Exercise #5 Bronx Company provided the following fnancial statements for the years 2011 and 2012: 2011 53,000 87,000 346,000 432,000 918,000 1,113,000 2031.000 2012 31,000 Assets Cash Marketable securites Accounts receivable 528,000 683.000 1,242,000 1,398,000 2. 640,000 Inventories Current assets Net fixed assets Total Assets Liabilies & Equity Accounts payable Accrued expenses Bank borrowings Current liabilities Common stock Retained earnings Total libiltes & equity 413,000 226,000 100,000 739,000 100,00 1,192,000 2.031,000 627,000 314,000 235,000 1,176,000 100,000 1,364000 2.640.000 Note: For 2012, depreciation was P189,000 interest paid was P21,00; taves paid amounted to P114,000, and no dividends were paid. Required: Prepare a statement of cash flows using the indirect method. Create chars using Excel to highight the firm's flow of cash.

Exercise #5 Bronx Company provided the following fnancial statements for the years 2011 and 2012: 2011 53,000 87,000 346,000 432,000 918,000 1,113,000 2031.000 2012 31,000 Assets Cash Marketable securites Accounts receivable 528,000 683.000 1,242,000 1,398,000 2. 640,000 Inventories Current assets Net fixed assets Total Assets Liabilies & Equity Accounts payable Accrued expenses Bank borrowings Current liabilities Common stock Retained earnings Total libiltes & equity 413,000 226,000 100,000 739,000 100,00 1,192,000 2.031,000 627,000 314,000 235,000 1,176,000 100,000 1,364000 2.640.000 Note: For 2012, depreciation was P189,000 interest paid was P21,00; taves paid amounted to P114,000, and no dividends were paid. Required: Prepare a statement of cash flows using the indirect method. Create chars using Excel to highight the firm's flow of cash.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

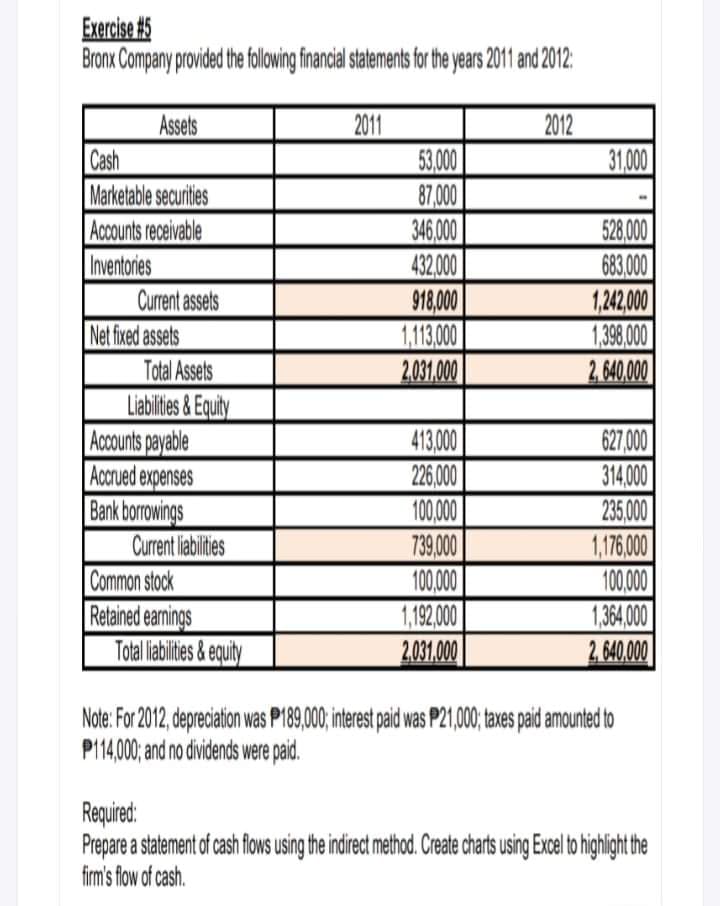

Transcribed Image Text:Exercise #5

Bronx Company provided the following financial statements for the years 2011 and 2012:

Assets

2012

31,000

2011

53,000

87,000

346,000

432,000

918,000

1,113,00

2031,000

Cash

Marketable securities

Accounts receivable

528,000

683,000

1,242,00

1,398,000

2,640,000

Inventories

Current assets

Net fixed assets

Total Assets

Liabilies &Equity

Accounts payable

Accrued expenses

Bank borwings

Current labilties

Common stock

Retained eamings

Totalliabilities & equity

413,000

226,000

100,000

739.000

100,000

1,192.000

2031.000

627,000

314000

235,000

1,176,000

100,000

1,364,00

2, 640,000

Note: For 2012, depreciation was P189,000 interest paid was P21,000; taxes paid amounted to

P114,000; and no dividends were paid.

Required:

Prepare a statement of cash flows using the indirect method. Create charts using Excel to highlight the

firm's flow of cash.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning