Wings Incorporated manufactures machine parts for aircraft engines. The CEO, Chucky Valters, was considering an offer from a subcontractor that would provide 2,300 units of product PQ107 for Valters for a price of $150.000. If Wings does not purchase these parts from the subcontractor it must produce them in-house with the following unit costs: Cost per Unit Direct materials $30 Direct labor 19 9 Variable overhead In addition to the above costs, if Wings produces part PQ107, it would have a retooling and design cost of $9,400. The relevant costs of producing 2,300 units of product PQ107 internally are:

Wings Incorporated manufactures machine parts for aircraft engines. The CEO, Chucky Valters, was considering an offer from a subcontractor that would provide 2,300 units of product PQ107 for Valters for a price of $150.000. If Wings does not purchase these parts from the subcontractor it must produce them in-house with the following unit costs: Cost per Unit Direct materials $30 Direct labor 19 9 Variable overhead In addition to the above costs, if Wings produces part PQ107, it would have a retooling and design cost of $9,400. The relevant costs of producing 2,300 units of product PQ107 internally are:

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7EB: Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has...

Related questions

Question

Wings Incorporated manufactures machine parts for aircraft engines. The CEO, Chucky Valters, was considering an offer from a subcontractor that would provide 2,300 units of product PQ107 for Valters

Transcribed Image Text:TB MC Qu. 11-21 (Algo) Wings Incorporated manufactures machine parts for ...

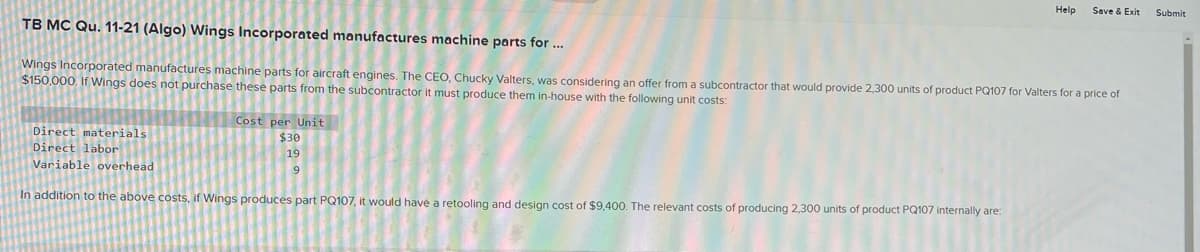

Wings Incorporated manufactures machine parts for aircraft engines. The CEO, Chucky Valters, was considering an offer from a subcontractor that would provide 2,300 units of product PQ107 for Valters for a price of

$150,000. If Wings does not purchase these parts from the subcontractor it must produce them in-house with the following unit costs:

Cost per Unit

$30

19

Help Save & Exit

Direct materials

Direct labor

Variable overhead

In addition to the above costs, if Wings produces part PQ107, it would have a retooling and design cost of $9,400. The relevant costs of producing 2,300 units of product PQ107 internally are:

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub