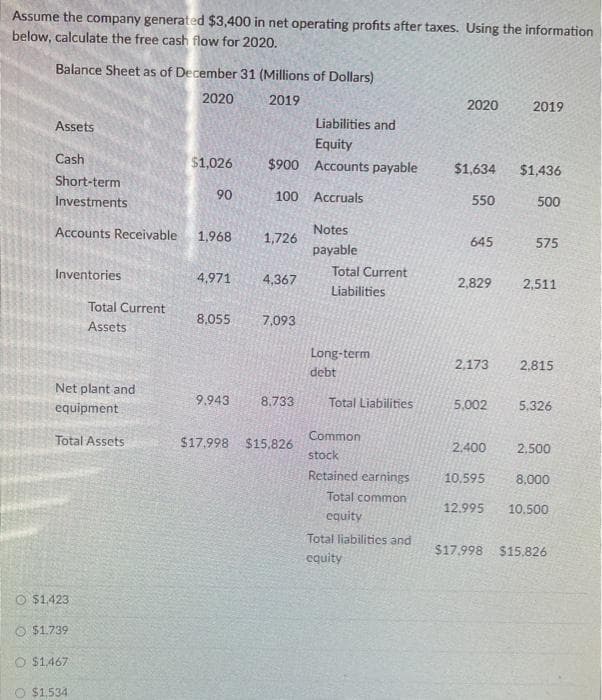

Assume the company generated $3,400 in net operating profits after taxes. Using the information below, calculate the free cash flow for 2020. Balance Sheet as of December 31 (Millions of Dollars) 2020 2019 2020 2019 Assets Liabilities and Equity Cash $1,026 $900 Accounts payable $1,634 $1,436 Short-term Investments 90 100 Accruals 550 500 Accounts Receivable 1,968 Notes 1,726 645 575 payable Inventories 4,971 4,367 Total Current 2,829 2,511 Liabilities Total Current 8,055 7.093 Assets Long-term 2,173 2,815 debt Net plant and equipment 9.943 8.733 Total Liabilities 5,002 5.326 Total Assets $17,998 $15,826 Common 2.400 2,500 stock Retained earnings 10.595 8,000 Total common 12.995 10.500 equity Total liabilities and $17.998 $15,826 cquity O $1.423 O $1.739 O $1,467 O $1.534

Assume the company generated $3,400 in net operating profits after taxes. Using the information below, calculate the free cash flow for 2020. Balance Sheet as of December 31 (Millions of Dollars) 2020 2019 2020 2019 Assets Liabilities and Equity Cash $1,026 $900 Accounts payable $1,634 $1,436 Short-term Investments 90 100 Accruals 550 500 Accounts Receivable 1,968 Notes 1,726 645 575 payable Inventories 4,971 4,367 Total Current 2,829 2,511 Liabilities Total Current 8,055 7.093 Assets Long-term 2,173 2,815 debt Net plant and equipment 9.943 8.733 Total Liabilities 5,002 5.326 Total Assets $17,998 $15,826 Common 2.400 2,500 stock Retained earnings 10.595 8,000 Total common 12.995 10.500 equity Total liabilities and $17.998 $15,826 cquity O $1.423 O $1.739 O $1,467 O $1.534

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 21BEA: Swasey Company earned net income of 1,800,000 in 20X2. Swasey provided the following information:...

Related questions

Question

Transcribed Image Text:Assume the company generated $3,400 in net operating profits after taxes. Using the information

below, calculate the free cash flow for 2020.

Balance Sheet as of December 31 (Millions of Dollars)

2020

2019

2020

2019

Assets

Liabilities and

Equity

$900 Accounts payable

Cash

$1,026

$1,634

$1,436

Short-term

Investments

90

100 Accruals

550

500

Accounts Receivable

1,968

1,726

Notes

645

575

payable

Inventories

4,971

4,367

Total Current

2,829

2,511

Liabilities

Total Current

8,055

7,093

Assets

Long-term

2,173

2,815

debt

Net plant and

equipment

१.943

8,733

Total Liabilities

5,002

5,326

Common

Total Assets

$17,998 $15.826

2.400

2,500

stock

Retained earnings

10,595

8,000

Total common

12.995

10,500

equity

Total liabilitics and

$17.998 $15,826

cquity

O $1.423

$1.739

O $1.467

O $1,534

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning