Assume a production function with constant returns to scale. Labour's share of income is 4/5 and capital's share is V5. If labour grows at 3%, capital at 2%, and the rate of technological advance is 1.2%, roughly how many years would it take to double the current level of output? Multiple Choice 23

Assume a production function with constant returns to scale. Labour's share of income is 4/5 and capital's share is V5. If labour grows at 3%, capital at 2%, and the rate of technological advance is 1.2%, roughly how many years would it take to double the current level of output? Multiple Choice 23

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 3CQ

Related questions

Question

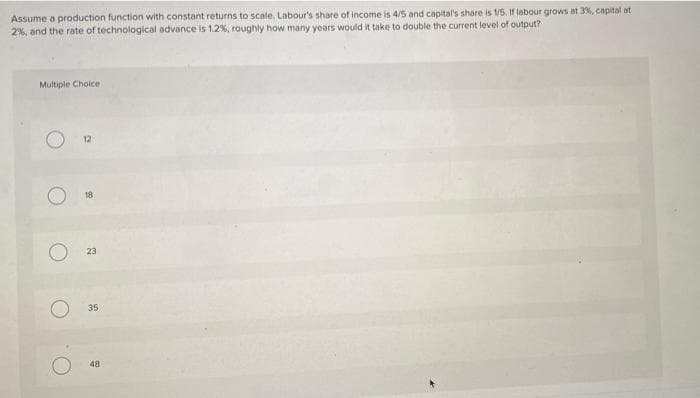

Transcribed Image Text:Assume a production function with constant returns to scale. Labour's share of income is 4/5 and capital's share is 1/5. If labour grows at 3%, capital ot

2%, and the rate of technological advance is 1.2%, roughly how many years would it take to double the current level of output?

Multiple Choice

12

18

23

35

48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning