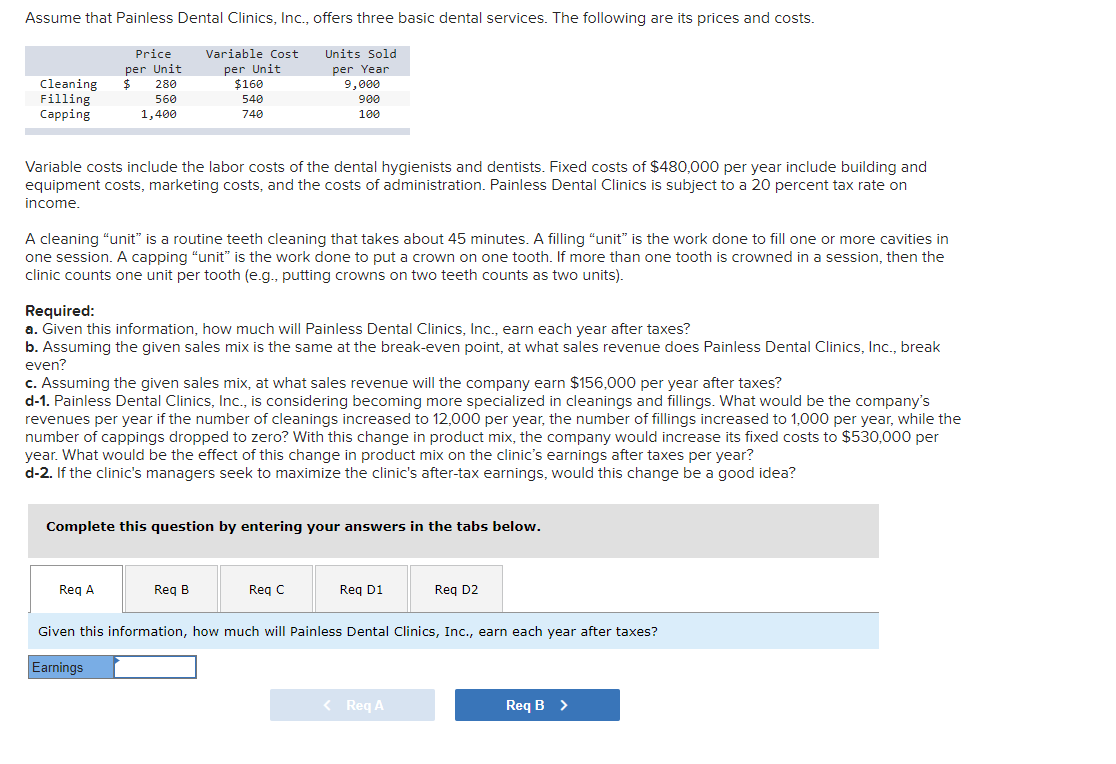

Assume that Painless Dental Clinics, Inc., offers three basic dental services. The following are its prices and costs. Price Variable Cost Units Sold per Unit $ per Unit $160 per Year 9,000 Cleaning Filling Capping 280 560 540 900 1,400 740 100 Variable costs include the labor costs of the dental hygienists and dentists. Fixed costs of $480,000 per year include building and equipment costs, marketing costs, and the costs of administration. Painless Dental Clinics is subject to a 20 percent tax rate on income. A cleaning "unit" is a routine teeth cleaning that takes about 45 minutes. A filling "unit" is the work done to fill one or more cavities in one session. A capping "unit" is the work done to put a crown on one tooth. If more than one tooth is crowned in a session, then the clinic counts one unit per tooth (e.g., putting crowns on two teeth counts as two units). Required: a. Given this information, how much will Painless Dental Clinics, Inc., earn each year after taxes? b. Assuming the given sales mix is the same at the break-even point, at what sales revenue does Painless Dental Clinics, Inc., break even? c. Assuming the given sales mix, at what sales revenue will the company earn $156,000 per year after taxes?

Assume that Painless Dental Clinics, Inc., offers three basic dental services. The following are its prices and costs. Price Variable Cost Units Sold per Unit $ per Unit $160 per Year 9,000 Cleaning Filling Capping 280 560 540 900 1,400 740 100 Variable costs include the labor costs of the dental hygienists and dentists. Fixed costs of $480,000 per year include building and equipment costs, marketing costs, and the costs of administration. Painless Dental Clinics is subject to a 20 percent tax rate on income. A cleaning "unit" is a routine teeth cleaning that takes about 45 minutes. A filling "unit" is the work done to fill one or more cavities in one session. A capping "unit" is the work done to put a crown on one tooth. If more than one tooth is crowned in a session, then the clinic counts one unit per tooth (e.g., putting crowns on two teeth counts as two units). Required: a. Given this information, how much will Painless Dental Clinics, Inc., earn each year after taxes? b. Assuming the given sales mix is the same at the break-even point, at what sales revenue does Painless Dental Clinics, Inc., break even? c. Assuming the given sales mix, at what sales revenue will the company earn $156,000 per year after taxes?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter10: Standard Costing And Variance Analysis

Section: Chapter Questions

Problem 3MTC

Related questions

Question

Assume that Painless Dental Clinics, Inc. offers three basic dental services. Teh following are its prices and costs.

Transcribed Image Text:Assume that Painless Dental Clinics, Ic., offers three basic dental services. The following are its prices and costs.

Price

Variable Cost

Units Sold

per Unit

2$

per Unit

$160

per Year

9,000

Cleaning

Filling

Capping

280

560

540

900

1,400

740

100

Variable costs include the labor costs of the dental hygienists and dentists. Fixed costs of $480,000 per year include building and

equipment costs, marketing costs, and the costs of administration. Painless Dental Clinics is subject to a 20 percent tax rate on

income.

A cleaning "unit" is a routine teeth cleaning that takes about 45 minutes. A filling "unit" is the work done to fill one or more cavities in

one session. A capping "unit" is the work done to put a crown on one tooth. If more than one tooth is crowned in a session, then the

clinic counts one unit per tooth (e.g., putting crowns on two teeth counts as two units).

Required:

a. Given this information, how much will Painless Dental Clinics, Inc., earn each year after taxes?

b. Assuming the given sales mix is the same at the break-even point, at what sales revenue does Painless Dental Clinics, Inc., break

even?

c. Assuming the given sales mix, at what sales revenue will the company earn $156,000 per year after taxes?

d-1. Painless Dental Clinics, Inc., is considering becoming more specialized in cleanings and fillings. What would be the company's

revenues per year if the number of cleanings increased to 12,000 per year, the number of fillings increased to 1,000 per year, while the

number of cappings dropped to zero? With this change in product mix, the company would increase its fixed costs to $530,000 per

year. What would be the effect of this change in product mix on the clinic's earnings after taxes per year?

d-2. If the clinic's managers seek to maximize the clinic's after-tax earnings, would this change be a good idea?

Complete this question by entering your answers in the tabs below.

Req A

Reg B

Reg C

Reg D1

Reg D2

Given this information, how much will Painless Dental Clinics, Inc., earn each year after taxes?

Earnings

< Req A

Req B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning