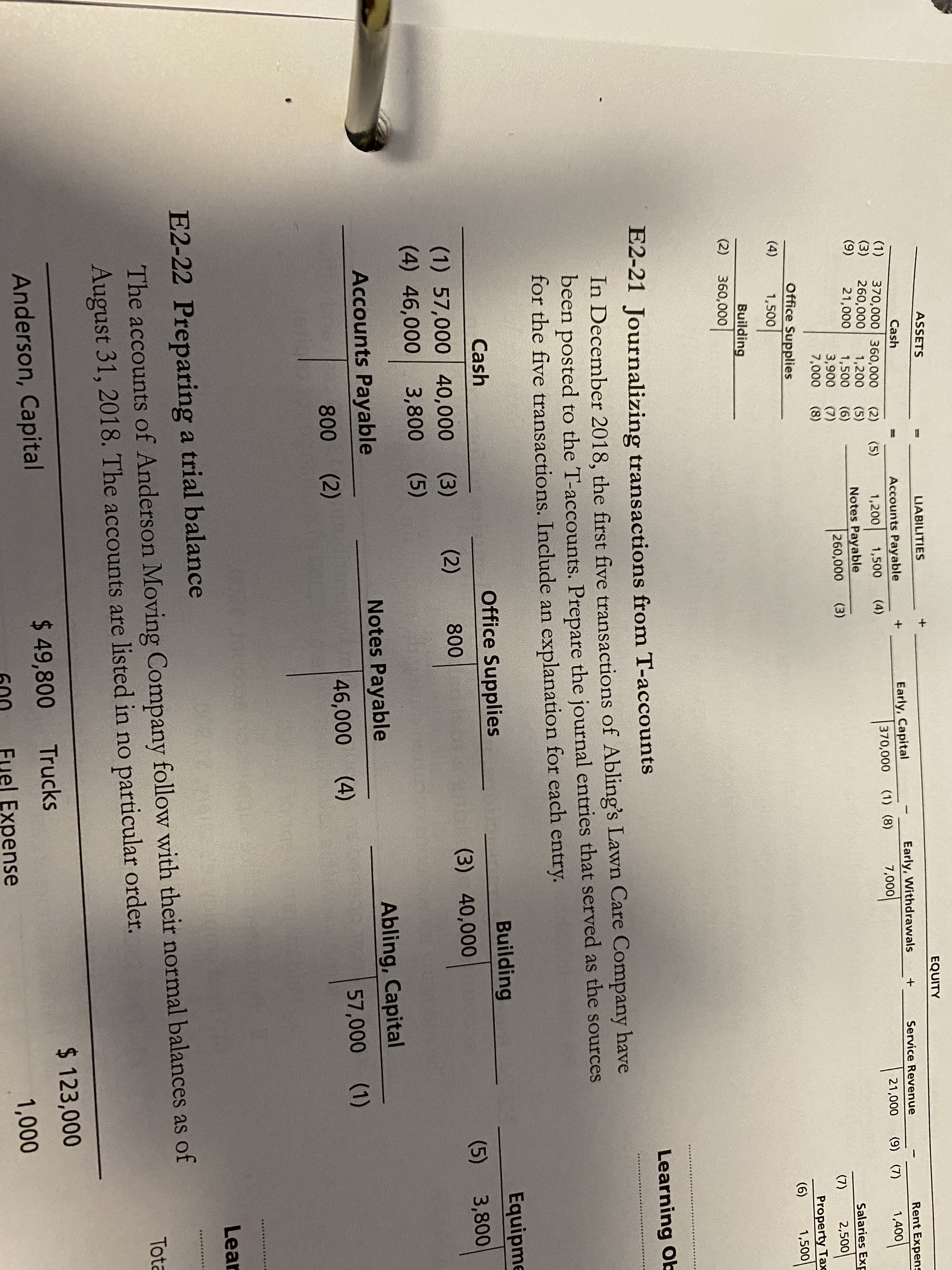

ASSETS EQUITY LIABILITIES Cash Early, Capital Early, Withdrawals Service Revenue Rent Expens Accounts Payable +. %3D (1) (3) (9) 370,000 360,000 260,000 21,000 (5) 1,200 1,500 (4) 370,000 (1) (8) 7,000 21,000 (9) (7) 1,400 1,200 1,500 (5) (6) (7) (8) Notes Payable Salaries Exp 260,000 (3) 3,900 7,000 (7) 2,500 Property Taxc 1,500 Office Supplies (6) (4) 1,500 Building (2) 360,000 Learning Ob E2-21 Journalizing transactions from T-accounts In December 2018, the first five transactions of Abling's Lawn Care Company have been posted to the T-accounts. Prepare the journal entries that served as the sources for the five transactions. Include an explanation for each entry. Office Supplies Building Equipme Cash (3) 40,000 (5) 3,800 (1) 57,000 40,000 (3) (2) 800 (4) 46,000 3,800 (5) Notes Payable Abling, Capital Accounts Payable 46,000 (4) 57,000 (1) 800 (2) Lear E2-22 Preparing a trial balance The accounts of Anderson Moving Company follow with their normal balances as of August 31, 2018. The accounts are listed in no particular order. Tota $123,000 Anderson, Capital $ 49,800 Trucks Fuel Expense 1,000

ASSETS EQUITY LIABILITIES Cash Early, Capital Early, Withdrawals Service Revenue Rent Expens Accounts Payable +. %3D (1) (3) (9) 370,000 360,000 260,000 21,000 (5) 1,200 1,500 (4) 370,000 (1) (8) 7,000 21,000 (9) (7) 1,400 1,200 1,500 (5) (6) (7) (8) Notes Payable Salaries Exp 260,000 (3) 3,900 7,000 (7) 2,500 Property Taxc 1,500 Office Supplies (6) (4) 1,500 Building (2) 360,000 Learning Ob E2-21 Journalizing transactions from T-accounts In December 2018, the first five transactions of Abling's Lawn Care Company have been posted to the T-accounts. Prepare the journal entries that served as the sources for the five transactions. Include an explanation for each entry. Office Supplies Building Equipme Cash (3) 40,000 (5) 3,800 (1) 57,000 40,000 (3) (2) 800 (4) 46,000 3,800 (5) Notes Payable Abling, Capital Accounts Payable 46,000 (4) 57,000 (1) 800 (2) Lear E2-22 Preparing a trial balance The accounts of Anderson Moving Company follow with their normal balances as of August 31, 2018. The accounts are listed in no particular order. Tota $123,000 Anderson, Capital $ 49,800 Trucks Fuel Expense 1,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:ASSETS

EQUITY

LIABILITIES

Cash

Early, Capital

Early, Withdrawals

Service Revenue

Rent Expens

Accounts Payable

+.

%3D

(1)

(3)

(9)

370,000 360,000

260,000

21,000

(5)

1,200

1,500

(4)

370,000

(1) (8)

7,000

21,000

(9) (7)

1,400

1,200

1,500

(5)

(6)

(7)

(8)

Notes Payable

Salaries Exp

260,000

(3)

3,900

7,000

(7)

2,500

Property Taxc

1,500

Office Supplies

(6)

(4)

1,500

Building

(2)

360,000

Learning Ob

E2-21 Journalizing transactions from T-accounts

In December 2018, the first five transactions of Abling's Lawn Care Company have

been posted to the T-accounts. Prepare the journal entries that served as the sources

for the five transactions. Include an explanation for each entry.

Office Supplies

Building

Equipme

Cash

(3) 40,000

(5)

3,800

(1) 57,000 40,000

(3)

(2)

800

(4) 46,000

3,800

(5)

Notes Payable

Abling, Capital

Accounts Payable

46,000

(4)

57,000 (1)

800

(2)

Lear

E2-22 Preparing a trial balance

The accounts of Anderson Moving Company follow with their normal balances as of

August 31, 2018. The accounts are listed in no particular order.

Tota

$123,000

Anderson, Capital

$ 49,800 Trucks

Fuel Expense

1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education