment of assets

Q: According to the World Commission on Environment and Development, sustainable development is defined…

A: Introduction:- The Brundtland Commission, formerly the World Commission on Environment and…

Q: [The following information applies to the questions displayed below.] NewTech purchases computer…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: Prepare a differential analysis dated September 30 to determine whether the company should make…

A: Solution:- a)Preparation of a differential analysis dated September 30 to determine whether the…

Q: hese issues associated with using accounting measures as performance measures through use of…

A: The answer has been mentioned below.

Q: Rizio Company purchases a machine for $12,400, terms 1/10, n/60, FOB shipping point. Rizio paid…

A: Cost of assets: As per the generally accepted accounting principles, the cost of assets includes all…

Q: On January 1, 2020, Johny Industries issued ten-year bonds with a face value of $2,000,000 and a…

A: The bonds are the financial instruments for the business which are used to raise money from the…

Q: Long-term assets can include investments such as the purchase of new equipment, the replacement of…

A: Capital investment is the long term investment in which the assets involved has useful life of…

Q: Truman Company acquired machinery on January 1, 2017 which it depreciated under the straight-line…

A: The change in estimated useful life of a fixed asset is a type of change in accounting estimate.

Q: ly if operational profits grow by 10%.

A: Depending on the circumstances, income is defined variously, such as for taxation, financial…

Q: Machinery purchased for $60,000 by Tom Brady Co. in 2016 was originally estimated to have a life of…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: Project A requires a $315,000 initial investment for new machinery with a five-year life and a…

A: Accounting rate of return is a conventional method used in evaluation of capital budgeted proposals.…

Q: Explain how a retailing firm would determine the cost of goods sold during an accounting period.

A: Retailing firm is an entity that is engaged in trading of goods at retail level. It is an entity…

Q: eceivable, marketing principles such as the five C’s of Credit are employed. For companies operating…

A: Accounts receivable is the amount of money owed to a corporation for items or services given or used…

Q: In 7 years Harry and Sally would like to have $20,000 for a down payment on a house. How much should…

A: A down payment seems to be a monetary payment made at the start of a purchase deal. It is frequently…

Q: Which of the following is not considered an effective cash management strategy? Multiple Choice…

A: Cash management: It implies to a process that includes the management, collection, and effective…

Q: Liquidation based valuation Sam Company is currently undergoing a liquidation proceeding and is…

A: Assets are measured in liquidation accounting at the expected price for which they may be sold -…

Q: The aligning of goals between a corporation’s strategy and a manager’s personal goals is known as…

A: Introduction:- Goal congruence denotes same goals are shared by top managers and their subordinates.…

Q: Please provide journal entries for the following: Jessica Johansen started Sewn for You, a…

A: Journal entries are the basic method for recording financial transactions in the books of accounts.…

Q: Welcome Care, a senior citizen day-care center, pays the major portion of its employees' medical…

A: Percentage Tax Method In the Percentage Tax method first to determine the allowance of withhold…

Q: Long-term debt that matures within one year and is to be converted into shares should be reported…

A: Current Liability: Current liabilities are financial commitments owed by a corporation that are due…

Q: Check my work mode : This shows what is correct or incorrect for the work you have completed so far.…

A: Depreciation is an accounting word that refers to a way of allocating the cost of a tangible or…

Q: Carrot Company sells one and two-year mail order subscriptions for video of the month business.…

A: Solution Unearned subscription revenue Unearned subscription revenue means the amount that has been…

Q: Good corporate citizenship makes good business sense. True / False

A: A good corporates citizenship Enhances business goodwill Enhances brand recognition among the…

Q: Payroll Taxes Hernandez Builders has a gross payroll for January amounting to $520,000. The…

A: 1.

Q: The Constructing Department of MEC Company had 2,600 units in work in process at the beginning of…

A:

Q: Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is…

A: Straight Line Method is a method where the Depreciable cost of an Assets is charged uniformly over…

Q: Hunt Co. at the end of 2021, its first year of operations, prepared a reconciliation between pretax…

A: Taxable income is the one upon which a certain tax percentage will be applied to be paid to…

Q: The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common…

A: For producing any additional product, only variable production cost per unit is incurred. So in case…

Q: Turn to Stone, Inc. manufactures statues of pop culture icons. All statues are the same size and…

A: Actual directmaterial cost per statue = Total cost incurred/Number of statues produced

Q: Match the following form (transaction type) with the appropriate transaction description: Рayment…

A: Transactions: A business transaction is a financial transaction that takes place between two or more…

Q: Dolittle and Dalley has $4,000 in purchases for January and $6,000 in purchases for February. It…

A: Total Cash payments for inventory in February = (Purchases for February ×70%) + (Purchases of…

Q: 1. Invested cash in the business, $5,000. 2. Paid office rent, $500. 3. Purchased office supplies on…

A: Introduction: Journal entries: Recording of a business transactions in a chronological order. First…

Q: 12/31/2021 Balances 27,000 51,000 95,000 Account Accounts payable Accounts receivable Accumulated…

A: 1. Income Statement - This statement shows the income earned and loss incurred by the organization…

Step by step

Solved in 2 steps

- Waseca Company had 5 convertible securities outstanding during all of 2019. It paid the appropriate interest (and amortized any related premium or discount using the straight line method) and dividends on each security during 2019. Each of the convertible securities is described in the following table: Additional data: Net income for 2019 totaled 119,460. The weighted average number of common shares outstanding during 2019 was 40,000 shares. No share options or warrants arc outstanding. The effective corporate income tax rate is 30%. Required: 1. Prepare a schedule that lists the impact of the assumed conversion of each convertible security on diluted earnings per share. 2. Prepare a ranking of the order in which each of the convertible securities should be included in diluted earnings per share. 3. Compute basic earnings per share. 4. Compute diluted earnings per share. 5. Indicate the amount(s) of the earnings per share that Waseca would report on its 2019 income statement.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 loss

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________

- Roseau Company is preparing its annual earnings per share amounts to be disclosed on its 2019 income statement. It has collected the following information at the end of 2019: 1. Net income: 120,400. Included in the net income is income from continuing operations of 130,400 and a loss from discontinued operations (net of income taxes) of 10,000. Corporate income tax rate: 30%. 2. Common stock outstanding on January 1, 2019: 20,000 shares. 3. Common stock issuances during 2019: July 6, 4,000 shares; August 24, 3,000 shares. 4. Stock dividend: On October 19, 2019, the company declared a 10% stock dividend that resulted in 2,700 additional outstanding shares of common stock. 5. Common stock prices: 2019 average market price, 30 per share; 2019 ending market price, 27 per share. 6. 7% preferred stock outstanding on January 1, 2019: 1,000 shares. Terms: 100 par, nonconvertible. Current dividends have been paid. No preferred stock issued during 2019. 7. 8% convertible preferred stock outstanding on January 1, 2019: 800 shares. The stock was issued in 2018 at 130 per share. Each 100 par preferred stock is currently convertible into 1.7 shares of common stock. Current dividends have been paid. To date, no preferred stock has been converted. 8. Bonds payable outstanding on January 1, 2019: 100,000 face value. These bonds were issued several years ago at 97 and pay annual interest of 9.6%. The discount is being amortized in the amount of 300 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 9. Compensatory share options outstanding: Key executives may currently acquire 3,000 shares of common stock at 20 per share. The options were granted in 2018. To date, none have been exercised. The unrecognized compensation cost (net of tax) related to the options is 4 per share. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Show how Roseau would report these earnings per share figures on its 2019 income statement. Include an explanatory note to the financial statements.Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.