You have recently been appointed as the cost accountant for Crane Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to clear up the production records of the mixing department for November 2022. You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in processing. You also find out that the beginning inventory for the month of November was 4,520 units with the following costs: Transferred-in costs Direct materials Conversion costs $18,080 3,957 26,986 In addition, during November, 18,080 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5,650 units that were 60% complete. During the month, direct materials of $29,830 were added and 9,610 hours of direct labour were used at a wage rate of $12 per hour. The overhead rate for 2022, applied on a basis of direct labour hours, was based on a predicted annual usage of 135,600 hours and a cost function derived from the following overhead equation: Y = 67,800 + 2X, where Y is the total overhead costs and X is the direct labour hours. Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022:

You have recently been appointed as the cost accountant for Crane Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to clear up the production records of the mixing department for November 2022. You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in processing. You also find out that the beginning inventory for the month of November was 4,520 units with the following costs: Transferred-in costs Direct materials Conversion costs $18,080 3,957 26,986 In addition, during November, 18,080 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5,650 units that were 60% complete. During the month, direct materials of $29,830 were added and 9,610 hours of direct labour were used at a wage rate of $12 per hour. The overhead rate for 2022, applied on a basis of direct labour hours, was based on a predicted annual usage of 135,600 hours and a cost function derived from the following overhead equation: Y = 67,800 + 2X, where Y is the total overhead costs and X is the direct labour hours. Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 22E: Fordman Company has a product that passes through two processes: Grinding and Polishing. During...

Related questions

Question

Please help me with all answers thanku

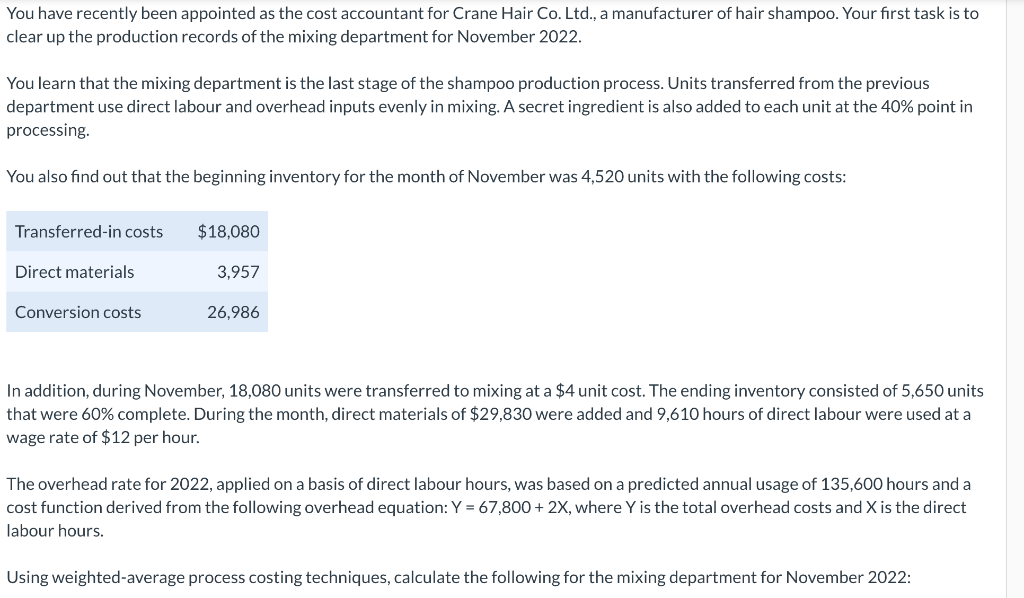

Transcribed Image Text:You have recently been appointed as the cost accountant for Crane Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to

clear up the production records of the mixing department for November 2022.

You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous

department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in

processing.

You also find out that the beginning inventory for the month of November was 4,520 units with the following costs:

Transferred-in costs

Direct materials

Conversion costs

$18,080

3,957

26,986

In addition, during November, 18,080 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5,650 units

that were 60% complete. During the month, direct materials of $29,830 were added and 9,610 hours of direct labour were used at a

wage rate of $12 per hour.

The overhead rate for 2022, applied on a basis of direct labour hours, was based on a predicted annual usage of 135,600 hours and a

cost function derived from the following overhead equation: Y = 67,800 + 2X, where Y is the total overhead costs and X is the direct

labour hours.

Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022:

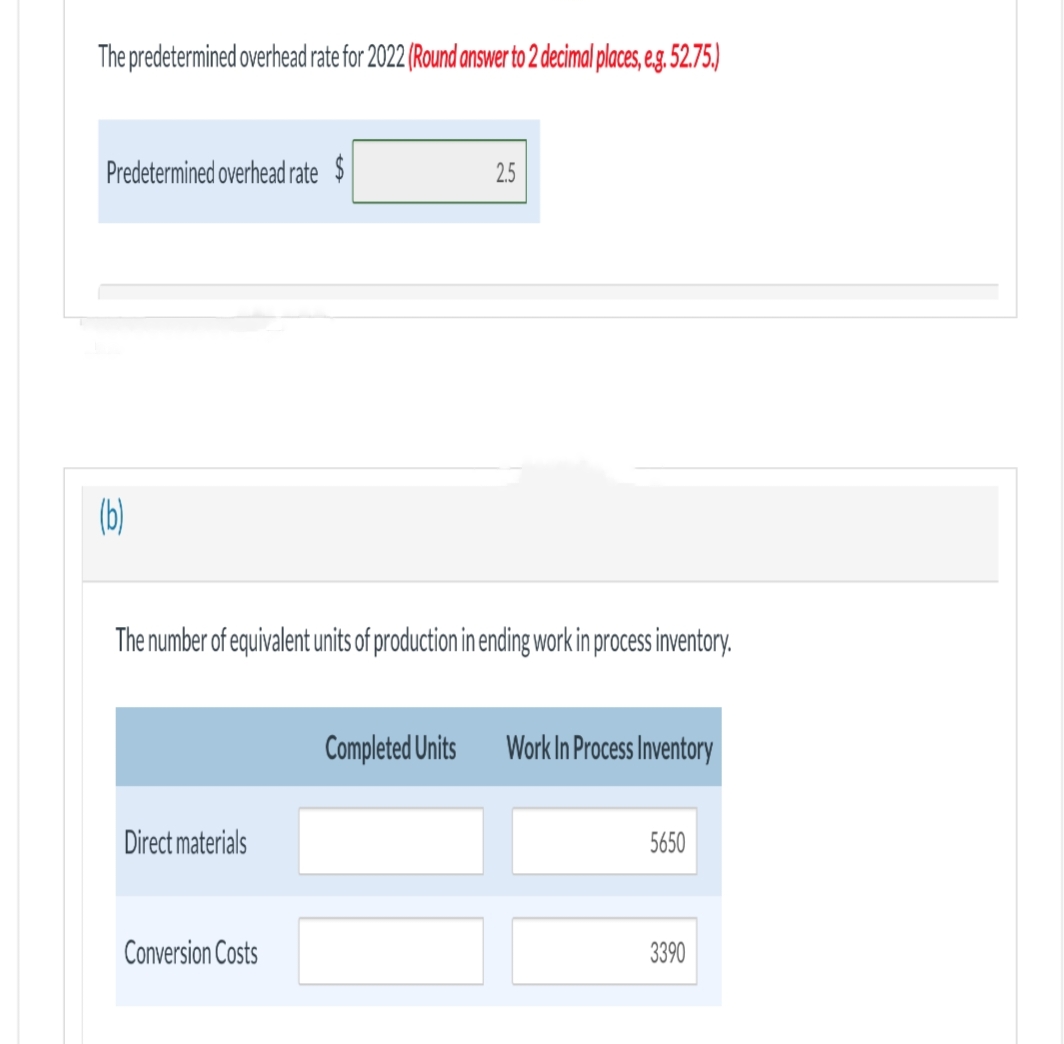

Transcribed Image Text:The predetermined overhead rate for 2022 (Round answer to 2 decimal places, e.g. 52.75.)

Predetermined overhead rate $

(b)

The number of equivalent units of production in ending work in process inventory.

Direct materials

2.5

Conversion Costs

Completed Units Work In Process Inventory

5650

3390

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College