LIQUIDITY FORMULA UNIT 2020 2019 2018 RATIOS WORKING Current Assets Current (9,716,448) 22,887,618 22,187,849 Liabilities CAPITAL CURRENT Current Assets / Current 0.66 2.61 2.42 Liabilities RATIO QUICK RATIO (Current Assets - Inventories - prepayments) Liabilities % 0.42 1.65 1.94 Current CASH Cash & Cash Equivalents / 0.23 1.34 1.28 Current Liabilities POSITION RATIO

Q: During Ramadhan, Miss Lenny sells varieties of Malay’s traditional food for iftar. She cooks curry…

A: The cost of the product means the total of all of the expenses that are incurred in the production…

Q: Change in Sales Mix and Contribution Margin Head Pops Inc. manufactures two models of solar-powered,…

A: Lets understand the basics. When there is excess capacity available then management may decide to…

Q: nap Company issues 12%, five-year bonds, on January 1 of this year, with a par value of $130,000 and…

A: Bonds are the financial instruments that issued by business to generate the cash for business. The…

Q: In valuation for purposes of determining gross estate, which is FALSE? Valuation 1.Land Higher…

A: The proper valuation of assets is very important in determining gross estate of the person if no…

Q: Peachtree Company uses sales journal, purchases journal, cash receipts journal, cash payments…

A: Purchase Journal - Purchase Journal is a form of table used to record all the purchases made on…

Q: What is the unearned interest income on January 1, 2022?

A: Given in the question: Lease term (in Years) 8 Annual Rental Payable in advance 767600…

Q: The insufficient capacity of SHELLA Craft is due to the availability of manpower that the company is…

A: Cost evaluation in the recruiting process is significant because it determines the quality of the…

Q: Julio and Milania are owners of Falcons Corporation, an S corporation. Each owns 50 percent of…

A: Introduction: An income statement representation that describes the income and expenses of an…

Q: Technology Manufacturing Corporation produces three types of semiconductors from a joint process.…

A: Technology Manufacturing Corporation produces three types of semiconductors from a joint process.…

Q: On October 1, 2021, Best Company purchased as debt investments at fair value through profit or loss,…

A: Accrued interest is one of the current asset being held by the business. This means interest revenue…

Q: Li Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal,…

A: The cash receipts journal follows the basic rule of accounting, which states that you should debit…

Q: What does the rule of 72 show as an approximate number of years? Selected answer will be…

A: Compounding is the process in which interest is credited on the principal amount as well as the…

Q: NXP Corporation issues P15 par value ordinary shares during 2021. The company received subscription…

A: The subscription received for 25000 shares at P18 per share from Mr. Navarro. He paid 45% but fails…

Q: I nee the statement COGM, COGS and income statement

A: Income statement (IS) refers to the statement which states the income as well as loss which is…

Q: In the account below, calculate the balance for September 16, 20-. Then perform the forwarding…

A: Posting balances into Ledger account is one of an important process of accounting cycle in which…

Q: 7. Company A records purchases using the net price method. It an item is purchased from a supplier…

A: Under the net method, purchases are recorded at the discounted price. Purchase discount is not…

Q: irections for Assignment A: eeknet Company's payroll register has the following totals for the…

A: Cash Payment Journal All cash payments (or disbursements) made by the company are recorded in a cash…

Q: Mickey Mouse Co. purchased equipment on January 1, 2019, at a cost of $50,000. Depreciation for 2019…

A: Introduction: Depreciation is a method of accounting that allocates the cost of a tangible or…

Q: A household has the following statistics related to Balance Sheet and annual Cash Flow: Balance…

A: Total operating percentage of a household indicates how much of total income is spent over its…

Q: rest Components makes aircraft parts. The following transactions occurred in July. Purchased…

A: Answer : a. Prepare Journal entries b. Prepare T account

Q: could someone please help me out

A: As per the guidelines, the solution for the first three parts is given. For getting answers for the…

Q: If there were 40000 pounds of direct materials on hand on January 1, 120000 pounds are desired for…

A: Raw Material Purchase Budget: When developing a production budget, it is necessary to determine how…

Q: 6. Find the future value on an investment of $12,000 for seven years at 6% annual interest…

A: Future value is value of the investment on a future date based on a interest rate Given PV= 12000…

Q: Popeye Company purchased a machine for $350,000 on January 1, 2020. Popeye depreciates machines of…

A: Decrease in the value of fixed assets are called depreciation, calculation of depreciation under…

Q: Required information [The following information applies to the questions displayed below.] Ramirez…

A: Depreciation is calculated to capture the wear and tear of the assets for the purpose of generating…

Q: The ABC Corporation received subscription for 9,000 ordinary shares at P40/share, where P35 is the…

A: Receivable from Highest Bidder Receivable from highest bidder which are arised when the delinquency…

Q: What

A:

Q: (a) Following are the partial balance sheet and some assumptions for Kiri-Kanan Company for 2021.…

A: Current Ratio :— It is the ratio between current assets and current liabilities. Inventory…

Q: Peter purchased a tractor for R350 000 on 1 September 2019. He estimated the residual value at R120…

A: Under the diminishing balance method, depreciation is calculated at the reduced balance which is…

Q: 1. A computer table sells for $198.50 and costs $158.70. Find the markup. Find the rate of markup…

A: Markup and Markup rate: Difference between the selling price of the product and the cost of the…

Q: A company is considering buying a part that they currently make for one of their products. The costs…

A: Introduction: The tangible elements that go into creating a product are referred to as direct…

Q: Use the journals provided in the assignment file to journalize the notes receivable transactions…

A: Journal Entries - Journal Entries are the primary level of recording transactions in the journal. It…

Q: The following information relates to the pension plan of Jin Company at December 31, 2018. Defined…

A: Retirement benefits are those benefits which are paid to the employees at the time of their…

Q: Requirement 2. Journalize in summary form the requisition of direct materials and the assignment of…

A: Under job order costing journal entries required for labor, material, overhead. At the end of…

Q: Eddy Co. is indebted to Cole under a P400,000, 12%, three-year note dated December 31, 2019. Because…

A: Lets understand the basics. When there is financial difficulties arise to borrower and borrower is…

Q: The 5s principle specifically defines a system for organizing and standardizing the workplace. What…

A: 5S seems to be a useful technique for detecting and reducing unproductive organizational activities.…

Q: Diane's Designs has two classes of stock authorized: 7%, $10 par value preferred and $1 par value…

A: Introduction: A journal entry is used to document a business transaction in the accounting records…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new…

A: Answer : Internal rate of return = 16.99%

Q: 2. Alliss Limited manufactures de-luxe juicing machines. Each machine has a wholesale price of £225.…

A: Workings: Budgeted Contribution Margin=Selling price-Variable cost per unit×Budgeted Units Net…

Q: Sunland Company plans to sell 11000 lawn chairs during May, 6700 in June, and 11000 during July. The…

A: Production - Production budget is the part of master budget. It is computed by following formula -…

Q: Which adjustments need to be recorded in the accounting records? Those that affected the bank…

A: Introduction: Accounting records include all paperwork and books used to generate financial…

Q: 1. For The period just ended, the gross margin of Robin Company was P 3,840,000, the cost of goods…

A: Direct labour refers to workers in manufacturing or services who are accountable for a specific…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: The cash collection schedule helps to estimate the cash to be collected from customers during the…

Q: Use direct method Comparative Balance Sheets Current assets Cash at Bank Accounts Receivable Less:…

A: A cash flow statement shows flows of cash during a specific period under different activities. There…

Q: Refer to the following selected financial information from Texas Electronics. Compute the company's…

A: The ratio analysis helps to anlayze the financial statements of the business on the basis of various…

Q: During Heaton Company's first two years of operations, it reported absorption costing net operating…

A: Req-1 Calculation of unit product cost under variable costing: Direct Materials $7.00…

Q: Following is information from Fredrickson Company for its first month of business. Cash Collections…

A: A Journal entry is a primary entry that records the financial transactions of the company. The…

Q: C Question 3 - Financial Statement **Only enter your response in the blue c.. a) Statement of…

A: Retained earnings is amount of earnings accumulated over the period of time. Statement of retained…

Q: Swifty has a standard of 1.2 pounds of materials per unit, at $4 per pound. In producing 3000 units,…

A: Materials Variance :— Variance analysis direct material price variance is the difference between the…

Q: Fixed manufacturing costs Variable manufacturing costs $36000 pe $18.00 pe foot Crane installed…

A: Answer : Calculate Budgeted total manufacturing cost for 40,000 linear feet of block : Given : Fixed…

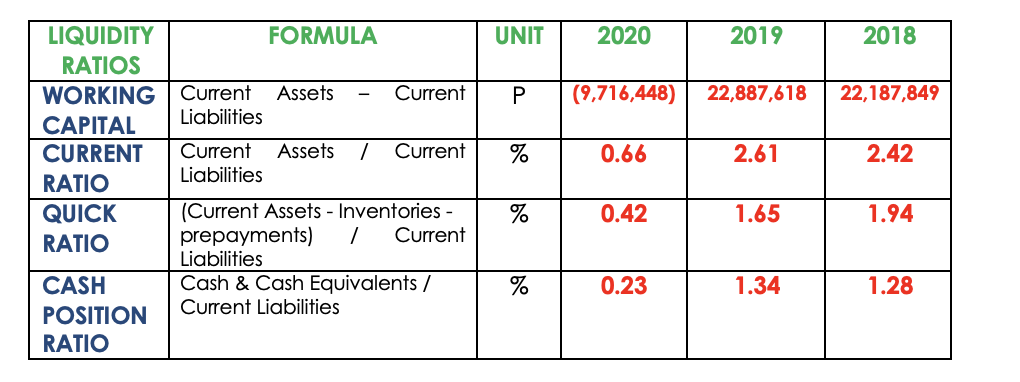

What is the financial analysis of each year?

Step by step

Solved in 2 steps

- Match the words with the term. Question 6 options: 12345 financial need 12345 risk capital 12345 internal source 12345 external sources 12345 financing requirement 1. working capital 2. subordinated debt 3. lenders 4. short-term debt 5. retained earningshttps://www.bartleby.com/questions-and-answers/finance-question/89c709bb-b568-401f-a90e-c8cdf900ce1a You need to find the NPV. Calculate the net cashflow and discount factors to find NPVDefine spontaneous liabilities-to-sales ratio (L0*/S0)

- The database summarizes financial information for 32 companies and their perceived risk of default. Convert these data into an Excel table. Use table-based calculations to find the average debt and average equity for companies with a risk of default, and also for those without a risk of default. Does there appear to be a difference between companies with and without a risk of default? Company Category Credit Score Debt Equity Default Assessment1 Service 604 10,644,614 3,975,798 Yes2 Manufacturing 714 4,787,980 2,120,721 No3 Manufacturing 732 179,433 1,785,756 No4 Manufacturing 792 8,464,689 11,939,364 No5 Service 623 3,273,638 779,720 Yes6 Manufacturing 702 13,367,369 4,392,888 Yes7 Service 764 4,117,031 6,145,790 No8 Manufacturing 690 7,356,986 5,853,539 No9 Service 802 7,283,191 11,667,373 No10 Service 610 14,899,343 3,939,546 Yes11 Manufacturing 590 8,731,914 19,948,036 No12 Manufacturing 824 577,722 31,488,366 No13 Service 762 8,637,970 4,570,078 No14 Manufacturing 601…Please answer in CAPITAL LETTER IF IT IS AN INFLOW(I )OR AN OUTFLOW (O)COLUMN 1 , AND COLUMN 2 , IF IT CORRESPONDS TO OPERATINGCASHFLOW(OC),INVESTMENT ACTIVITY CASHFLOW(IC), FINANCING ACTIVITY CASHFLOW ( FC)Example: Reduce marketable securities : I OC ( "I" or "O") AND ("OC", "IC" o "FC" )Activity INFLOW " I" orOutflow "O" OPERATINGCASHFLOW(OC), INVESTMENTACTIVITY CASHFLOW(IC), FINANCINGACTIVITY CASHFLOW ( FC) 1. Purchase of treasurystock2. Purchase of availablefor sale investment 3. Sale of equipment at aloss 4. Increase in accountspayable 5. Retirement of bonds 6. Issuance of bonds 7. Decrease in accountspayable 8. Increase in inventory9. Loan from bank bysigning a note 10. Increase in accountsreceivable 11. Purchase of equipmentby issuing a note 12. Purchase of land andbuilding. 13. Decrease in accountsreceivable.14. Payment of dividends. 15.…Refer to the financial state-ment data for Abercrombie Fitch in Problem 4.25 in Chapter 4. Exhibit 5.16 presents risk ratios for Abercrombie Fitch for fiscal Year 3 and Year 4. Exhibit 5.16 REQUIRED a. Compute the amounts of these ratios for fiscal Year 5. b. Assess the changes in the short-term liquidity risk of Abercrombie Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5. c. Assess the changes in the long-term solvency risk of Abercrombie Fitch between fiscal Year 3 and fiscal Year 5 and the level of that risk at the end of fiscal Year 5.

- Below is an equation to compute the present value of a cash flow series. Determine the cash flow profile that is implied by the equation. P = −7,000 + [1,850 + 200 (A|G8%, 6)] (P|A8%, 6) (P|F8%, 4)Please question #4 of P9.26. Calculate the resulting gain or loss. What is the impact of the gain or loss on Bonds payable, Bond discount and Cash? Where will the gain/loss be reported n the company's statement of cash flows?#205 The amortization of bond premium on long-term debt should be presented in a statement of cash flows (using the indirect method for operating activities) as a(n) Question 205 options: deduction from net income. investing activity. addition to net income. financing activity.

- Fundamentals of Engineering Economy (8012101-2) Based on the interest rates and cash flows shown in the cash flow diagram, determine the value of $X.Which of the following cash flow streams could be evaluated using the basic Internal Rate of Return (IRR) method? A. CF1 $100 CF2 = -$20 CF3 - $20 B. CF1 =-$100 CF2 $20 CF3 $20 c. CF1 -$100 CF2 = $20 CFJ -$20 D. CF1 $100 CF2 = $20 CFJ $20 All of the above E.Q31 Which of the following is equal to the present value of all cash proceeds received by a stock investor? a. Dividend payout ratio b. Retention ratio c. Discount rate d. Value