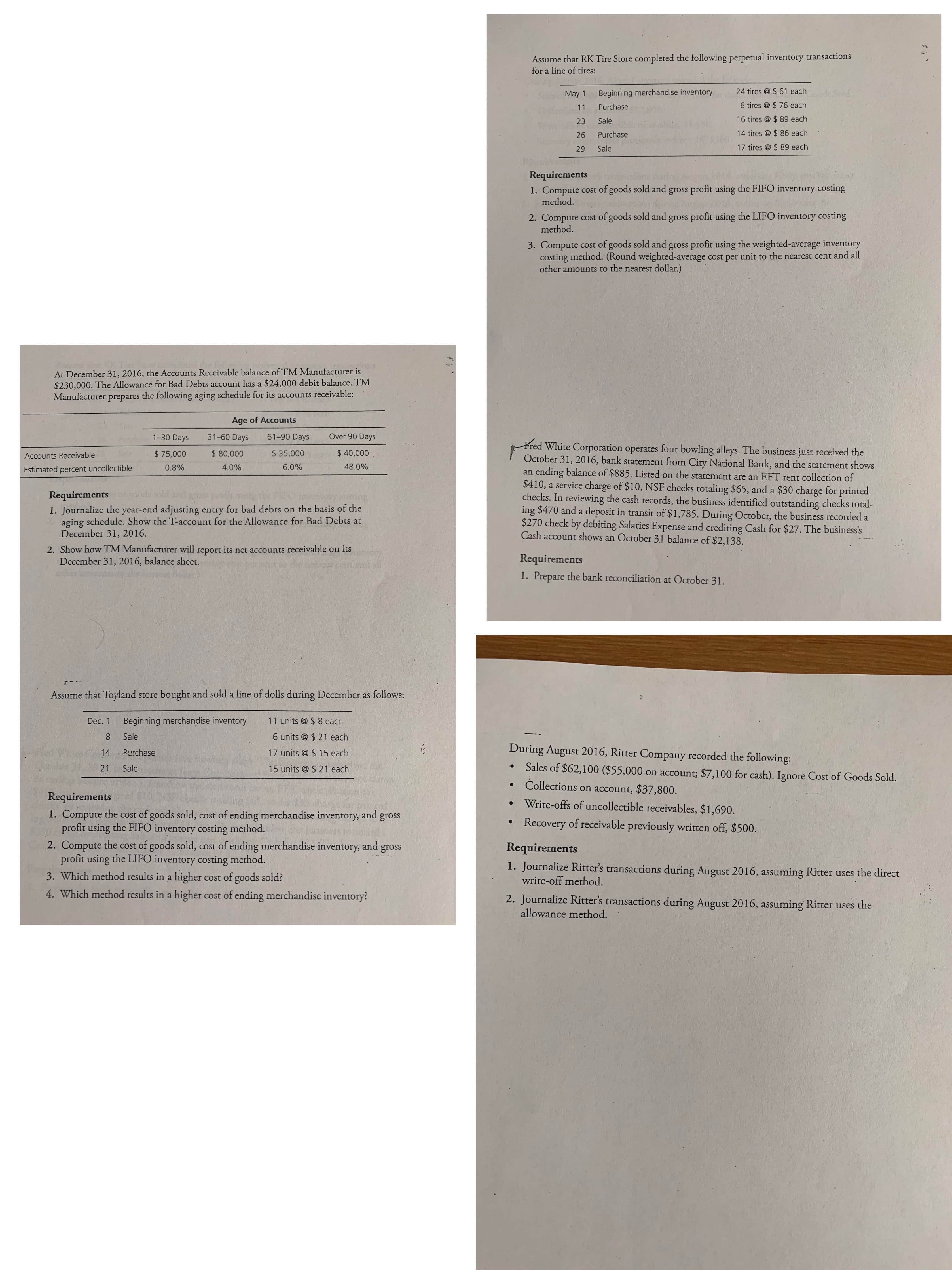

Assume that RK Tire Store completed the following perpetual inventory transactions for a line of tires: May 1 Beginning merchandise inventory 24 tires @ $ 61 each 11 Purchase 6 tires @ $ 76 each 23 Sale 16 tires @ $ 89 each 26 Purchase 14 tires @ $ 86 each 29 Sale 17 tires @ $ 89 each Requirements 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. 2. Compute cost of goods sold and gross profit using the LIFO inventory costing method. 3. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) At December 31, 2016, the Accounts Receivable balance of TM Manufacturer is $230,000. The Allowance for Bad Debts account has a $24,000 debit balance. TM Manufacturer prepares the following aging schedule for its accounts receivable: Age of Accounts 1-30 Days 31-60 Days 61-90 Days Over 90 Days Fred White Corporation operates four bowling alleys. The business just received the October 31, 2016, bank statement from City National Bank, and the statement shows an ending balance of $885. Listed on the statement are an EFT rent collection of $410, a service charge of $10, NSF checks totaling $65, and a $30 charge for printed checks. In reviewing the cash records, the business identified outstanding checks total- ing $470 and a deposit in transit of $1,785. During October, the business recorded a $270 check by debiting Salaries Expense and crediting Cash for $27. The business's Cash account shows an October 31 balance of $2,138. Accounts Receivable $ 75,000 $ 80,000 $ 35,000 $ 40,000 Estimated percent uncollectible 0.8% 4.0% 6.0% 48.0% Requirementsor 1. Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2016. 2. Show how TM Manufacturer will report its net accounts receivable on its December 31, 2016, balance sheet. Requirements 1. Prepare the bank reconciliation at October 31. Assume that Toyland store bought and sold a line of dolls during December as follows: Dec. 1 Beginning merchandise inventory 11 units @ $ 8 each Sale 6 units @ $ 21 each 14 Purchase During August 2016, Ritter Company recorded the following: 17 units @ $ 15 each 21 Sales of $62,100 ($55,000 on account; $7,100 for cash). Ignore Cost of Goods Sold. Sale 15 units @ $ 21 each Collections on account, $37,800. Requirements Write-offs of uncollectible receivables, $1,690. 1. Compute the cost of goods sold, cost of ending merchandise inventory, profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? and gross Recovery of receivable previously written off, $500. gross Requirements 1. Journalize Ritter's transactions during August 2016, assuming Ritter uses the direct write-off method. 4. Which method results in a higher cost of ending merchandise inventory? 2. Journalize Ritter's transactions during August 2016, assuming Ritter uses the allowance method.

Assume that RK Tire Store completed the following perpetual inventory transactions for a line of tires: May 1 Beginning merchandise inventory 24 tires @ $ 61 each 11 Purchase 6 tires @ $ 76 each 23 Sale 16 tires @ $ 89 each 26 Purchase 14 tires @ $ 86 each 29 Sale 17 tires @ $ 89 each Requirements 1. Compute cost of goods sold and gross profit using the FIFO inventory costing method. 2. Compute cost of goods sold and gross profit using the LIFO inventory costing method. 3. Compute cost of goods sold and gross profit using the weighted-average inventory costing method. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar.) At December 31, 2016, the Accounts Receivable balance of TM Manufacturer is $230,000. The Allowance for Bad Debts account has a $24,000 debit balance. TM Manufacturer prepares the following aging schedule for its accounts receivable: Age of Accounts 1-30 Days 31-60 Days 61-90 Days Over 90 Days Fred White Corporation operates four bowling alleys. The business just received the October 31, 2016, bank statement from City National Bank, and the statement shows an ending balance of $885. Listed on the statement are an EFT rent collection of $410, a service charge of $10, NSF checks totaling $65, and a $30 charge for printed checks. In reviewing the cash records, the business identified outstanding checks total- ing $470 and a deposit in transit of $1,785. During October, the business recorded a $270 check by debiting Salaries Expense and crediting Cash for $27. The business's Cash account shows an October 31 balance of $2,138. Accounts Receivable $ 75,000 $ 80,000 $ 35,000 $ 40,000 Estimated percent uncollectible 0.8% 4.0% 6.0% 48.0% Requirementsor 1. Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-account for the Allowance for Bad Debts at December 31, 2016. 2. Show how TM Manufacturer will report its net accounts receivable on its December 31, 2016, balance sheet. Requirements 1. Prepare the bank reconciliation at October 31. Assume that Toyland store bought and sold a line of dolls during December as follows: Dec. 1 Beginning merchandise inventory 11 units @ $ 8 each Sale 6 units @ $ 21 each 14 Purchase During August 2016, Ritter Company recorded the following: 17 units @ $ 15 each 21 Sales of $62,100 ($55,000 on account; $7,100 for cash). Ignore Cost of Goods Sold. Sale 15 units @ $ 21 each Collections on account, $37,800. Requirements Write-offs of uncollectible receivables, $1,690. 1. Compute the cost of goods sold, cost of ending merchandise inventory, profit using the FIFO inventory costing method. 2. Compute the cost of goods sold, cost of ending merchandise inventory, and profit using the LIFO inventory costing method. 3. Which method results in a higher cost of goods sold? and gross Recovery of receivable previously written off, $500. gross Requirements 1. Journalize Ritter's transactions during August 2016, assuming Ritter uses the direct write-off method. 4. Which method results in a higher cost of ending merchandise inventory? 2. Journalize Ritter's transactions during August 2016, assuming Ritter uses the allowance method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 67APSA: Inventory Costing Methods Andersons Department Store has the following data for inventory,...

Related questions

Question

I tried to put all the questions in one picture to the best of my abilities

Transcribed Image Text:Assume that RK Tire Store completed the following perpetual inventory transactions

for a line of tires:

May 1

Beginning merchandise inventory

24 tires @ $ 61 each

11

Purchase

6 tires @ $ 76 each

23

Sale

16 tires @ $ 89 each

26

Purchase

14 tires @ $ 86 each

29

Sale

17 tires @ $ 89 each

Requirements

1. Compute cost of goods sold and gross profit using the FIFO inventory costing

method.

2. Compute cost of goods sold and gross profit using the LIFO inventory costing

method.

3. Compute cost of goods sold and gross profit using the weighted-average inventory

costing method. (Round weighted-average cost per unit to the nearest cent and all

other amounts to the nearest dollar.)

At December 31, 2016, the Accounts Receivable balance of TM Manufacturer is

$230,000. The Allowance for Bad Debts account has a $24,000 debit balance. TM

Manufacturer prepares the following aging schedule for its accounts receivable:

Age of Accounts

1-30 Days

31-60 Days

61-90 Days

Over 90 Days

Fred White Corporation operates four bowling alleys. The business just received the

October 31, 2016, bank statement from City National Bank, and the statement shows

an ending balance of $885. Listed on the statement are an EFT rent collection of

$410, a service charge of $10, NSF checks totaling $65, and a $30 charge for printed

checks. In reviewing the cash records, the business identified outstanding checks total-

ing $470 and a deposit in transit of $1,785. During October, the business recorded a

$270 check by debiting Salaries Expense and crediting Cash for $27. The business's

Cash account shows an October 31 balance of $2,138.

Accounts Receivable

$ 75,000

$ 80,000

$ 35,000

$ 40,000

Estimated percent uncollectible

0.8%

4.0%

6.0%

48.0%

Requirementsor

1. Journalize the year-end adjusting entry for bad debts on the basis of the

aging schedule. Show the T-account for the Allowance for Bad Debts at

December 31, 2016.

2. Show how TM Manufacturer will report its net accounts receivable on its

December 31, 2016, balance sheet.

Requirements

1. Prepare the bank reconciliation at October 31.

Assume that Toyland store bought and sold a line of dolls during December as follows:

Dec. 1

Beginning merchandise inventory

11 units @ $ 8 each

Sale

6 units @ $ 21 each

14 Purchase

During August 2016, Ritter Company recorded the following:

17 units @ $ 15 each

21

Sales of $62,100 ($55,000 on account; $7,100 for cash). Ignore Cost of Goods Sold.

Sale

15 units @ $ 21 each

Collections on account, $37,800.

Requirements

Write-offs of uncollectible receivables, $1,690.

1. Compute the cost of goods sold, cost of ending merchandise inventory,

profit using the FIFO inventory costing method.

2. Compute the cost of goods sold, cost of ending merchandise inventory, and

profit using the LIFO inventory costing method.

3. Which method results in a higher cost of goods sold?

and

gross

Recovery of receivable previously written off, $500.

gross

Requirements

1. Journalize Ritter's transactions during August 2016, assuming Ritter uses the direct

write-off method.

4. Which method results in a higher cost of ending merchandise inventory?

2. Journalize Ritter's transactions during August 2016, assuming Ritter uses the

allowance method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning