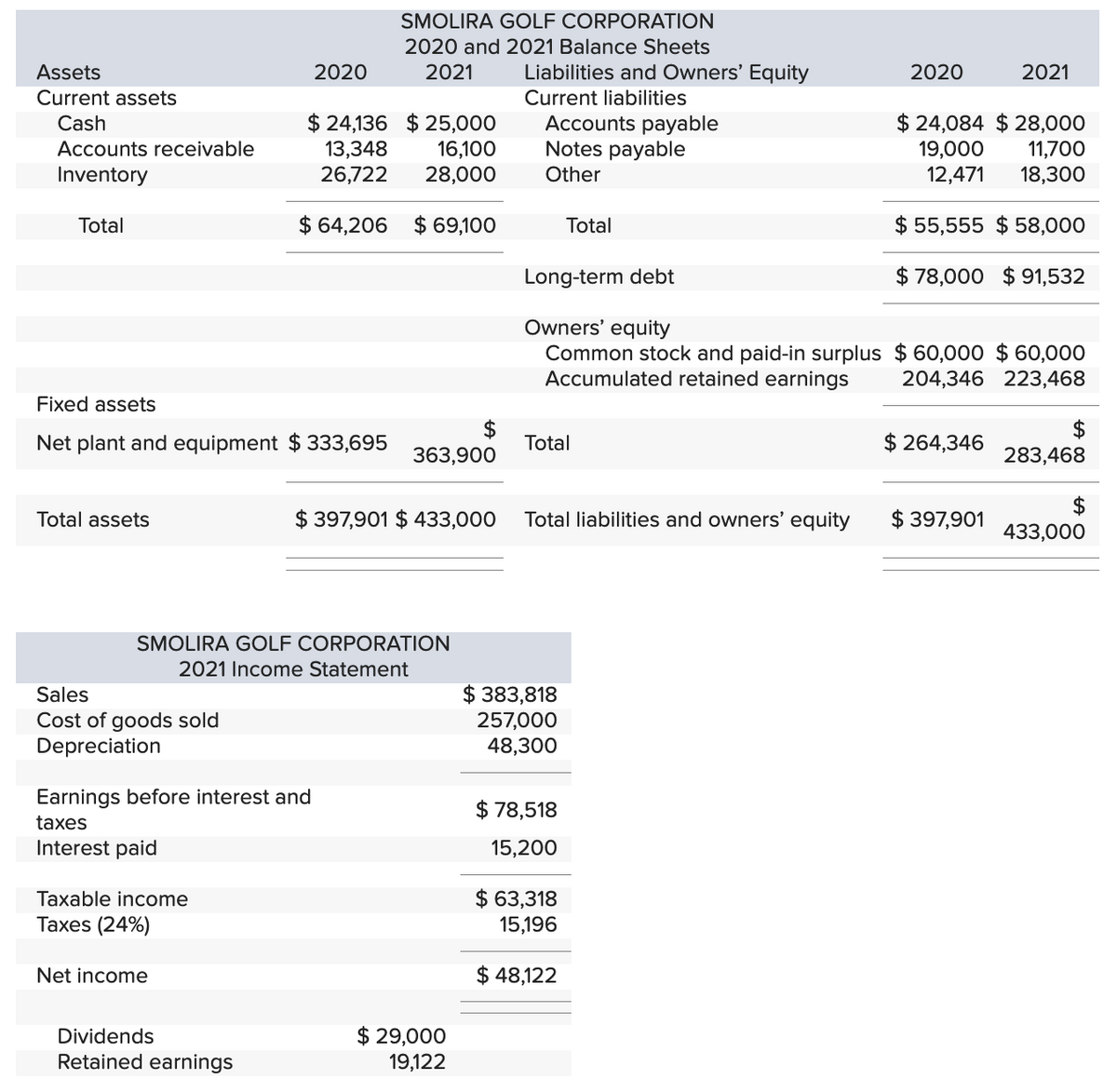

Assets Current assets Cash Accounts receivable Inventory Total Total assets Fixed assets Net plant and equipment $333,695 Sales Cost of goods sold Depreciation Taxable income Taxes (24%) 2020 Earnings before interest and taxes Interest paid Net income $24,136 $25,000 13,348 16,100 26,722 28,000 $ 64,206 $ 69,100 SMOLIRA GOLF CORPORATION 2021 Income Statement Dividends Retained earnings SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $ 363,900 $397,901 $ 433,000 $ 29,000 19,122 Accounts payable Notes payable Other Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total Total liabilities and owners' equity $ 383,818 257,000 48,300 $78,518 15,200 $ 63,318 15,196 $48,122 2020 $24,084 $ 28,000 19,000 11,700 12,471 18,300 $ 55,555 $ 58,000 $78,000 $91,532 2021 $60,000 $60,000 204,346 223,468 $ 264,346 $397,901 $ 283,468 $ 433,000

Some recent financial statements for Smolira Golf Corporation follow.

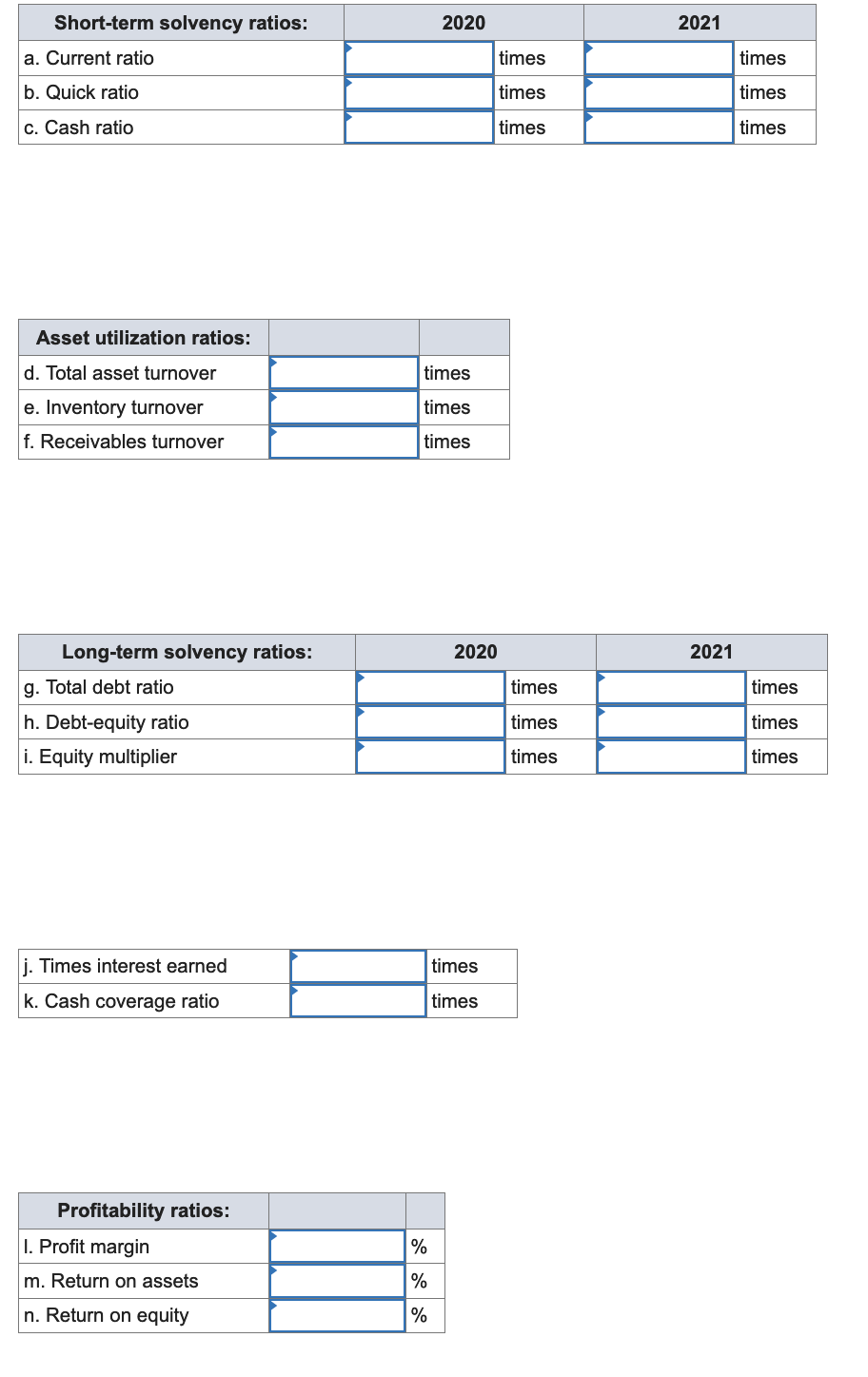

Find the following financial ratios for Smolira Golf Corporation (use year-end figures rather than average values where appropriate): (Enter the profitability ratio answers as a percent rounded to 2 decimal places, e.g., 32.16. Round the remaining answers to 2 decimal places, e.g., 32.16.)

“Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for you. To get remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.”.

Short term solvency ratios or liquidity ratios are those which are determined to know if the entity would be able to pay off its current liabilities using its current assets or not.

Step by step

Solved in 2 steps with 2 images