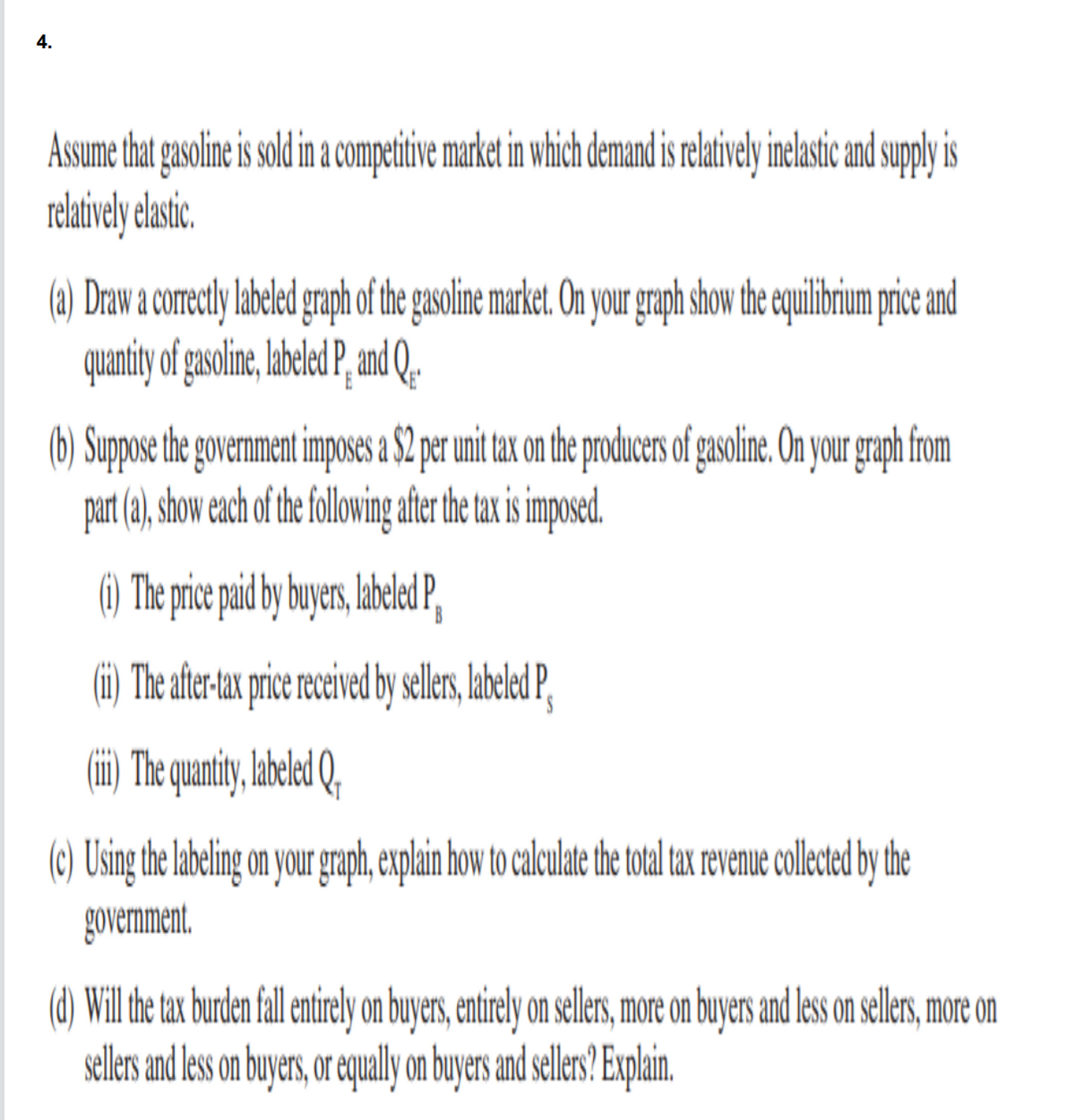

Assume that gasoline is sod ina competitive market in which demand is relaively inelasic and suppy is celatively elasic. (a) Draw a corectly abeled gaph of the gasliemarket. On your graph how the equilibrium price and quanity of gsolne, lbeled P,and Q. 16) Suppose the government imposes a $2 per uni ax onthe roducers of gasoline. On yourgrph from par (a),show each of hefollowin aftr he tax isimposed. () The price ad y byer, abeledP, (i) The after-tax price received byseler, labeled P, (ii) The qanty, abele Q, (c) Using the labeling on your graph, explain how to calculate te otal tax revenue collected bythe government.

Assume that gasoline is sod ina competitive market in which demand is relaively inelasic and suppy is celatively elasic. (a) Draw a corectly abeled gaph of the gasliemarket. On your graph how the equilibrium price and quanity of gsolne, lbeled P,and Q. 16) Suppose the government imposes a $2 per uni ax onthe roducers of gasoline. On yourgrph from par (a),show each of hefollowin aftr he tax isimposed. () The price ad y byer, abeledP, (i) The after-tax price received byseler, labeled P, (ii) The qanty, abele Q, (c) Using the labeling on your graph, explain how to calculate te otal tax revenue collected bythe government.

Principles of Macroeconomics (MindTap Course List)

7th Edition

ISBN:9781285165912

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter7: Consumers, Producers, And The Efficiency Of Markets

Section: Chapter Questions

Problem 7PA

Related questions

Question

Transcribed Image Text:4.

Assume that gasoline is od in competive marke in which demand is relaively inelatic and sup is

relatively elsi.

(a) Draw a comeclylabeled graph ofthe asoline market. On you graph show the quilibrumprce and

quantity of gsoine, labeled P, ndQ.

E

(b) Suppose the goverment imposes a $2 per uni ax on he roducers of gasoline. On your graph from

par (a),show each of he folowingaftr he tax imposed.

(1) The price paid by buyer,labeled P,

(i) The after-ax price eceied b sellr, abele P,

(i) The quanity, abeled

(c) Using the labeling on your graph, explain how tocalulae the total tax revenue collected by the

government.

(d) Will the tax burden fall enirely on buyers, entrely on eles, more on buyers and less on seler,more on

seller and es on buyers, or eqully on buyers and seller? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning