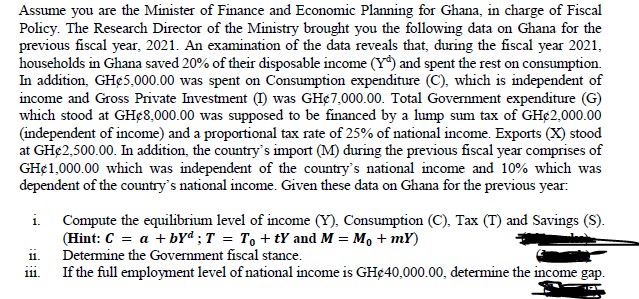

Assume you are the Minister of Finance and Economic Planning for Ghana, in charge of Fiscal Policy. The Research Director of the Ministry brought you the following data on Ghana for the previous fiscal year, 2021. An examination of the data reveals that, during the fiscal year 2021, households in Ghana saved 20% of their disposable income (Y) and spent the rest on consumption. In addition, GH5,000.00 was spent on Consumption expenditure (C), which is independent of income and Gross Private Investment (I) was GH$7,000.00. Total Government expenditure (G) which stood at GHe8,000.00 was supposed to be financed by a lump sum tax of GH€2,000.00 (independent of income) and a proportional tax rate of 25% of national income. Exports (X) stood at GH€2,500.00. In addition, the country's import (M) during the previous fiscal year comprises of GHe 1,000.00 which was independent of the country's national income and 10% which was dependent of the country's national income. Given these data on Ghana for the previous year. i. Compute the equilibrium level of income (Y), Consumption (C), Tax (T) and Savings (S). (Hint: C = a + byd ; T = T₁+tY and M = M₁ + mY) Determine the Government fiscal stance. 11. 111. If the full employment level of national income is GHe 40,000.00, determine the income gap.

Assume you are the Minister of Finance and Economic Planning for Ghana, in charge of Fiscal Policy. The Research Director of the Ministry brought you the following data on Ghana for the previous fiscal year, 2021. An examination of the data reveals that, during the fiscal year 2021, households in Ghana saved 20% of their disposable income (Y) and spent the rest on consumption. In addition, GH5,000.00 was spent on Consumption expenditure (C), which is independent of income and Gross Private Investment (I) was GH$7,000.00. Total Government expenditure (G) which stood at GHe8,000.00 was supposed to be financed by a lump sum tax of GH€2,000.00 (independent of income) and a proportional tax rate of 25% of national income. Exports (X) stood at GH€2,500.00. In addition, the country's import (M) during the previous fiscal year comprises of GHe 1,000.00 which was independent of the country's national income and 10% which was dependent of the country's national income. Given these data on Ghana for the previous year. i. Compute the equilibrium level of income (Y), Consumption (C), Tax (T) and Savings (S). (Hint: C = a + byd ; T = T₁+tY and M = M₁ + mY) Determine the Government fiscal stance. 11. 111. If the full employment level of national income is GHe 40,000.00, determine the income gap.

Chapter2: Mathematics For Microeconomics

Section: Chapter Questions

Problem 2.4P

Related questions

Question

Transcribed Image Text:Assume you are the Minister of Finance and Economic Planning for Ghana, in charge of Fiscal

Policy. The Research Director of the Ministry brought you the following data on Ghana for the

previous fiscal year, 2021. An examination of the data reveals that, during the fiscal year 2021,

households in Ghana saved 20% of their disposable income (Y) and spent the rest on consumption.

In addition, GH¢5,000.00 was spent on Consumption expenditure (C), which is independent of

income and Gross Private Investment (I) was GH¢7,000.00. Total Government expenditure (G)

which stood at GHc8,000.00 was supposed to be financed by a lump sum tax of GH¢2,000.00

(independent of income) and a proportional tax rate of 25% of national income. Exports (X) stood

at GH¢ 2,500.00. In addition, the country's import (M) during the previous fiscal year comprises of

GH$1,000.00 which was independent of the country's national income and 10% which was

dependent of the country's national income. Given these data on Ghana for the previous year:

i. Compute the equilibrium level of income (Y), Consumption (C), Tax (T) and Savings (S).

(Hint: C = a + byd ; T = To +tY and M = M₁ + mY)

Determine the Government fiscal stance.

11.

111.

If the full employment level of national income is GH¢40,000.00, determine the income gap.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you