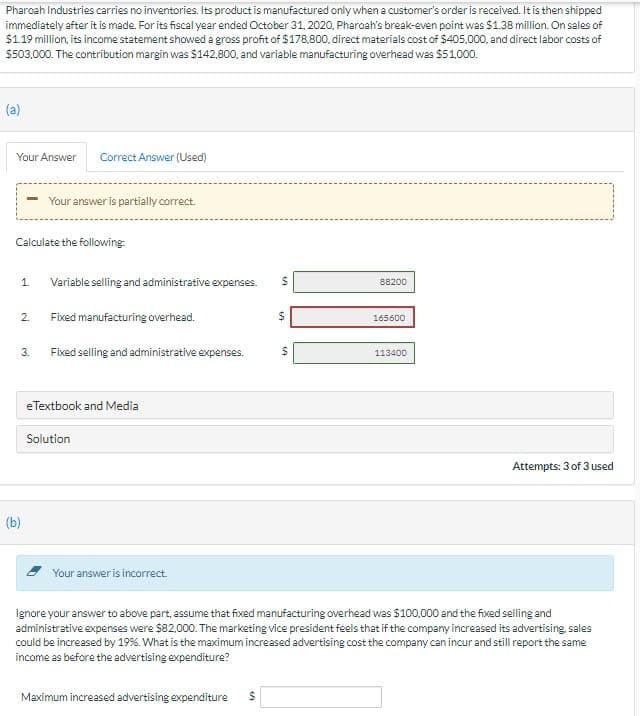

Pharoah Industries carries no inventories. Its product is manufactured only when a customer's order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Pharoah's break-even point was $1.38 million. On sales of $119 million, its income statement showed a gross profit of $178,800, direct materials cost of $405,000, and direct labor costs of $503,000. The contribution margin was $142,800, and variable manufacturing overhead was $51,000. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Calculate the following: 1. Variable selling and administrative expenses. 88200 Fixed manufacturing overhead. 165600 3. Fixed selling and administrative expenses. 113400 %24 2.

Pharoah Industries carries no inventories. Its product is manufactured only when a customer's order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Pharoah's break-even point was $1.38 million. On sales of $119 million, its income statement showed a gross profit of $178,800, direct materials cost of $405,000, and direct labor costs of $503,000. The contribution margin was $142,800, and variable manufacturing overhead was $51,000. (a) Your Answer Correct Answer (Used) Your answer is partially correct. Calculate the following: 1. Variable selling and administrative expenses. 88200 Fixed manufacturing overhead. 165600 3. Fixed selling and administrative expenses. 113400 %24 2.

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 16E

Related questions

Topic Video

Question

Transcribed Image Text:Pharoah Industries carries no inventories. Its product is manufactured only when a customer's order is received. It is then shipped

immediately after it is made. For its fiscal year ended October 31, 2020, Pharoah's break-even point was $1.38 million. On sales of

$119 million, its income statement showed a gross profit of $178,800, direct materials cost of $405.000, and direct labor costs of

$503,000. The contribution margin was $142,800, and variable manufacturing overhead was $51,000.

(a)

Your Answer

Correct Answer (Used)

- Your answer is partially correct.

Calculate the following:

1.

Variable selling and administrative expenses.

88200

2.

Fixed manufacturing overhead.

24

165600

3.

Fixed selling and administrative expenses.

113400

eTextbook and Media

Solution

Attempts: 3 of 3 used

(b)

Your answer is incorrect.

Ignore your answer to above part, assume that fixed manufacturing overhead was $100,000 and the fixed selling and

administrative expenses were $82,000. The marketing vice president feels that if the company increased its advertising, sales

could be increased by 19%. What is the maximum increased advertising cost the company can incur and still report the same

income as before the advertising expenditure?

Maximum increased advertising expenditure

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning