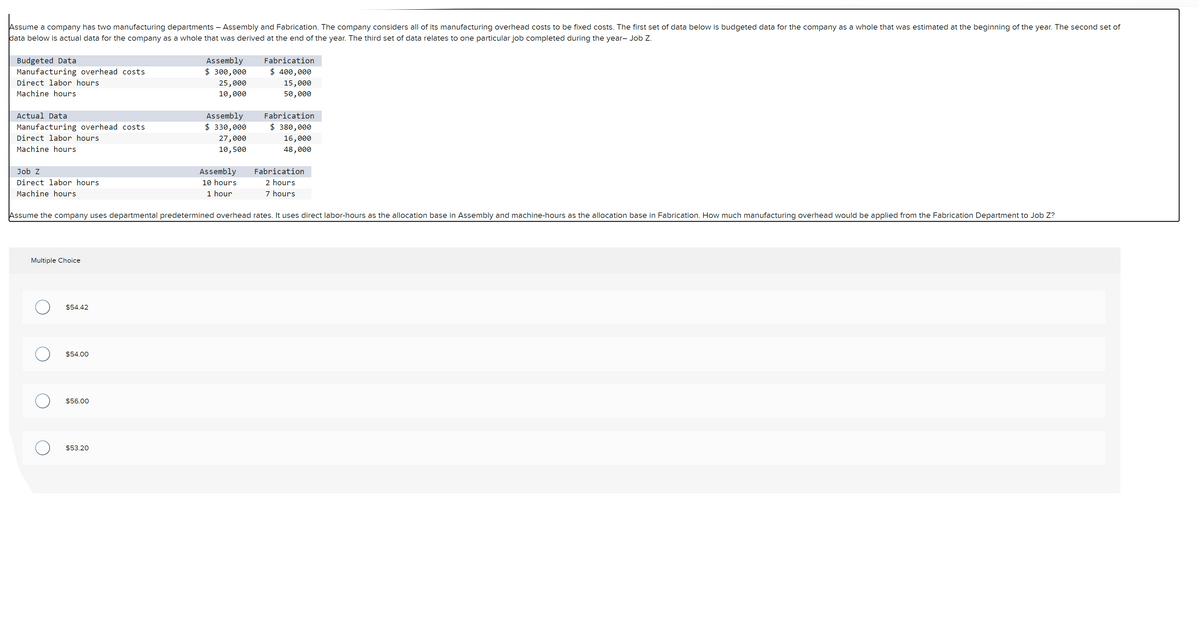

Assume a company has two manufacturing departments - Assembly and Fabrication. The company considers all of its manufacturing overhead costs to be fixed costs. The first set of data below is budgeted data for the company as a whole that was estimated at the beginning of the year. The second set of data below is actual data for the company as a whole that was derived at the end of the year. The third set of data relates to one particular job completed during the year-Job Z Budgeted Data Manufacturing overhead costs Direct labor hours Machine hours Actual Data Manufacturing overhead costs Direct labor hours Machine hours Multiple Choice ο ο ο ο $54.42 Job Z Direct labor hours Machine hours Assume the company uses departmental predetermined overhead rates. It uses direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication. How much manufacturing overhead would be applied from the Fabrication Department to Job 2? $54.00 $56.00 Assembly $ 300,000 25,000 10,000 $53.20 Assembly $ 330,000 27,000 10,500 Fabrication $ 400,000 15,000 50,000 Assembly 10 hours 1 hour Fabrication $ 380,000 16,000 48,000 Fabrication 2 hours 7 hours

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Please do not give solution in image format thanku

Trending now

This is a popular solution!

Step by step

Solved in 3 steps