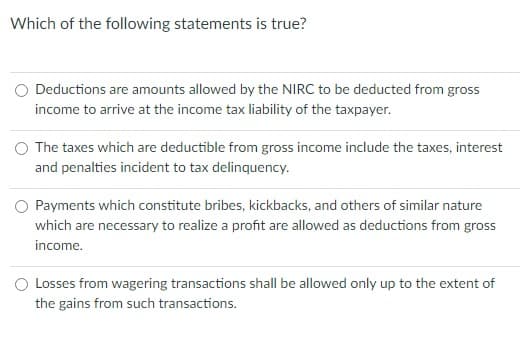

Which of the following statements is true? Deductions are amounts allowed by the NIRC to be deducted from gross income to arrive at the income tax liability of the taxpayer. O The taxes which are deductible from gross income include the taxes, interest and penalties incident to tax delinquency. O Payments which constitute bribes, kickbacks, and others of similar nature which are necessary to realize a profit are allowed as deductions from gross income. O Losses from wagering transactions shall be allowed only up to the extent of the gains from such transactions.

Which of the following statements is true? Deductions are amounts allowed by the NIRC to be deducted from gross income to arrive at the income tax liability of the taxpayer. O The taxes which are deductible from gross income include the taxes, interest and penalties incident to tax delinquency. O Payments which constitute bribes, kickbacks, and others of similar nature which are necessary to realize a profit are allowed as deductions from gross income. O Losses from wagering transactions shall be allowed only up to the extent of the gains from such transactions.

Chapter17: Tax Practice And Ethics

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

Transcribed Image Text:Which of the following statements is true?

Deductions are amounts allowed by the NIRC to be deducted from gross

income to arrive at the income tax liability of the taxpayer.

The taxes which are deductible from gross income include the taxes, interest

and penalties incident to tax delinquency.

O Payments which constitute bribes, kickbacks, and others of similar nature

which are necessary to realize a profit are allowed as deductions from gross

income.

O Losses from wagering transactions shall be allowed only up to the extent of

the gains from such transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you