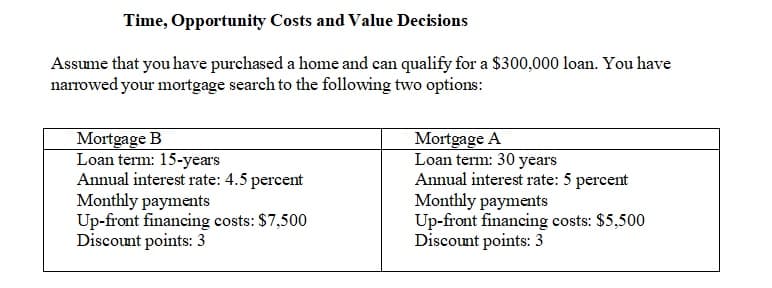

Assume that you have purchased a home and can qualify for a $300,000 loan. You have narrowed your mortgage search to the following two options: Mortgage B Loan term: 15-years Annual interest rate: 4.5 percent Monthly payments Up-front financing costs: $7,500 Discount points: 3 Mortgage A Loan term: 30 years Annual interest rate: 5 percent Monthly payments Up-front financing costs: $5,500 Discount points: 3

Assume that you have purchased a home and can qualify for a $300,000 loan. You have narrowed your mortgage search to the following two options: Mortgage B Loan term: 15-years Annual interest rate: 4.5 percent Monthly payments Up-front financing costs: $7,500 Discount points: 3 Mortgage A Loan term: 30 years Annual interest rate: 5 percent Monthly payments Up-front financing costs: $5,500 Discount points: 3

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter5: Making Automobile And Housing Decisions

Section: Chapter Questions

Problem 8FPE

Related questions

Question

Note: 1 discount point = 1% of loan amount

a)Calculate the effective borrowing cost to the borrower.

b) Compute Lender's Yield.

c) Based on the effective borrowing cost, which loan would you choose? Explain your answer using your calculations from a) and b).

Transcribed Image Text:Time, Opportunity Costs and Value Decisions

Assume that you have purchased a home and can qualify for a $300,000 loan. You have

narrowed your mortgage search to the following two options:

Mortgage B

Loan term: 15-years

Annual interest rate: 4.5 percent

Monthly payments

Up-front financing costs: $7,500

Discount points: 3

Mortgage A

Loan term: 30 years

Annual interest rate: 5 percent

Monthly payments

Up-front financing costs: $5,500

Discount points: 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,