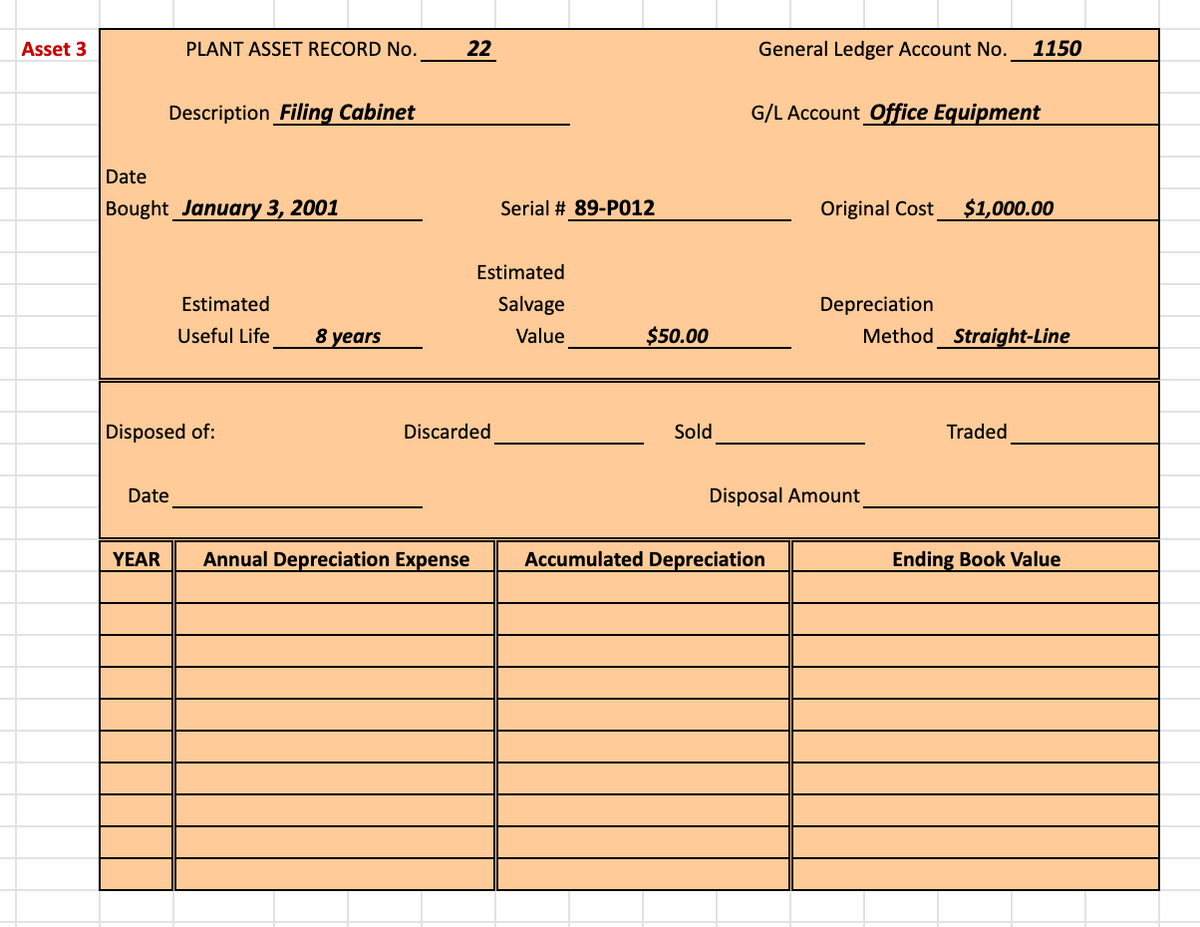

Asset 3 Date PLANT ASSET RECORD No. Description Filing Cabinet Bought_January 3, 2001 Date Estimated Useful Life Disposed of: 8 years 22 Serial # 89-P012 Estimated Salvage Value Discarded $50.00 Sold General Ledger Account No. 1150 G/L Account Office Equipment Original Cost $1,000.00 YEAR Annual Depreciation Expense Accumulated Depreciation Depreciation Disposal Amount Method _Straight-Line Traded Ending Book Value

Asset 3 Date PLANT ASSET RECORD No. Description Filing Cabinet Bought_January 3, 2001 Date Estimated Useful Life Disposed of: 8 years 22 Serial # 89-P012 Estimated Salvage Value Discarded $50.00 Sold General Ledger Account No. 1150 G/L Account Office Equipment Original Cost $1,000.00 YEAR Annual Depreciation Expense Accumulated Depreciation Depreciation Disposal Amount Method _Straight-Line Traded Ending Book Value

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14RE: (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a...

Related questions

Question

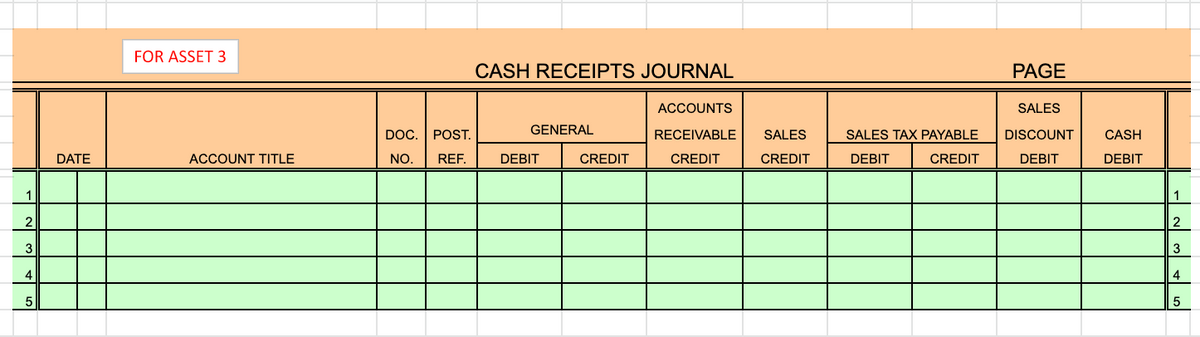

Please also complete cash receipt journal, thank you!

Transcribed Image Text:1

2

3

4

5

DATE

FOR ASSET 3

ACCOUNT TITLE

DOC. POST.

NO. REF.

CASH RECEIPTS JOURNAL

GENERAL

DEBIT

CREDIT

ACCOUNTS

RECEIVABLE SALES

CREDIT

CREDIT

SALES TAX PAYABLE

DEBIT CREDIT

PAGE

SALES

DISCOUNT CASH

DEBIT

DEBIT

1

2

3

4

5

Transcribed Image Text:Asset 3

Date

PLANT ASSET RECORD No.

Description Filing Cabinet

Bought_January 3, 2001

Date

Estimated

Useful Life

Disposed of:

8 years

22

Serial #89-P012

Estimated

Salvage

Value

Discarded

$50.00

Sold

General Ledger Account No. 1150

G/L Account Office Equipment

Original Cost

YEAR Annual Depreciation Expense Accumulated Depreciation

Depreciation

Disposal Amount

$1,000.00

Method Straight-Line

Traded

Ending Book Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning