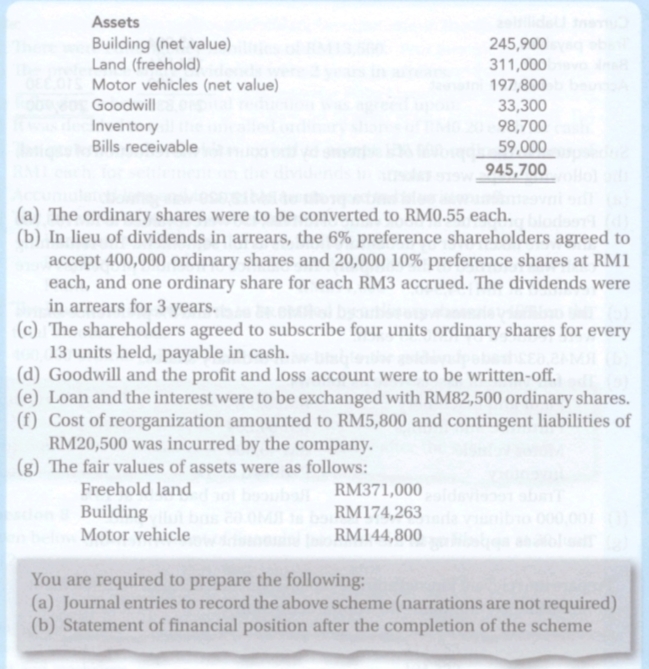

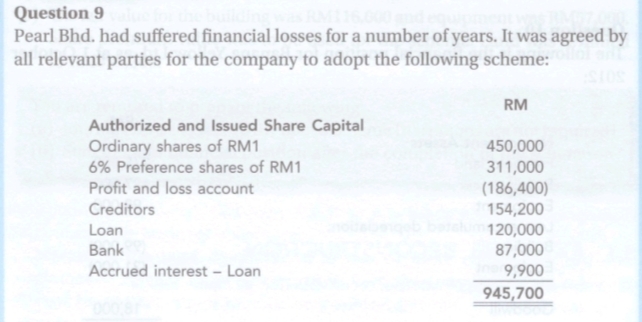

Assets Building (net value) Land (freehold) Motor vehicles (net value) 245,900 311,000 197,800 33,300 98,700 Goodwill Inventory Bills receivable 59,000 945,700 (a) The ordinary shares were to be converted to RM0.55 each. (b) In lieu of dividends in arrears, the 6% preference shareholders agreed to accept 400,000 ordinary shares and 20,000 10% preference shares at RM1 each, and one ordinary share for each RM3 accrued. The dividends were in arrears for 3 years. (c) The shareholders agreed to subscribe four units ordinary shares for every 13 units held, payable in cash. (d) Goodwill and the profit and loss account were to be written-off. (e) Loan and the interest were to be exchanged with RM82,500 ordinary shares. (f) Cost of reorganization amounted to RM5,800 and contingent liabilities of RM20,500 was incurred by the company. g) The fair values of assets were as follows: Freehold land RM371,000 Building RM174,263 Motor vehicle RM144,800 You are required to prepare the following: (a) Journal entries to record the above scheme (narrations are not required) (b) Statement of financial position after the completion of the scheme

Assets Building (net value) Land (freehold) Motor vehicles (net value) 245,900 311,000 197,800 33,300 98,700 Goodwill Inventory Bills receivable 59,000 945,700 (a) The ordinary shares were to be converted to RM0.55 each. (b) In lieu of dividends in arrears, the 6% preference shareholders agreed to accept 400,000 ordinary shares and 20,000 10% preference shares at RM1 each, and one ordinary share for each RM3 accrued. The dividends were in arrears for 3 years. (c) The shareholders agreed to subscribe four units ordinary shares for every 13 units held, payable in cash. (d) Goodwill and the profit and loss account were to be written-off. (e) Loan and the interest were to be exchanged with RM82,500 ordinary shares. (f) Cost of reorganization amounted to RM5,800 and contingent liabilities of RM20,500 was incurred by the company. g) The fair values of assets were as follows: Freehold land RM371,000 Building RM174,263 Motor vehicle RM144,800 You are required to prepare the following: (a) Journal entries to record the above scheme (narrations are not required) (b) Statement of financial position after the completion of the scheme

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 12CE

Related questions

Question

Transcribed Image Text:Assets

Building (net value)

Land (freehold)

Motor vehicles (net value)

245,900

311,000

197,800

33,300

98,700

Goodwill

Inventory

Bills receivable

59,000

945,700

(a) The ordinary shares were to be converted to RM0.55 each.

(b) In lieu of dividends in arrears, the 6% preference shareholders agreed to

accept 400,000 ordinary shares and 20,000 10% preference shares at RM1

each, and one ordinary share for each RM3 accrued. The dividends were

in arrears for 3 years.

(c) The shareholders agreed to subscribe four units ordinary shares for every

13 units held, payable in cash.

(d) Goodwill and the profit and loss account were to be written-off.

(e) Loan and the interest were to be exchanged with RM82,500 ordinary shares.

(f) Cost of reorganization amounted to RM5,800 and contingent liabilities of

RM20,500 was incurred by the company.

g) The fair values of assets were as follows:

Freehold land

RM371,000

Building

RM174,263

Motor vehicle

RM144,800

You are required to prepare the following:

(a) Journal entries to record the above scheme (narrations are not required)

(b) Statement of financial position after the completion of the scheme

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning