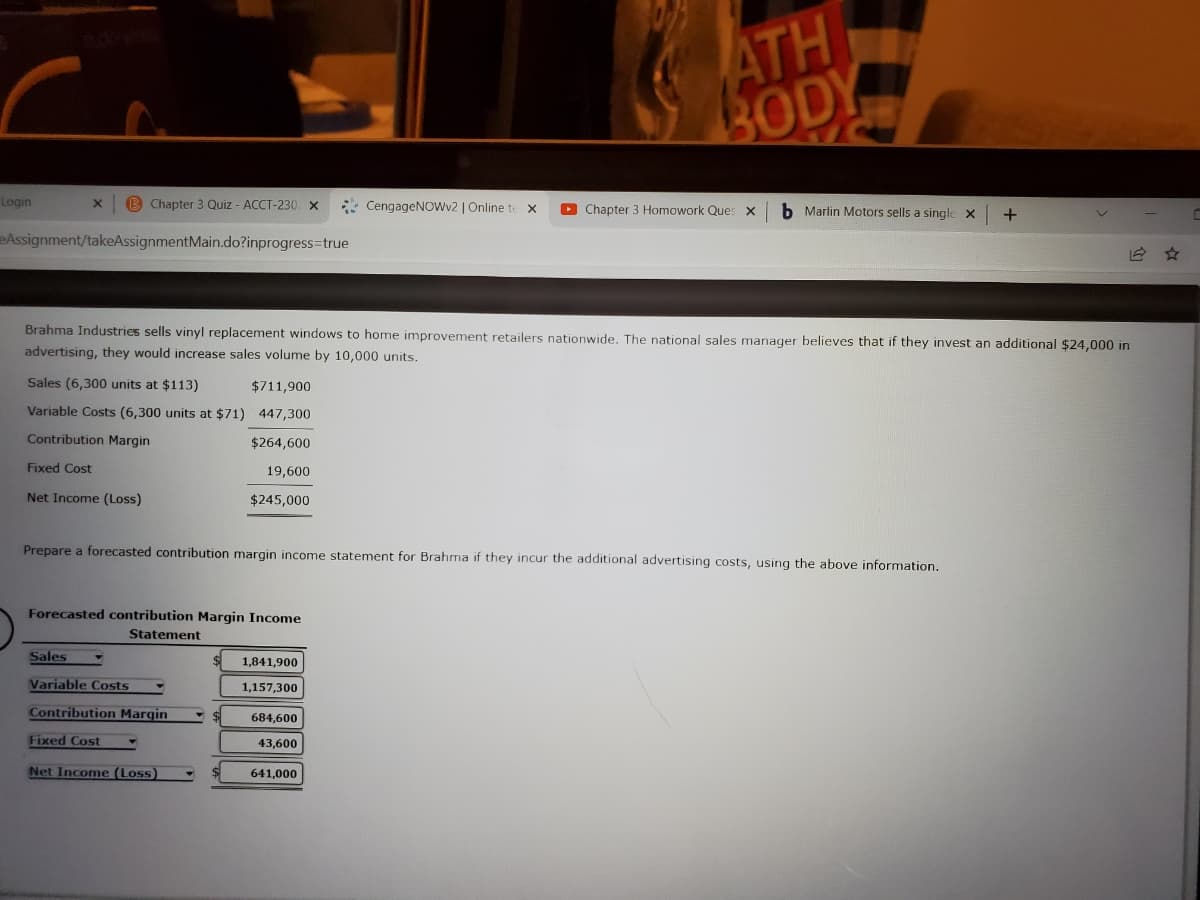

Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $24,000 in advertising, they would increase sales volume by 10,000 units. Sales (6,300 units at $113) $711,900 Variable Costs (6,300 units at $71) 447,300 Contribution Margin $264,600 Fixed Cost 19,600 Net Income (Loss) $245,000 Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using the above information. Forecasted contribution Margin Income Statement Sales 1,841,900 Variable Costs 1,157,300 Contribution Margin 684,600 Fixed Cost 43,600 Net Income (Loss) 641,000

Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $24,000 in advertising, they would increase sales volume by 10,000 units. Sales (6,300 units at $113) $711,900 Variable Costs (6,300 units at $71) 447,300 Contribution Margin $264,600 Fixed Cost 19,600 Net Income (Loss) $245,000 Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using the above information. Forecasted contribution Margin Income Statement Sales 1,841,900 Variable Costs 1,157,300 Contribution Margin 684,600 Fixed Cost 43,600 Net Income (Loss) 641,000

Chapter4: Operating Activities: Sales And Cash Receipts

Section: Chapter Questions

Problem 4.8C

Related questions

Question

Making I did the numbers correctly?

Transcribed Image Text:ATH

BODY

Login

B Chapter 3 Quiz - ACCT-230 x

* CengageNOwv2 | Online te X

O Chapter 3 Homowork Ques x

b Marlin Motors sells a single X

eAssignment/takeAssignmentMain.do?inprogress-true

Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $24,000 in

advertising, they would increase sales volume by 10,000 units.

Sales (6,300 units at $113)

$711,900

Variable Costs (6,300 units at $71) 447,300

Contribution Margin

$264,600

Fixed Cost

19,600

Net Income (Loss)

$245,000

Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using the above information.

Forecasted contribution Margin Income

Statement

Sales

1,841,900

Variable Costs

1,157,300

Contribution Margin

684,600

Fixed Cost

43,600

Net Income (Loss)

641,000

Expert Solution

Step 1

Total forecasted fixed costs = current fixed costs + additional advertising costs

= $19,600 + 24,000

= $43,600

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub