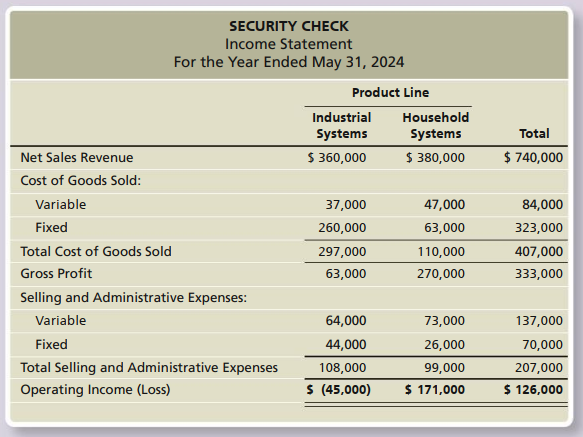

SECURITY CHECK Income Statement For the Year Ended May 31, 2024 Product Line Industrial Systems Household Systems Total Net Sales Revenue S 360,000 $ 380,000 $ 740,000 Cost of Goods Sold: Variable 37,000 47,000 84,000 Fixed 260,000 63,000 323,000 Total Cost of Goods Sold 297,000 110,000 407,000 Gross Profit 63,000 270,000 333,000 Selling and Administrative Expenses: Variable 64,000 73,000 137,000 Fixed 44,000 26,000 70,000 Total Selling and Administrative Expenses 108,000 99,000 207,000 Operating Income (Loss) S (45,000) $ 171,000 $ 126,000

SECURITY CHECK Income Statement For the Year Ended May 31, 2024 Product Line Industrial Systems Household Systems Total Net Sales Revenue S 360,000 $ 380,000 $ 740,000 Cost of Goods Sold: Variable 37,000 47,000 84,000 Fixed 260,000 63,000 323,000 Total Cost of Goods Sold 297,000 110,000 407,000 Gross Profit 63,000 270,000 333,000 Selling and Administrative Expenses: Variable 64,000 73,000 137,000 Fixed 44,000 26,000 70,000 Total Selling and Administrative Expenses 108,000 99,000 207,000 Operating Income (Loss) S (45,000) $ 171,000 $ 126,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.7P

Related questions

Question

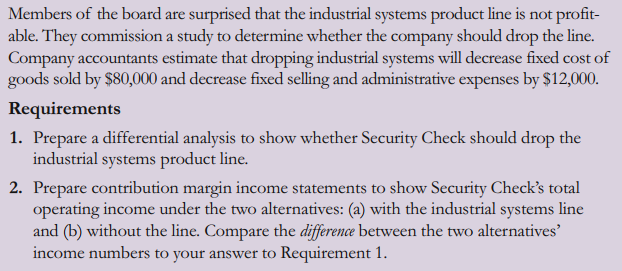

Help please... also for 2b.) $(41,000)

Transcribed Image Text:SECURITY CHECK

Income Statement

For the Year Ended May 31, 2024

Product Line

Industrial

Household

Systems

Systems

Total

Net Sales Revenue

$ 360,000

$ 380,000

$ 740,000

Cost of Goods Sold:

Variable

37,000

47,000

84,000

Fixed

260,000

63,000

323,000

Total Cost of Goods Sold

297,000

110,000

407,000

Gross Profit

63,000

270,000

333,000

Selling and Administrative Expenses:

Variable

64,000

73,000

137,000

Fixed

44,000

26,000

70,000

Total Selling and Administrative Expenses

108,000

99,000

207,000

Operating Income (Loss)

S (45,000)

$ 171,000

$ 126,000

Transcribed Image Text:Members of the board are surprised that the industrial systems product line is not profit-

able. They commission a study to determine whether the company should drop the line.

Company accountants estimate that dropping industrial systems will decrease fixed cost of

goods sold by $80,000 and decrease fixed selling and administrative expenses by $12,000.

Requirements

1. Prepare a differential analysis to show whether Security Check should drop the

industrial systems product line.

2. Prepare contribution margin income statements to show Security Check's total

operating income under the two alternatives: (a) with the industrial systems line

and (b) without the line. Compare the difference between the two alternatives'

income numbers to your answer to Requirement 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning