ASDF Corporate Income Statement Current Year Units Sold 100,000 $37.84 $3, 784,000 $1,284,000 Unit Price Sales Revenue Variable Expenses (Materials & Labor) Fixed Expenses (Marketing & Overhead) Earnings Before Interest & Taxes $350,000 $2,150,000 (ЕВIT) $198,000 $1,952,000 Paid Interest Earnings Before Taxes (EBT) $664,000 Тахes Net Income after Taxes (NIAT) $1,288,000 $258,000 Dividends Retained Earnings $1,030,000 11. Calculate the number of units ASDF must sale to break even. That is calculate BECa Unit Sales. Where: FC Total fixed costs Pu-Price per unit VGu Variable cost per unit Total Fixed Costs FC (Pu-VCu) BE Unit Sales* = Contribution Margin This is the point where: Total Costs (TC)= Total Revenue (TR) BE Unit Sales (

ASDF Corporate Income Statement Current Year Units Sold 100,000 $37.84 $3, 784,000 $1,284,000 Unit Price Sales Revenue Variable Expenses (Materials & Labor) Fixed Expenses (Marketing & Overhead) Earnings Before Interest & Taxes $350,000 $2,150,000 (ЕВIT) $198,000 $1,952,000 Paid Interest Earnings Before Taxes (EBT) $664,000 Тахes Net Income after Taxes (NIAT) $1,288,000 $258,000 Dividends Retained Earnings $1,030,000 11. Calculate the number of units ASDF must sale to break even. That is calculate BECa Unit Sales. Where: FC Total fixed costs Pu-Price per unit VGu Variable cost per unit Total Fixed Costs FC (Pu-VCu) BE Unit Sales* = Contribution Margin This is the point where: Total Costs (TC)= Total Revenue (TR) BE Unit Sales (

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

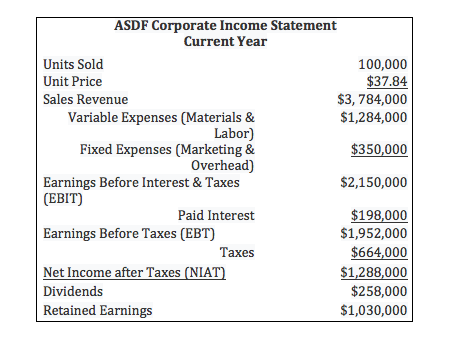

Transcribed Image Text:ASDF Corporate Income Statement

Current Year

Units Sold

100,000

$37.84

$3, 784,000

$1,284,000

Unit Price

Sales Revenue

Variable Expenses (Materials &

Labor)

Fixed Expenses (Marketing &

Overhead)

Earnings Before Interest & Taxes

$350,000

$2,150,000

(ЕВIT)

$198,000

$1,952,000

Paid Interest

Earnings Before Taxes (EBT)

$664,000

Тахes

Net Income after Taxes (NIAT)

$1,288,000

$258,000

Dividends

Retained Earnings

$1,030,000

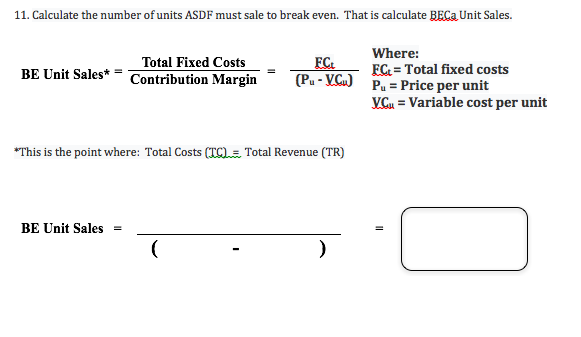

Transcribed Image Text:11. Calculate the number of units ASDF must sale to break even. That is calculate BECa Unit Sales.

Where:

FC Total fixed costs

Pu-Price per unit

VGu Variable cost per unit

Total Fixed Costs

FC

(Pu-VCu)

BE Unit Sales* =

Contribution Margin

This is the point where: Total Costs (TC)= Total Revenue (TR)

BE Unit Sales

(

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub