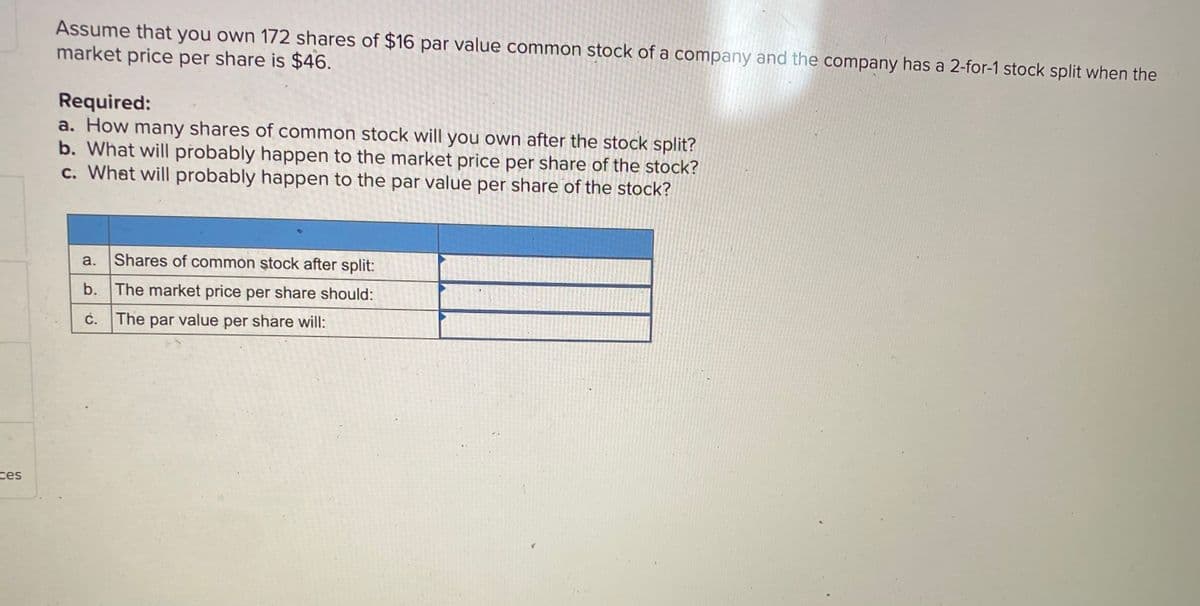

Assume that you own 172 shares of $16 par value common stock of a company and the company has a 2-for-1 stock split when the market price per share is $46. Required: a. How many shares of common stock will you own after the stock split? b. What will probably happen to the market price per share of the stock? c. What will probably happen to the par value per share of the stock? Shares of common stock after split: a. b. The market price per share should: C. The par value per share will:

Assume that you own 172 shares of $16 par value common stock of a company and the company has a 2-for-1 stock split when the market price per share is $46. Required: a. How many shares of common stock will you own after the stock split? b. What will probably happen to the market price per share of the stock? c. What will probably happen to the par value per share of the stock? Shares of common stock after split: a. b. The market price per share should: C. The par value per share will:

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 5P

Related questions

Question

hello, I need help please

Transcribed Image Text:Assume that you own 172 shares of $16 par value common stock of a company and the company has a 2-for-1 stock split when the

market price per share is $46.

Required:

a. How many shares of common stock will you own after the stock split?

b. What will přobably happen to the market price per share of the stock?

c. What will probably happen to the par value per share of the stock?

a. Shares of common ştock after split:

b. The market price per share should:

c. The par value per share will:

ces

Expert Solution

Step 1

a. Shares of common stock after split = Shares of common stock before split x split ratio

= 172 shares x 2/1

= 344 shares

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning