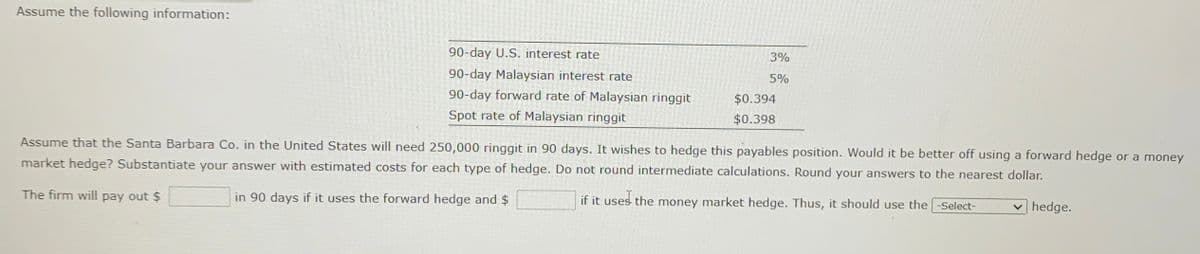

Assume the following information: 90-day U.S. interest rate 90-day Malaysian interest rate 3% 5% 90-day forward rate of Malaysian ringgit Spot rate of Malaysian ringgit $0.394 $0.398 Assume that the Santa Barbara Co. in the United States will need 250,000 ringgit in 90 days. It wishes to hedge this payables position. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated costs for each type of hedge. Do not round intermediate calculations. Round your answers to the nearest dollar. The firm will pay out $ in 90 days if it uses the forward hedge and $ if it uses the money market hedge. Thus, it should use the -Select- hedge.

Assume the following information: 90-day U.S. interest rate 90-day Malaysian interest rate 3% 5% 90-day forward rate of Malaysian ringgit Spot rate of Malaysian ringgit $0.394 $0.398 Assume that the Santa Barbara Co. in the United States will need 250,000 ringgit in 90 days. It wishes to hedge this payables position. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated costs for each type of hedge. Do not round intermediate calculations. Round your answers to the nearest dollar. The firm will pay out $ in 90 days if it uses the forward hedge and $ if it uses the money market hedge. Thus, it should use the -Select- hedge.

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 30QA

Related questions

Question

Transcribed Image Text:Assume the following information:

90-day U.S. interest rate

90-day Malaysian interest rate

3%

5%

90-day forward rate of Malaysian ringgit

Spot rate of Malaysian ringgit

$0.394

$0.398

Assume that the Santa Barbara Co. in the United States will need 250,000 ringgit in 90 days. It wishes to hedge this payables position. Would it be better off using a forward hedge or a money

market hedge? Substantiate your answer with estimated costs for each type of hedge. Do not round intermediate calculations. Round your answers to the nearest dollar.

The firm will pay out $

in 90 days if it uses the forward hedge and $

if it uses the money market hedge. Thus, it should use the -Select-

hedge.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning