Assume prices were stable during the period. The following values were obtained from the inventory records of Harris Company which has a fiscal year ending on December 31: Inventory, January 1, 2019, LIFO $80,000 Inventory, March 31, 2019, LIFO 70,000 Required: 1. Under what conditions is Harris’s inventory liquidation not reflected in its first-quarter interim financial statements? 2. Assuming that the liquidation is not to be reflected, what adjusting entry would Harris make?

Assume prices were stable during the period. The following values were obtained from the inventory records of Harris Company which has a fiscal year ending on December 31: Inventory, January 1, 2019, LIFO $80,000 Inventory, March 31, 2019, LIFO 70,000 Required: 1. Under what conditions is Harris’s inventory liquidation not reflected in its first-quarter interim financial statements? 2. Assuming that the liquidation is not to be reflected, what adjusting entry would Harris make?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12MCQ: Smoltz Company reported the following information for the current year: cost of goods sold,...

Related questions

Question

Assume prices were stable during the period. The following values were obtained from the inventory records of Harris Company which has a fiscal year ending on December 31:

| Inventory, January 1, 2019, LIFO | $80,000 |

| Inventory, March 31, 2019, LIFO | 70,000 |

| Required: | |

| 1. | Under what conditions is Harris’s inventory liquidation not reflected in its first-quarter interim financial statements? |

| 2. | Assuming that the liquidation is not to be reflected, what |

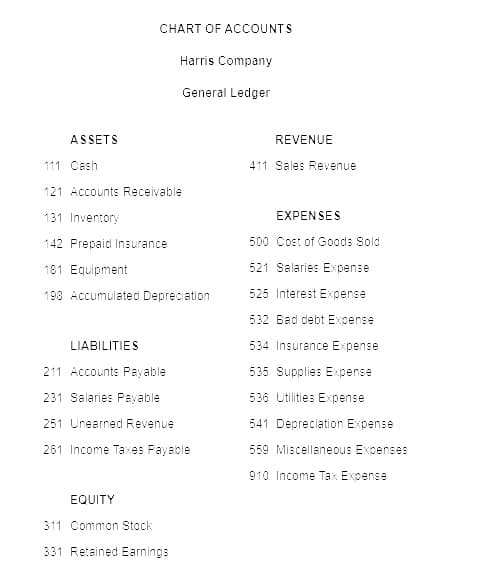

Transcribed Image Text:CHART OF ACCOUNTS

Harris Company

General Ledger

ASSETS

REVENUE

111 Cash

411 Sales Revenue

121 Accounts Receivable

131 Inventory

EXPENSES

142 Prepaid Insurance

500 Cost of Goods Sold

181 Equipment

521 Salaries Expense

198 Accumulated Depreciation

525 Interest Expense

532 Bad debt Expense

LIABILITIES

534 Insurance Expense

211 Accounts Payable

535 Supplies Expense

231 Salaries Payable

536 Utilities Expense

251 Unearned Revenue

541 Depreciation Expense

261 Income Taxes Payable

559 Miscellaneous Expenses

910 Income Tax Expense

EQUITY

311 Common Stock

331 Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning