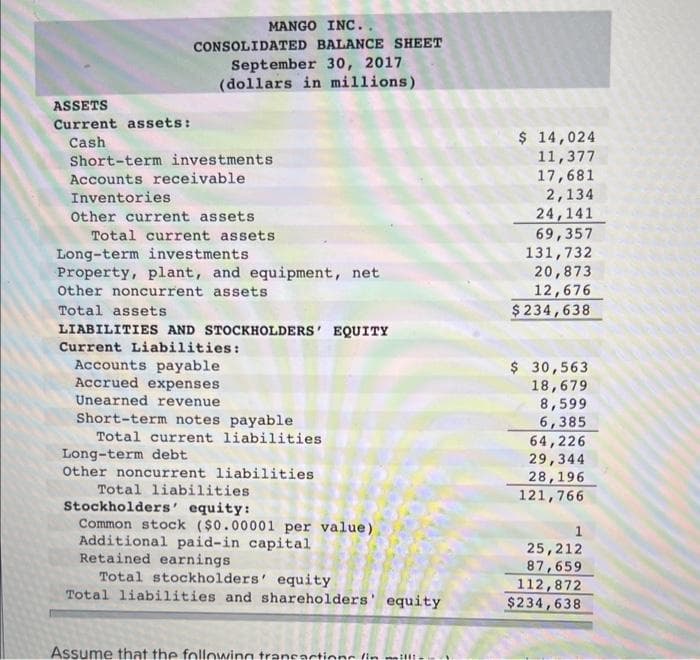

ASSETS Current assets: Cash MANGO INC.. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable. Accrued expenses Unearned revenue Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $ 30,563 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638

ASSETS Current assets: Cash MANGO INC.. CONSOLIDATED BALANCE SHEET September 30, 2017 (dollars in millions) Short-term investments Accounts receivable Inventories Other current assets Total current assets Long-term investments Property, plant, and equipment, net Other noncurrent assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable. Accrued expenses Unearned revenue Short-term notes payable Total current liabilities Long-term debt Other noncurrent liabilities Total liabilities Stockholders' equity: Common stock ($0.00001 per value) Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and shareholders' equity $ 14,024 11,377 17,681 2,134 24,141 69,357 131,732 20,873 12,676 $234,638 $ 30,563 18,679 8,599 6,385 64,226 29,344 28,196 121,766 1 25,212 87,659 112,872 $234,638

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.1P

Related questions

Question

Transcribed Image Text:ASSETS

Current assets:

Cash

MANGO INC..

CONSOLIDATED BALANCE SHEET

September 30, 2017

(dollars in millions)

Short-term investments

Accounts receivable

Inventories

Other current assets

Total current assets

Long-term investments

Property, plant, and equipment, net

Other noncurrent assets

Total assets

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable

Accrued expenses

Unearned revenue.

Short-term notes payable

Total current liabilities

Long-term debt

Other noncurrent liabilities

Total liabilities.

Stockholders' equity:

Common stock ($0.00001 per value)

Additional paid-in capital

Retained earnings

Total stockholders' equity

Total liabilities and shareholders' equity

Assume that the following transactions

fin

$ 14,024

11,377

17,681

2,134

24,141

69,357

131,732

20,873

12,676

$234,638

$ 30,563

18,679

8,599

6,385

64,226

29,344

28,196

121,766

1

25,212

87,659

112,872

$234,638

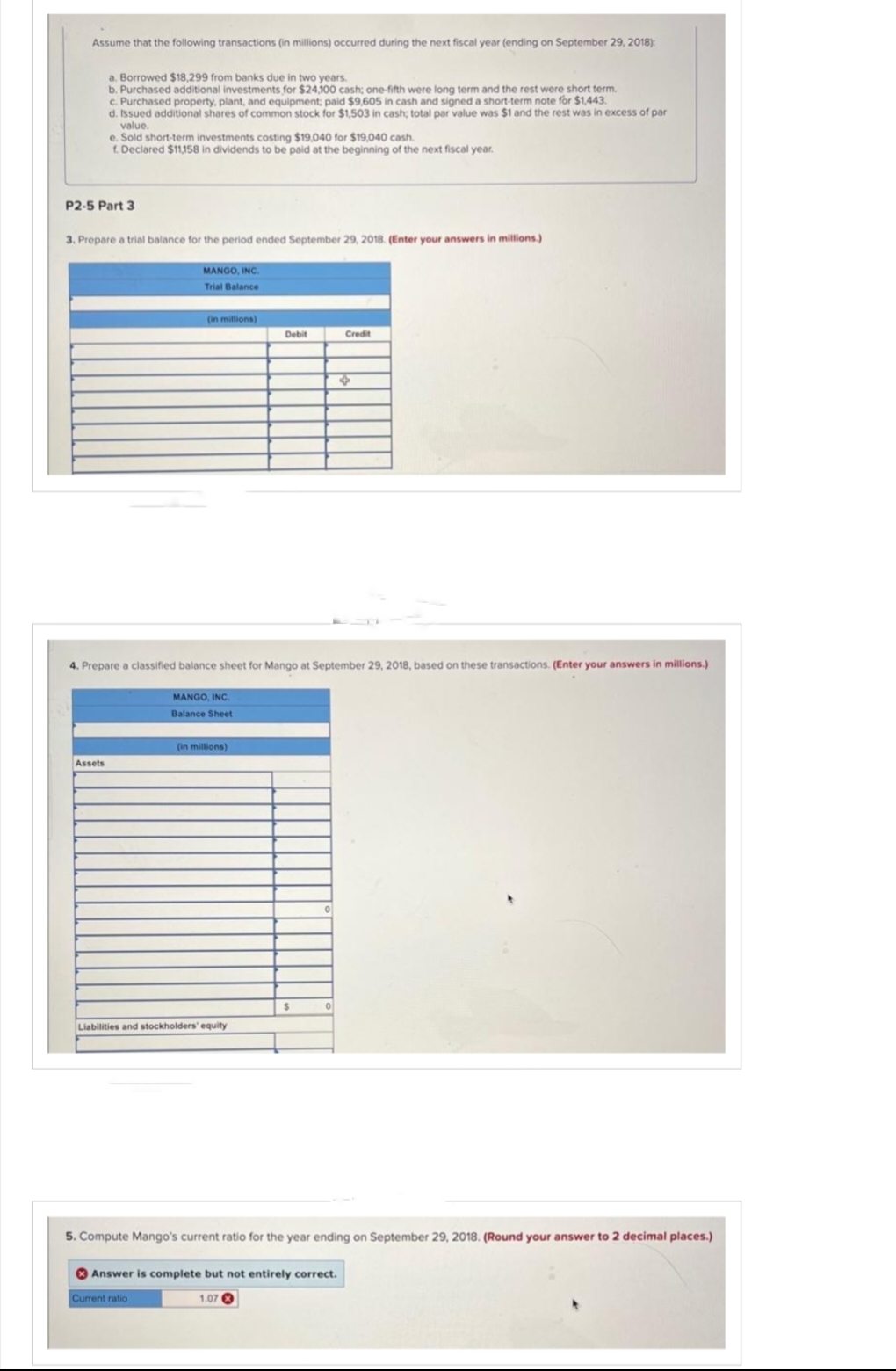

Transcribed Image Text:Assume that the following transactions (in millions) occurred during the next fiscal year (ending on September 29, 2018):

a. Borrowed $18,299 from banks due in two years.

b. Purchased additional investments for $24,100 cash; one-fifth were long term and the rest were short term.

Purchased property, plant, and equipment; paid $9,605 in cash and signed a short-term note for $1,443.

d. Issued additional shares of common stock for $1,503 in cash; total par value was $1 and the rest was in excess of par

value.

e. Sold short-term investments costing $19,040 for $19,040 cash.

f. Declared $11,158 in dividends to be paid at the beginning of the next fiscal year.

P2-5 Part 3

3. Prepare a trial balance for the period ended September 29, 2018. (Enter your answers in millions.)

Assets

MANGO, INC.

Trial Balance

(in millions)

4. Prepare a classified balance sheet for Mango at September 29, 2018, based on these transactions. (Enter your answers in millions.)

MANGO, INC.

Balance Sheet

(in millions)

Debit

Liabilities and stockholders' equity

$

0

Credit

5. Compute Mango's current ratio for the year ending on September 29, 2018. (Round your answer to 2 decimal places.)

Answer is complete but not entirely correct.

Current ratio

1.07

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub