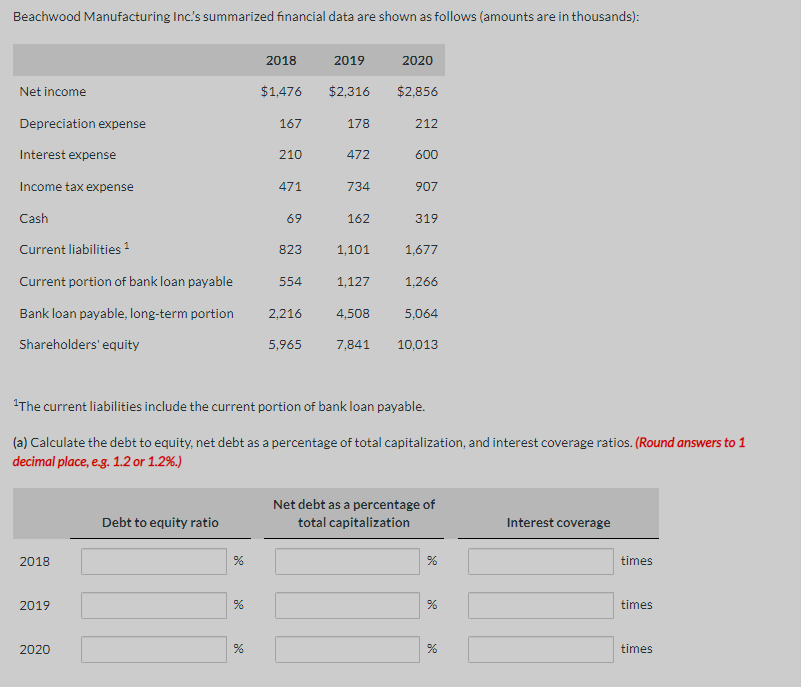

Beachwood Manufacturing Inc's summarized financial data are shown as follows (amounts are in thousands): 2018 2019 2020 Net income $1,476 $2,316 $2,856 Depreciation expense 167 178 212 Interest expense 210 472 600 Income tax expense 471 734 907 Cash 69 162 319 Current liabilities 1 823 1,101 1,677 Current portion of bank loan payable 554 1,127 1,266 Bank loan payable, long-term portion 2,216 4,508 5,064 Shareholders' equity 5,965 7,841 10,013 1The current liabilities include the current portion of bank loan payable. (a) Calculate the debt to equity, net debt as a percentage of total capitalization, and interest coverage ratios. (Round answers to 1 decimal place, e.g. 1.2 or 1.2%.) Net debt as a percentage of total capitalization Debt to equity ratio Interest coverage 2018 % times 2019 times 2020 times

Beachwood Manufacturing Inc's summarized financial data are shown as follows (amounts are in thousands): 2018 2019 2020 Net income $1,476 $2,316 $2,856 Depreciation expense 167 178 212 Interest expense 210 472 600 Income tax expense 471 734 907 Cash 69 162 319 Current liabilities 1 823 1,101 1,677 Current portion of bank loan payable 554 1,127 1,266 Bank loan payable, long-term portion 2,216 4,508 5,064 Shareholders' equity 5,965 7,841 10,013 1The current liabilities include the current portion of bank loan payable. (a) Calculate the debt to equity, net debt as a percentage of total capitalization, and interest coverage ratios. (Round answers to 1 decimal place, e.g. 1.2 or 1.2%.) Net debt as a percentage of total capitalization Debt to equity ratio Interest coverage 2018 % times 2019 times 2020 times

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 2DQ

Related questions

Question

Transcribed Image Text:Beachwood Manufacturing Inc's summarized financial data are shown as follows (amounts are in thousands):

2018

2019

2020

Net income

$1,476

$2,316

$2,856

Depreciation expense

167

178

212

Interest expense

210

472

600

Income tax expense

471

734

907

Cash

69

162

319

Current liabilities 1

823

1,101

1,677

Current portion of bank loan payable

554

1,127

1,266

Bank loan payable, long-term portion

2,216

4,508

5,064

Shareholders' equity

5,965

7,841

10,013

1The current liabilities include the current portion of bank loan payable.

(a) Calculate the debt to equity, net debt as a percentage of total capitalization, and interest coverage ratios. (Round answers to 1

decimal place, e.g. 1.2 or 1.2%.)

Net debt as a percentage of

total capitalization

Debt to equity ratio

Interest coverage

2018

times

2019

times

2020

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning