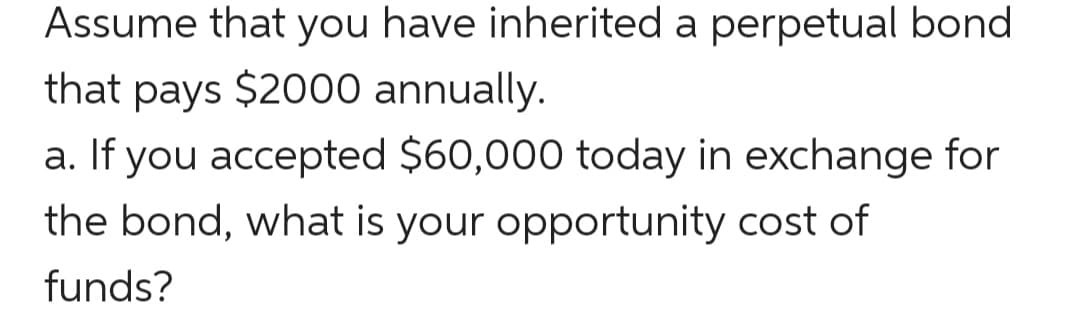

Assume that you have inherited a perpetual bond that pays $2000 annually. a. If you accepted $60,000 today in exchange for the bond, what is your opportunity cost of funds?

Q: What is the maximum amount you would pay for an asset that generates an income of $250,000 at the…

A:

Q: You’re dreaming of what to do during a nice summer day. You could mow the lawn which you would pay…

A: Opportunity cost is defined as the benefits an individual, business, or investor forgoes when he/she…

Q: 3) How does a society benefit from the production of capital goods?

A: The production possibility frontier is a curve which illustrates the varying amounts of two products…

Q: The Biden administration's "Buy American" agenda proposes to increase the federal government's…

A: In a market, when people makes changes in their decision based on different market condition or…

Q: In a circular flow diagram which one of the follwing transactions happens in the market for goods…

A: In a circular flow diagram the following transactions happens:A)Selena pays a storekeeper $2 for a…

Q: What two arguments does Smith make in his book? 1. 2.

A: The economics as a study is a very vast area, which deals with various models, factors, conditions,…

Q: 4. Assume that the PF for wine is: Qwine = T0.5 * log(Lwine) and for laptops is: Qiaptop log(K) *…

A: Question4: opportunity cost: dQwinedLwinedQlaptopdLLaptp = T0.5Lwinelog(K)Llaptop = T0.5*…

Q: When we speak of "capital" in economics we mean? a. financial instruments like stocks and bonds b.…

A: Answer: Correct option: (b) Explanation: In economics, capital is the term used for goods used to…

Q: What is the opportunity cost of your MBA education? How does the opportunity cost to you change if…

A: Opportunity cost is the foregone benefit from an alternative selected.

Q: You have been going to school and working 10 hours a week. The school offers you a scholarship worth…

A: 1)Opportunity cost in time-10 hours In money 10*10=100 per week. 2)I would choose quarter because…

Q: 1.Give an example of some actionthat has both a monetary and non monetary opportunity? 2.describe…

A: Trade-off is a situation in which quantity of some goods are given up in order to gain quantities of…

Q: Marginal Efficiency of Capital" is best explained how?

A: Marginal efficiency of capital is the expected rate of return on investment at a particular level of…

Q: Which of the statements best describes a situation represented by point A? Look at the image to…

A: From the given figure, we can see that at point A, quantity demanded of loanable funds is greater…

Q: Which of the following attributes is most closely associated with a necessity entrepreneur? A.…

A: An entity or organization that is being engaged in activities including professional, commercial, or…

Q: You can either spend spring break working at home for $80 per day or go to Florida for the week. If…

A: Opportunity Cost is the cost of next best alternative. Opportunity Cost is when in making a decision…

Q: Bong-Cha is deciding what to do during the 30-minute break between her college classes. One rule she…

A: Here, it is given that Bong-Cha makes her decision on how to spend her 30 mins break. Also, she has…

Q: Now that we've talked a little about what economics is, let's consider the concept of value. When we…

A: Circular flow of money shows how money moves within society, from producer to laborer in form of…

Q: Please use the graph to answer the given questions. Assume the people act rationally. Which of…

A:

Q: What is opportunity cost? As scarce resource, financial capital has opportunity cost. What…

A: Opportunity cost is associated with almost every resource used by individuals when making social and…

Q: ________ is a fundamental aspect of economic system in which individuals, rather than the state,…

A: Economic freedom or liberty is a fundamental aspect of an economic system in which individuals,…

Q: Which of the below statements DOES NOT capture what Charles Wheelan has expressed in chapter 6…

A: The summary of chapter 6 Productivity and Human Capital of Naked Economics is as follows : Human…

Q: Which statement explains how people working in their own self-interest produce goods, services, and…

A:

Q: If your tuition is $5,000 this semester, your books cost $600, you can only work 20 rather than 40…

A: Opportunity cost refers to the best given up values among the alternate in the process of gaining…

Q: Which of the following is not an issue that economists are interested in microeconomics? Lütfen…

A: Microeconomics is a social science that investigates the consequences of incentives and actions,…

Q: You have been going to school and working 10 hours a week. The school offers you a scholarship worth…

A: A) In one quarter time is = 12 week (assumed 4 weeks per month and 3 months in one quarter)…

Q: Demsetz argues that many market failure arguments are wrong because they ignore that real life is…

A: Economists look at a variety of issues known as "market failure" - conditions that, at the very…

Q: Q2: Micro VS Macroeconomics? Classify the following questions as Microeconomics or Macroeconomics…

A: To understand the economic behavior of various market factors, the learning of these factors is…

Q: With the aid of diagram, explain the economic concept of scarcity, efficiency and full employment…

A: The economic concept of scarcity, efficiency and the full employment and the trade off are the…

Q: What is the maximum amount you would pay for an asset that generates an income of P150,000 at the…

A: Opportunity cost of money is the amount of dollars that an individual will forgo by choosing to hold…

Q: y. Bob's opportunity cost of remaining in college is

A: Opportunity cost is the loss of potential gain from other alternatives when one particular…

Q: Explain how interest operates in a free-market economy and establisha basis for understanding the…

A: In an unregulated economy, financing costs (or interest rates) are the cost for loanable assets and…

Q: What is the essence of studying the various fundamental laws and theories of learning? Explain.

A: Learning is the process of acquiring skills, knowledge, attributes, and values.

Q: Incentives matter. Which of the below situations that find DOES NOT indicate a strong positive…

A: Incentives can be defined as anything that motivates a person to do something.

Q: Suppose you start with a point on the Production Possibilities Curve. Now, unemployment increases…

A: If there is a recession and therefore an increase in unemployment associated with a decrease in…

Q: than 250 words

A: An opportunity for investment in any situation exists where there is an option of purchasing…

Q: Explain this, Instead of utilizing humans to produce wealth, we have to utilize wealth to produce…

A: Human capability refers to the set of various functioning skills that an individual possesses in…

Q: What is the maximum amount you would pay for an asset that generates an income of $250,000 at the…

A: The measure that depicts value of current income stream being discounted at specified rate of return…

Q: A universal assumption in economic theories is that a) people are motivated by self-interest b)…

A: The theory that depicts a set of principles and ideas that tend to outline the different functions…

Q: QUESTION 24 According to Swift, which is the most accurate statement? The proposal O a. makes good…

A: Many philosophers, sociologists and economists make their theories relates to the paste and current…

Q: Why is money not considered to be a capital resource in economics? Why is entrepreneurial ability…

A: Money is anything that is generally accepted as a medium of exchange to buy or sell goods and…

Q: Provide example on how individuals may get finding from the capital markets?

A: Capital market is the market where long term funds are raised by individuals , firms , companies .…

Q: when we choose to go to college, we have to give up the salary that we should be able to get if we…

A: Opportunity Cost is the cost of foregone alternative. It is the cost of the alternative that is not…

Q: Why do you think that college enrollments have flattened from 2010 to 2019 and are projected to be…

A: When making decisions, rational consumers want to maximize their own utility or satisfaction. Often,…

Q: Suppose you get $1,000 as a birthday gift. You can spend it today or you can put the money in a…

A: The opportunity cost of spending the money can be calculated as follows: When the $1,000 gift amount…

Q: Please provide a short and concise answer to the following question: How is capital defined in…

A: Capital, according to financial capital economics, is an important aspect of running a firm and…

Q: Countries like finlamd and norway are unlikely to suffere from the scarcity problem as defined in…

A: Financial Balloon in the economy is a situation where there is sudden surge in the prices of assets…

Step by step

Solved in 2 steps with 2 images

- Julie lives for two periods. She works in the first, saves some of her income, and retires inthe second and lives off her savings. For every coconut she saves today, she earns an interestrate of r = 2%. Julie’s generation comprises of 1,000 people and each generation grows byn% relative to the previous one.a. In the first period Julie saves 100 coconuts for retirement. How many coconuts will shehave when she retires?b. Now suppose that the government implements a pay-as-you-go social security system,forcing every person in Julie’s generation to pay 100 coconuts to a social security fund thatwill distribute the money to the currently old. In exchange, when Julie retires each youngperson will pay 100 coconuts to the social security fund, and the revenue will be dividedequally among the future retirees. How much will be the revenue of the social securitysystem, and how many coconuts will each retiree will receive?c. What will have to be the range of values for n so that the government’s…A farmer selling eggs at 50.92 pesos a dozen gains 20%. If he sells the eggs at the same price after the costs of the eggs rises by 0.107, how much will be his new gain in percent?All Stafford loans are O only for full-time students for undergraduate and graduate students O subsidized by the government O for undergraduate students

- How do we use these FOCs to show that (wtNt)/Yt =(1-α) if Yt = At Ktα Nt1-αINTEREST THEORY PLEASE ASWER WITOUT EXCELSuppose the interest rate is 6 percent. Round your answers to 2 decimal places. a. What is the future value of $100 five years from now? How much of the futurebvalue is totla interest? b. By how much would total interest be greater at an interest rate of 8 percent than at an interest rate of 6 percent?

- (A) explain how rapid urbanization can pose a problem in the country. Explain in 3 sentences only. (B) How can rising rural-urban migration can be controlled? Explain in 3 sentences only.1. Describe what T’Challa thinks Wakanda’s relationship with the outside world should be. DescThree students have each saved $1,000.each has an investment opportunity in which he or she can invest upto $2,000.Here are the rates of return on the students investment project:a.If borrowing and lendind are prohibited,so each student uses only personal saving to finance his or her own investment project ,how much will each student have a year later when the project pays its return?b.Now suppose their school opens up a market for loanable funds in which students ran borrow and lend among themselves at an interest rate r.What would determine whether a student would choose to be a borrower or lender in this market?c.Among these three students,what would be the quantity of loanable funds supplied and quantity demanded at an interest rate of 7 percent?At 10percent?d.At what interest rate would the loanable funds market among these three students be in equilibrium?At this interest rate,which student(s) would borrow and which student(s) would lend?e.At the equilibrium interest rate,how…

- 4. The table below shows the total endowments of labour and capital in Germany andAustria, respectively.GermanyWorkers 100 Machines 20 Austria Workers 10Machines 4 Assess all the statements below and judge which of them is true and which is false.Provide a short justification for your assessment.According to the Heckscher-Ohlin model…a) …both countries are comparatively abundant in labour.b) …Austria is comparatively abundant in capital.c) …Germany exports should be in goods that use either labour or capital, depending on thegood.d) …Germany exports should be in goods that intensively use labour in production.e) …Austria will lose from trade, since it has both much less labour and capital endowment.In SWOT analysis what are the similarities and differences between strengths and opportunities? What are the similarities and differences between weakness and threats?a. There are two nation, UK and RSA and the combined capital stock is OA. b. In isolation, UK invests OA of capital for a yield of OC. The TP is OFGA and RSA invests O*A of capital for a yield of O*H. The TP is and the combined capital stock is OA. b. In isolation, UK invests 0A of capital for a yield of OC. The TP is OFGA and RSA invests O*A of capital for a yield of O*H. The TP is O*JMA © 87% 4 C. Since UK is capital abundant, the return on capital is low, Capital will move to where it can earn a higher return. In this case, to SA. Therefore, AB of capital moves from the UK to RSA d. With the transfer of capital to RSA, the total return on capital in UK increases from OCGA to ONRA total return on capital in RSA falls from O*HMA to O*TRA