Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=assignment-take&inprogress-f Calculator Show Me How eBook Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: 1,800 units at $108 Jan. 1 Inventory 2,240 units at $110 Purchase Mar. 10 2,000 units at $116 Purchase Aug. 30 Purchase 1,960 units at $120 Dec. 12 There are 2,000 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Cost of Merchandise Inventory and Cost of Merchandise Sold Merchandise Inventory Merchandise Sold Inventory Method First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Feజcosok y Check My Work Note that this exercise uses the periodic inventory System. FIFO means that the first units purchased are assumed inventory costs for the period are calculated by taking the number of items remaining in the physical inventory tim of items in last purchase layer is less than the number in ending inventory, the balance of the ending inventory iten purchase cost. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory fr Check My Work All work saved. E e 12 SPombya4roy. ldu CKE

Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=assignment-take&inprogress-f Calculator Show Me How eBook Periodic Inventory by Three Methods; Cost of Merchandise Sold The units of an item available for sale during the year were as follows: 1,800 units at $108 Jan. 1 Inventory 2,240 units at $110 Purchase Mar. 10 2,000 units at $116 Purchase Aug. 30 Purchase 1,960 units at $120 Dec. 12 There are 2,000 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost and the cost of merchandise sold by three methods. Cost of Merchandise Inventory and Cost of Merchandise Sold Merchandise Inventory Merchandise Sold Inventory Method First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Feజcosok y Check My Work Note that this exercise uses the periodic inventory System. FIFO means that the first units purchased are assumed inventory costs for the period are calculated by taking the number of items remaining in the physical inventory tim of items in last purchase layer is less than the number in ending inventory, the balance of the ending inventory iten purchase cost. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory fr Check My Work All work saved. E e 12 SPombya4roy. ldu CKE

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

Transcribed Image Text:Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=assignment-take&inprogress-f

Calculator

Show Me How

eBook

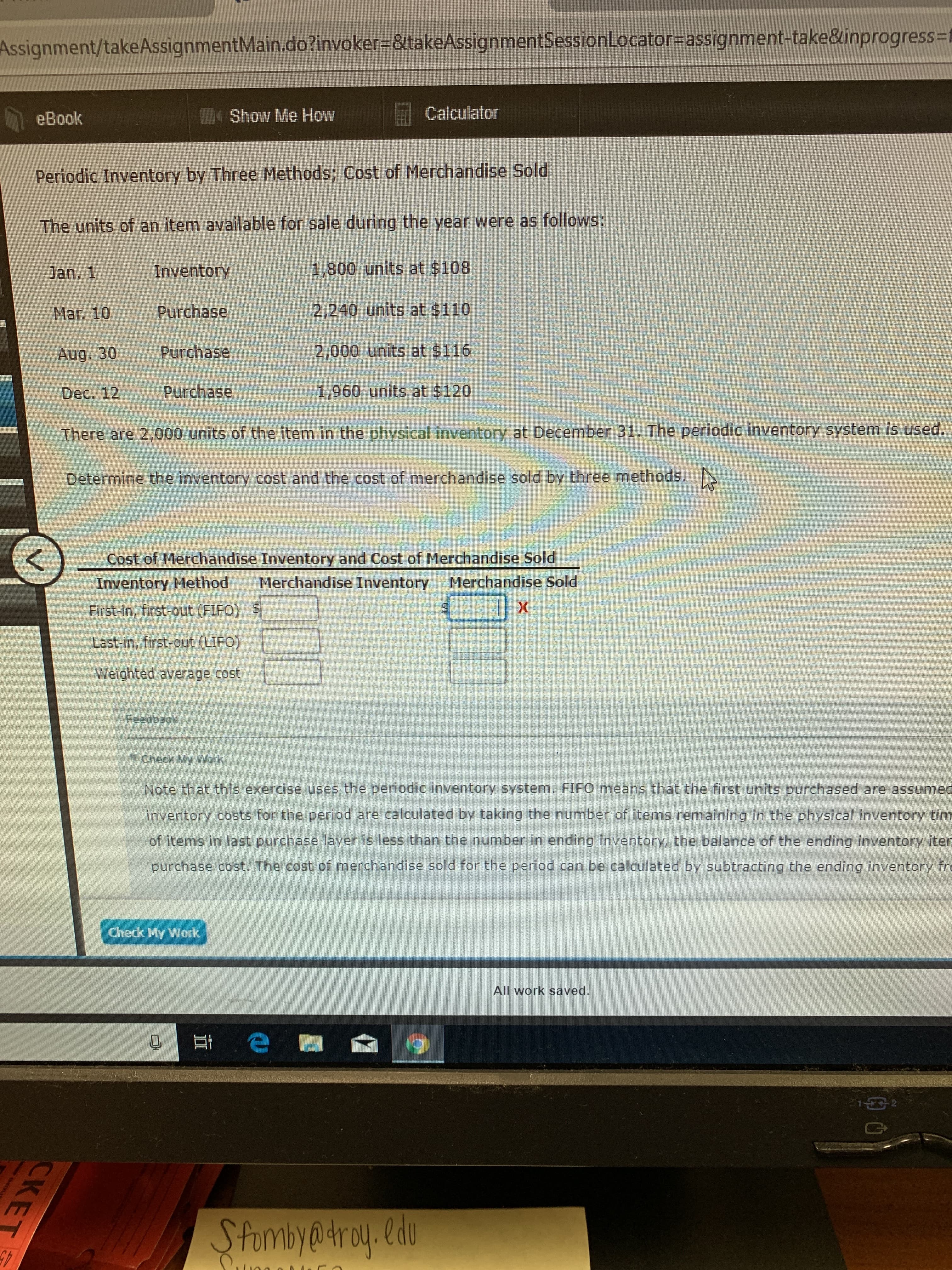

Periodic Inventory by Three Methods; Cost of Merchandise Sold

The units of an item available for sale during the year were as follows:

1,800 units at $108

Jan. 1

Inventory

2,240 units at $110

Purchase

Mar. 10

2,000 units at $116

Purchase

Aug. 30

Purchase

1,960 units at $120

Dec. 12

There are 2,000 units of the item in the physical inventory at December 31. The periodic inventory system is used.

Determine the inventory cost and the cost of merchandise sold by three methods.

Cost of Merchandise Inventory and Cost of Merchandise Sold

Merchandise Inventory

Merchandise Sold

Inventory Method

First-in, first-out (FIFO)

Last-in, first-out (LIFO)

Weighted average cost

Feజcosok

y Check My Work

Note that this exercise uses the periodic inventory System. FIFO means that the first units purchased are assumed

inventory costs for the period are calculated by taking the number of items remaining in the physical inventory tim

of items in last purchase layer is less than the number in ending inventory, the balance of the ending inventory iten

purchase cost. The cost of merchandise sold for the period can be calculated by subtracting the ending inventory fr

Check My Work

All work saved.

E e

12

SPombya4roy. ldu

CKE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning