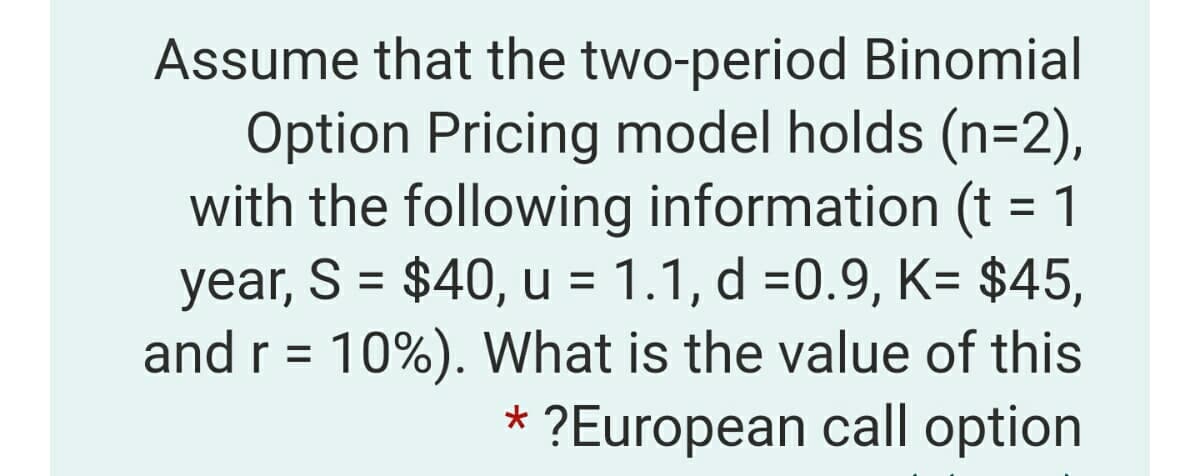

Assume that the two-period Binomial Option Pricing model holds (n=2), with the following information (t = 1 year, S = $40, u = 1.1, d =0.9, K= $45, and r = 10%). What is the value of this * ?European call option %D

Assume that the two-period Binomial Option Pricing model holds (n=2), with the following information (t = 1 year, S = $40, u = 1.1, d =0.9, K= $45, and r = 10%). What is the value of this * ?European call option %D

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 27QA

Related questions

Question

100%

Transcribed Image Text:Assume that the two-period Binomial

Option Pricing model holds (n=2),

with the following information (t = 1

year, S = $40, u = 1.1, d =0.9, K= $45,

and r = 10%). What is the value of this

* ?European call option

%3D

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you